Form 2441 Child and Dependent Care Expenses Department of the Treasury Internal Revenue Service 99 1040 1040A 2024

Understanding Form 2441 Child And Dependent Care Expenses

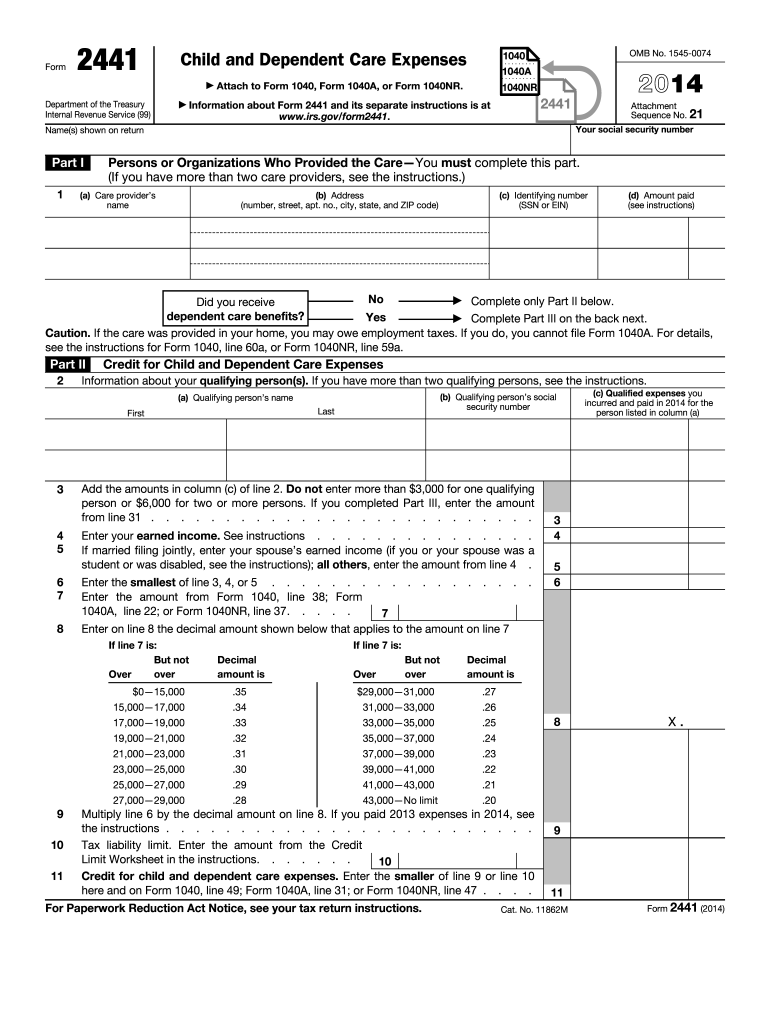

Form 2441 is a tax form used by taxpayers in the United States to claim the Child and Dependent Care Expenses Credit. This form is essential for individuals who incur expenses for the care of qualifying children or dependents while they work or look for work. The purpose of the credit is to alleviate some of the financial burdens associated with childcare and dependent care costs. Taxpayers can use this form to report their eligible expenses and calculate the credit amount they may be entitled to receive, which can significantly reduce their overall tax liability.

Steps to Complete Form 2441

Completing Form 2441 involves several steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary documentation, including receipts for childcare expenses and information about the care providers. Next, fill out the form by providing your personal information, such as your name, Social Security number, and filing status. Then, enter the details of your qualifying expenses, including the names and addresses of the care providers. Finally, calculate the credit amount based on the IRS guidelines and ensure that all information is accurate before submission.

Eligibility Criteria for Form 2441

To qualify for the Child and Dependent Care Expenses Credit, taxpayers must meet specific eligibility criteria. The care must be provided for a child under the age of thirteen or for a spouse or dependent who is physically or mentally incapable of self-care. Additionally, the taxpayer must have earned income, and the care expenses must be necessary for the taxpayer to work or actively look for work. There are also limits on the amount of expenses that can be claimed based on the number of qualifying individuals and the taxpayer's income level.

Obtaining Form 2441

Taxpayers can obtain Form 2441 from the Internal Revenue Service (IRS) website or by visiting a local IRS office. The form is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include Form 2441, allowing users to complete and file their taxes electronically. It is important to ensure that the most current version of the form is used, as tax laws and guidelines may change from year to year.

Filing Methods for Form 2441

Form 2441 can be submitted through various methods, including electronic filing and traditional mail. Taxpayers who choose to file their taxes online can typically complete and submit Form 2441 directly through their tax software. For those who prefer to file by mail, the completed form should be sent to the appropriate IRS address based on the taxpayer's location and filing status. It is essential to keep a copy of the submitted form and any supporting documentation for personal records and potential audits.

IRS Guidelines for Form 2441

The IRS provides specific guidelines for completing and filing Form 2441. These guidelines outline what constitutes qualifying expenses, how to calculate the credit, and the documentation required to support the claim. Taxpayers should refer to the IRS instructions for Form 2441 to ensure compliance with all requirements. Understanding these guidelines can help prevent errors and ensure that taxpayers receive the maximum credit available for their childcare and dependent care expenses.

Create this form in 5 minutes or less

Find and fill out the correct form 2441 child and dependent care expenses department of the treasury internal revenue service 99 1040 1040a

Create this form in 5 minutes!

How to create an eSignature for the form 2441 child and dependent care expenses department of the treasury internal revenue service 99 1040 1040a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2441 Child And Dependent Care Expenses Department Of The Treasury Internal Revenue Service 99 1040 1040A?

Form 2441 is used to claim the Child and Dependent Care Credit, which helps taxpayers offset the costs of care for children or dependents while they work or look for work. This form is essential for those filing their taxes using IRS Form 1040 or 1040A, ensuring they receive the credits they qualify for.

-

How can airSlate SignNow assist with Form 2441 Child And Dependent Care Expenses?

airSlate SignNow provides a streamlined solution for managing and eSigning documents related to Form 2441 Child And Dependent Care Expenses. Our platform allows users to easily send, sign, and store necessary documents, making tax preparation more efficient.

-

What features does airSlate SignNow offer for handling tax forms like Form 2441?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing tax forms like Form 2441 Child And Dependent Care Expenses. These features help ensure that all necessary information is accurately captured and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form 2441?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage documents related to Form 2441 Child And Dependent Care Expenses without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to manage Form 2441 Child And Dependent Care Expenses alongside your other financial documents. This integration enhances workflow efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including Form 2441 Child And Dependent Care Expenses, offers numerous benefits such as increased efficiency, enhanced security, and easy access to documents from anywhere. Our platform simplifies the eSigning process, making tax season less stressful.

-

How secure is airSlate SignNow when handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information, including data related to Form 2441 Child And Dependent Care Expenses. You can trust that your documents are safe with us.

Get more for Form 2441 Child And Dependent Care Expenses Department Of The Treasury Internal Revenue Service 99 1040 1040A

- Gannon university transcript request form

- Therapy daily log form

- Fit life questionnaire dr tom bilella form

- W2 request form baltimore city public schools baltimorecityschools

- Application instructions for the ryland robert reel form

- Taxpayer register form tax gov kh

- Form ct 5 1 request for additional extension of time to file

- Market consultant contract template form

Find out other Form 2441 Child And Dependent Care Expenses Department Of The Treasury Internal Revenue Service 99 1040 1040A

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast