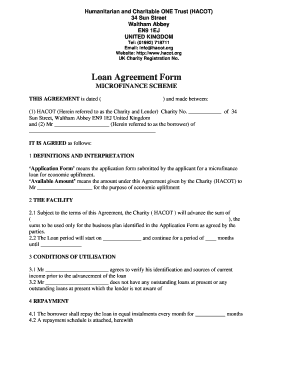

Sks Microfinance Loan Application Form

What is the Gabaykonek Application Microfinance?

The Gabaykonek application microfinance is a digital platform designed to facilitate access to microfinance services. It allows users to apply for microloans through an intuitive online interface. This application is tailored to meet the needs of individuals and small businesses seeking financial assistance. By leveraging technology, the Gabaykonek application streamlines the loan application process, making it more accessible and efficient for users.

Key Elements of the Gabaykonek Application Microfinance

Understanding the key elements of the Gabaykonek application is essential for successful completion. The application typically includes the following components:

- Personal Information: Basic details such as name, address, and contact information.

- Financial Information: Income details, existing debts, and financial obligations.

- Loan Amount Requested: The specific amount of money the applicant wishes to borrow.

- Purpose of the Loan: A brief explanation of how the funds will be used, which helps lenders assess risk.

Steps to Complete the Gabaykonek Application Microfinance

Completing the Gabaykonek application involves several straightforward steps:

- Access the Application: Visit the Gabaykonek microfinance platform and locate the application form.

- Fill Out Personal Information: Provide accurate personal and financial details as requested.

- Specify Loan Details: Indicate the desired loan amount and its intended use.

- Review and Submit: Double-check all entries for accuracy before submitting the application.

Legal Use of the Gabaykonek Application Microfinance

The Gabaykonek application microfinance must comply with relevant legal frameworks to ensure its validity. This includes adherence to federal and state regulations governing microfinance lending. The application process should incorporate necessary disclosures and consumer protections to safeguard applicants' rights. Understanding these legal aspects can help users navigate the application process with confidence.

Required Documents for the Gabaykonek Application Microfinance

Applicants typically need to provide several documents to support their Gabaykonek application. Commonly required documents include:

- Identification: A government-issued ID such as a driver's license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Business Documentation: For business applicants, documents such as business licenses or tax ID numbers may be required.

Application Process & Approval Time

The application process for the Gabaykonek microfinance typically involves several stages, including submission, review, and approval. After submitting the application, applicants can expect a response within a specified timeframe, often ranging from a few days to a couple of weeks. Factors that may influence approval time include the completeness of the application and the lender's assessment of the applicant's creditworthiness.

Quick guide on how to complete sks microfinance loan application form

Effortlessly Prepare Sks Microfinance Loan Application Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without any hurdles. Manage Sks Microfinance Loan Application Form on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

Effortless Modification and eSigning of Sks Microfinance Loan Application Form

- Find Sks Microfinance Loan Application Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Verify the details and click the Done button to save your updates.

- Decide how you want to send your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Sks Microfinance Loan Application Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sks microfinance loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan agreement template download?

A loan agreement template download is a pre-formatted document that outlines the terms and conditions of a loan between a lender and a borrower. It simplifies the process of creating a legally binding agreement, ensuring that all essential details are included. With airSlate SignNow, you can easily access and customize these templates to meet your specific needs.

-

How can I download a loan agreement template from airSlate SignNow?

To download a loan agreement template from airSlate SignNow, simply visit our website and navigate to the templates section. Select the loan agreement template that suits your needs, and use the download option to obtain the file in your desired format. This ensures you have a customizable document ready for your loan transactions.

-

Is there a cost associated with downloading the loan agreement template?

Downloading the loan agreement template from airSlate SignNow is cost-effective and comes at no additional charge for registered users. We offer a variety of templates, including loan agreements, as part of our subscription plans. Explore our pricing page to find a plan that suits your requirements.

-

What are the primary features of the loan agreement template?

The loan agreement template features clear sections for borrower and lender information, loan amount, interest rates, repayment terms, and more. These elements help ensure that all signNow aspects of the loan are covered. With airSlate SignNow, you can easily customize these templates to fit your unique situation.

-

What are the benefits of using a loan agreement template download?

Using a loan agreement template download saves you time and effort by providing a structured format that simplifies the agreement creation process. It reduces the risk of legal issues by ensuring compliance with necessary requirements. Additionally, it allows you to focus on the terms of your loan rather than drafting the document from scratch.

-

Can I integrate the loan agreement template with other tools?

Yes, airSlate SignNow allows seamless integration with various tools and platforms, which enhances the functionality of your loan agreement template download. You can sync documents with cloud storage solutions and manage workflows more efficiently. This helps you keep everything organized and boosts productivity in your business operations.

-

How secure is the loan agreement template downloaded from airSlate SignNow?

The loan agreement template downloaded from airSlate SignNow is highly secure as we prioritize the protection of your data. Our platform uses encryption and secure access protocols to ensure that your documents remain confidential. With airSlate SignNow, you can confidently manage and sign your loan agreements online.

Get more for Sks Microfinance Loan Application Form

Find out other Sks Microfinance Loan Application Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT