Idr Application PDF Form

What is the Income Driven Repayment Application PDF?

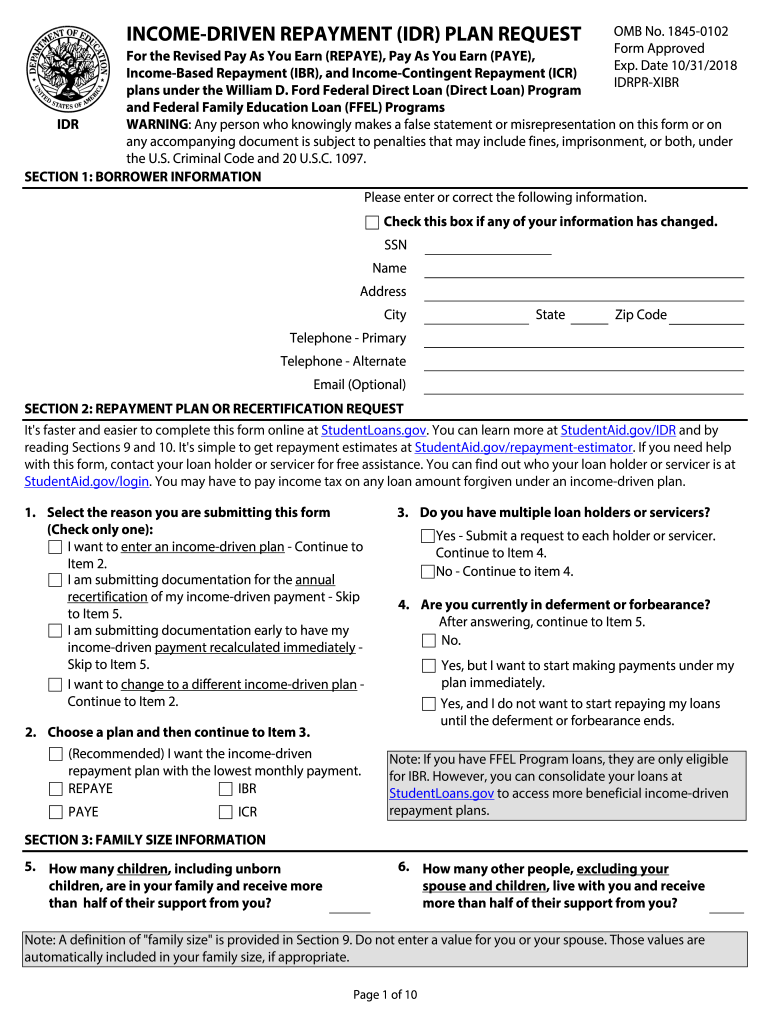

The Income Driven Repayment Application PDF is a crucial document for borrowers with federal student loans seeking to lower their monthly payments based on their income. This form allows individuals to apply for various income-driven repayment plans, such as Income-Based Repayment (IBR) and Pay As You Earn (PAYE). By submitting this form, borrowers can adjust their repayment plans according to their financial circumstances, making it easier to manage student loan debt.

Steps to Complete the Income Driven Repayment Application PDF

Completing the Income Driven Repayment Application PDF involves several key steps to ensure accuracy and compliance. Begin by gathering necessary financial information, including your income, family size, and any additional financial obligations. Next, fill out the form with your personal details, ensuring that all information is current and accurate. After completing the form, review it for any errors before submitting it to your loan servicer. It is advisable to keep a copy of the completed form for your records.

Required Documents for the Income Driven Repayment Application PDF

When filling out the Income Driven Repayment Application PDF, borrowers must provide specific documentation to support their application. Required documents typically include:

- Proof of income, such as recent pay stubs or tax returns

- Information on family size, which may require documentation like birth certificates or tax returns for dependents

- Any other financial information that may impact your repayment plan

Providing complete and accurate documentation is essential for a smooth application process and timely approval.

Form Submission Methods for the Income Driven Repayment Application PDF

Borrowers can submit the Income Driven Repayment Application PDF through various methods, depending on their preferences and the requirements of their loan servicer. Common submission methods include:

- Online submission through the loan servicer's website, which may offer a secure portal for uploading documents

- Mailing the completed form to the designated address provided by the loan servicer

- In-person submission at a local office, if available, for those who prefer face-to-face interactions

Choosing the right submission method can help ensure that your application is processed efficiently.

Eligibility Criteria for the Income Driven Repayment Application PDF

To qualify for income-driven repayment plans using the Income Driven Repayment Application PDF, borrowers must meet certain eligibility criteria. These criteria typically include:

- Having federal student loans, as private loans do not qualify for these repayment plans

- Demonstrating a financial need based on income and family size

- Being in good standing with your loan servicer, meaning no defaults or delinquencies

Understanding these eligibility requirements is vital for borrowers seeking to benefit from reduced monthly payments.

Legal Use of the Income Driven Repayment Application PDF

The Income Driven Repayment Application PDF is legally binding once signed and submitted. It is essential for borrowers to understand that providing false information or failing to report changes in income or family size can have legal consequences. Compliance with the terms outlined in the application is crucial for maintaining eligibility for income-driven repayment plans. Additionally, borrowers should ensure that they are aware of their rights and responsibilities under federal student loan regulations.

Quick guide on how to complete idr application pdf

Complete Idr Application Pdf effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Idr Application Pdf on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Idr Application Pdf with minimal effort

- Find Idr Application Pdf and click on Get Form to begin.

- Utilize our tools to complete your form submission.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Idr Application Pdf and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idr application pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fed loans income based repayment form?

The fed loans income based repayment form is a crucial document that helps borrowers manage their federal student loans based on their income. By completing this form, borrowers can potentially reduce their monthly loan payments to a more manageable amount. It is a key tool for those seeking financial relief through income-driven repayment plans.

-

How does airSlate SignNow simplify the fed loans income based repayment form process?

airSlate SignNow streamlines the process of filling out and submitting the fed loans income based repayment form. Our platform provides an intuitive interface and customizable templates to ensure you can complete your documents quickly and efficiently. Additionally, you can eSign and send all necessary paperwork, saving you time and hassle.

-

Is there a cost associated with using airSlate SignNow for the fed loans income based repayment form?

Using airSlate SignNow for the fed loans income based repayment form is cost-effective and comes with various pricing plans to suit your needs. We offer a free trial so users can explore our features before committing. Depending on the plan, you can access additional features that enhance your document management experience.

-

Can I integrate airSlate SignNow with other tools for managing the fed loans income based repayment form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tools and software, allowing you to manage your fed loans income based repayment form alongside your existing workflows. Whether you use CRM systems, cloud storage, or productivity applications, our integrations help streamline your processes.

-

What are the benefits of using airSlate SignNow for the fed loans income based repayment form?

By using airSlate SignNow for the fed loans income based repayment form, you gain efficiency, security, and ease of use. Our platform ensures that your documents are securely signed and easily accessible, while also signNowly reducing the time spent on paperwork. This enables you to focus more on managing your loans rather than getting bogged down in administrative tasks.

-

How do I get started with the fed loans income based repayment form in airSlate SignNow?

Getting started with the fed loans income based repayment form in airSlate SignNow is straightforward. Simply sign up for an account, choose a template or create your own, and start filling in the required details. Once completed, you can eSign and share the form directly without any delays.

-

Is customer support available for questions about the fed loans income based repayment form?

Yes, airSlate SignNow offers robust customer support to assist with any questions regarding the fed loans income based repayment form. Whether you need help navigating the platform or addressing specific document-related queries, our support team is available via chat, email, or phone to provide timely assistance.

Get more for Idr Application Pdf

Find out other Idr Application Pdf

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple