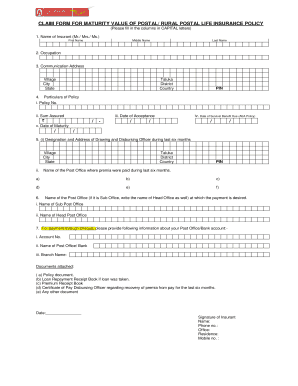

How to Claim Pli Maturity Amount Online Form

How to claim PLI maturity amount online

Claiming the PLI maturity amount online is a straightforward process that allows policyholders to receive their benefits efficiently. To begin, you will need to visit the official website of the postal life insurance service. Ensure you have your policy number and personal identification details ready for verification.

Once on the website, navigate to the claims section. Here, you will find options for online claim submission. Select the appropriate form for the maturity claim and fill it out with accurate information. This typically includes your policy details, personal information, and bank account details for fund transfer.

After completing the form, submit it electronically. You may receive a confirmation email indicating that your claim is being processed. It's important to keep track of your claim status through the portal, as updates will be provided there.

Required documents for PLI maturity claim

When claiming your PLI maturity amount online, specific documents are necessary to ensure a smooth process. These typically include:

- Your policy document, which contains essential details about your coverage.

- A government-issued identification proof, such as a driver's license or passport, to verify your identity.

- Bank account details, including your account number and the name of the bank, for direct transfer of funds.

- Any additional forms or documents requested by the postal life insurance service, which may vary based on your specific policy.

Having these documents ready will help expedite your claim and reduce any potential delays.

Steps to complete the PLI maturity claim form

Completing the PLI maturity claim form online involves several key steps. Follow these to ensure accuracy and efficiency:

- Log in to the official postal life insurance website.

- Access the claims section and select the maturity claim form.

- Fill in your personal details, including your full name, address, and contact information.

- Enter your policy number and the maturity amount you are claiming.

- Attach the required documents as specified in the guidelines.

- Review your information for accuracy before submitting the form.

- Submit the form and note any confirmation details provided.

Following these steps will help ensure that your claim is processed without unnecessary complications.

Key elements of the PLI maturity claim process

Understanding the key elements of the PLI maturity claim process is crucial for a successful outcome. These elements include:

- Eligibility: Ensure that your policy has matured and is eligible for a claim.

- Documentation: Gather all necessary documents to support your claim.

- Timeliness: Submit your claim promptly to avoid delays.

- Verification: Be prepared for any verification processes that may be required by the insurance provider.

Being aware of these elements can significantly enhance your experience while claiming your PLI maturity amount.

How to check PLI maturity status online

To check the status of your PLI maturity claim online, start by visiting the postal life insurance website. Look for the claims status section, where you can enter your policy number and personal details to retrieve information about your claim.

Once you input the required information, the system will provide you with the current status of your claim. This may include whether your claim is under processing, approved, or if additional information is needed. Regularly checking your claim status can help you stay informed and address any issues promptly.

Quick guide on how to complete how to claim pli maturity amount online

Effortlessly Create How To Claim Pli Maturity Amount Online on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly without any holdups. Manage How To Claim Pli Maturity Amount Online on any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to edit and electronically sign How To Claim Pli Maturity Amount Online with ease

- Obtain How To Claim Pli Maturity Amount Online and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically designed by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to record your modifications.

- Choose your preferred method for sharing your form, via email, text message (SMS), invite link, or download it to your computer.

Put an end to missing or misfiled documents, tedious form navigation, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Edit and electronically sign How To Claim Pli Maturity Amount Online while ensuring effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to claim pli maturity amount online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PLI maturity amount table PDF?

The PLI maturity amount table PDF is a document that outlines the various maturity amounts for different policies under the Public Life Insurance scheme. It helps policyholders understand the returns they can expect at the end of their policy term. Having access to this table is crucial for making informed financial decisions.

-

How can I download the PLI maturity amount table PDF?

You can download the PLI maturity amount table PDF easily from our website. Simply navigate to the resources section, where you will find the downloadable link for the table. This ensures you have the most accurate and up-to-date information regarding maturity amounts.

-

What are the benefits of using the PLI maturity amount table PDF?

The PLI maturity amount table PDF provides clarity on the financial returns from your policy, helping you plan your future investments. Additionally, it serves as a quick reference for comparing different plans and their maturity amounts. This feature aids in better financial planning and decision-making.

-

Is the PLI maturity amount table PDF updated regularly?

Yes, the PLI maturity amount table PDF is updated regularly to reflect any changes in policy details or amounts. This ensures that you have access to the most current information. Staying updated can signNowly impact your investment strategies and choices.

-

Can I integrate the PLI maturity amount table PDF with other financial tools?

Absolutely! Our platform supports integrations with various financial tools to help you manage your investments better. You can import the data from the PLI maturity amount table PDF into these tools for enhanced analysis and tracking of your financial growth.

-

What features does airSlate SignNow offer for eSigning documents related to PLI policies?

airSlate SignNow offers easy-to-use eSigning solutions that streamline the entire documentation process for your PLI policies. You can sign, send, and manage documents securely online, ensuring that all your policy related documents are handled efficiently. This is particularly advantageous for timely submissions and approvals.

-

How does using the PLI maturity amount table PDF save me money?

By providing clear insights into your potential returns, the PLI maturity amount table PDF allows you to choose policies that best meet your financial goals. Making informed decisions can lead to better savings and optimized investments over time. This means you spend less on unnecessary premiums while ensuring maximum benefits.

Get more for How To Claim Pli Maturity Amount Online

- Chop dermatology expedited appointment form

- Pentecostal ordination service form

- Locator slip deped editable form

- Primary school admission form 2022

- Dunhams application form 201830267

- Restriction request form amerihealth administrators

- California department of social services ccrc annual report form

- Form 02ag040 personal care assistant pca supervisory visit

Find out other How To Claim Pli Maturity Amount Online

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free