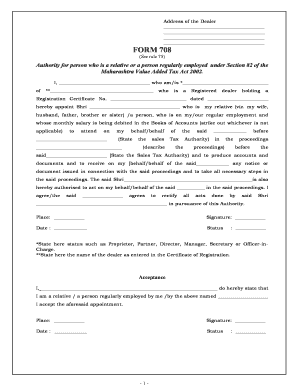

Form 708

What is the Form 708

The Form 708, often referred to as the 708 form, is a legal document primarily used for tax purposes in the United States. It is associated with the Multi-Stage Tax Act (MVAT) and is essential for businesses that need to report sales and other related tax obligations. This form helps in the accurate calculation of tax liabilities and ensures compliance with state regulations. Understanding the purpose and requirements of the Form 708 is crucial for businesses to avoid penalties and maintain good standing with tax authorities.

How to use the Form 708

Using the Form 708 involves several key steps to ensure accurate completion. First, gather all necessary financial records, including sales invoices and receipts. Next, carefully fill out each section of the form, providing accurate figures for sales and tax collected. It's important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on state regulations. Familiarizing yourself with the specific requirements of the Form 708 will streamline the process and help avoid common pitfalls.

Steps to complete the Form 708

Completing the Form 708 requires attention to detail and adherence to specific guidelines. Here are the essential steps:

- Gather all relevant financial documents, including sales records and tax rates applicable to your business.

- Begin filling out the form by entering your business information, including name, address, and tax identification number.

- Input your total sales for the reporting period, ensuring accuracy in your calculations.

- Calculate the total tax due based on your sales figures and applicable tax rates.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 708

The legal use of the Form 708 is governed by state tax laws and regulations. It is essential for businesses to understand that submitting this form is not just a matter of compliance but also a legal obligation. Failure to accurately complete and file the Form 708 can result in penalties, interest on unpaid taxes, and potential audits. Therefore, businesses should ensure that they are familiar with the legal implications of the form and maintain accurate records to support their submissions.

Key elements of the Form 708

The Form 708 includes several key elements that must be accurately filled out to ensure compliance. These elements typically include:

- Business Information: Name, address, and tax identification number.

- Sales Figures: Total sales for the reporting period.

- Tax Calculation: Total tax due based on sales and applicable rates.

- Signature: Required signature of the business owner or authorized representative.

Each of these elements plays a crucial role in the validity of the form and must be completed with precision.

Filing Deadlines / Important Dates

Filing deadlines for the Form 708 can vary by state, but it is typically required to be submitted quarterly or annually, depending on the business's sales volume. It is important for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates related to the Form 708 will help ensure timely compliance. Additionally, businesses should regularly check for any updates or changes to filing requirements that may affect their obligations.

Quick guide on how to complete form 708

Effortlessly Prepare Form 708 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a fantastic eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate template and securely preserve it online. airSlate SignNow equips you with all the resources you need to generate, modify, and electronically sign your documents quickly and without interruptions. Manage Form 708 on any device using the airSlate SignNow applications for Android or iOS and enhance your document-focused tasks today.

How to Modify and Electronically Sign Form 708 with Ease

- Obtain Form 708 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Form 708 and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 708

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 708 and how does it work?

Form 708 is an essential document that facilitates smooth transactions and eSigning processes. With airSlate SignNow, businesses can easily create, send, and manage Form 708 electronically, ensuring a secure and efficient way to complete important agreements.

-

How much does it cost to use airSlate SignNow for Form 708?

Pricing for airSlate SignNow varies based on the plan you select, starting at an affordable rate. Each plan comes with features that enhance your ability to manage Form 708 effectively, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for handling Form 708?

airSlate SignNow provides a range of features for managing Form 708, including customizable templates, real-time collaboration, and secure storage. These features streamline the signing process, making it easy to track and manage your documents.

-

Can I integrate airSlate SignNow with other applications for Form 708?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow for Form 708. This includes popular tools like Google Drive, Dropbox, and CRM systems, allowing for easy document sharing and organization.

-

What are the benefits of using airSlate SignNow for Form 708?

Using airSlate SignNow for Form 708 streamlines your document signing process, saving time and reducing errors. Additionally, it provides a user-friendly interface and robust security measures ensuring that your documents are safe and easily accessible.

-

Is airSlate SignNow secure for processing Form 708?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, making it safe for processing Form 708. You can confidently eSign and store your documents knowing they are protected.

-

How do I get started with airSlate SignNow for Form 708?

Getting started with airSlate SignNow for Form 708 is simple. Just sign up for an account, choose the plan that suits your needs, and you can begin creating and managing your Form 708 documents immediately.

Get more for Form 708

- Printable bomb threat checklist template form

- College visit worksheet pdf 219263062 form

- 5 2 rewriting percent expressions form

- Oasis d form

- Deficiency slip form

- Child adolescent diagnostic assessment form

- Prokureursorde pretoria form

- Notification of birth for registration new zealand government te bb form

Find out other Form 708

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT