Minority Loan Application Form PDF

What is the minority loan application form PDF?

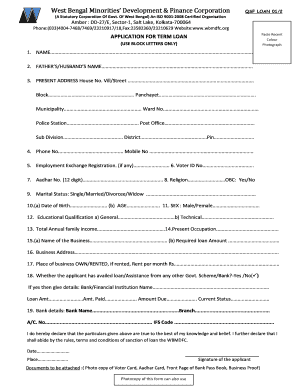

The minority loan application form PDF is a standardized document used by individuals seeking financial assistance specifically designed for minority-owned businesses. This form collects essential information about the applicant, including personal details, business structure, financial history, and the purpose of the loan. By using this form, applicants can ensure they provide the necessary information in a clear and organized manner, which is crucial for the evaluation of their loan request.

Steps to complete the minority loan application form PDF

Completing the minority loan application form PDF involves several key steps to ensure accuracy and compliance. First, gather all required documentation, including identification, business licenses, and financial statements. Next, carefully fill out the form, providing detailed responses to each section. It is important to double-check for any errors or omissions before submitting the form. Finally, ensure that you sign and date the application, as this is necessary for it to be considered valid.

Required documents for the minority loan application

When applying for a minority loan, several documents are typically required to support your application. These documents may include:

- Personal identification, such as a driver's license or passport.

- Business licenses and registration documents.

- Financial statements, including balance sheets and income statements.

- Tax returns for the past few years.

- Business plans that outline your objectives and strategies.

Having these documents ready can streamline the application process and improve your chances of approval.

Legal use of the minority loan application form PDF

The minority loan application form PDF is legally binding when completed and signed correctly. It is essential to comply with all applicable laws and regulations when filling out this form. This includes providing accurate information and ensuring that all signatures are valid. The use of digital signatures is permissible, provided that the signing process adheres to the legal standards set forth by the ESIGN Act and UETA. This ensures that your application is treated with the same legal weight as a traditional paper document.

Application process and approval time

The application process for a minority loan typically involves several stages. After submitting the minority loan application form PDF along with the required documents, the lending institution will review your application. This review may take anywhere from a few days to several weeks, depending on the lender's policies and the complexity of your application. Once the review is complete, you will be notified of the decision. If approved, you will receive details regarding the loan amount, terms, and conditions.

Eligibility criteria for minority loans

Eligibility for minority loans often depends on various factors, including the applicant's business type, credit history, and the specific requirements of the lending institution. Common criteria may include:

- Ownership of at least fifty-one percent of the business by minority individuals.

- A demonstrated need for financial assistance to support business growth.

- A solid business plan that outlines the intended use of the funds.

- Compliance with local, state, and federal regulations.

Understanding these criteria can help applicants prepare a stronger application and increase their chances of securing funding.

Quick guide on how to complete minority loan application form pdf

Complete Minority Loan Application Form Pdf effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Minority Loan Application Form Pdf on any device using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

The easiest way to edit and eSign Minority Loan Application Form Pdf without hassle

- Obtain Minority Loan Application Form Pdf and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your updates.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Modify and eSign Minority Loan Application Form Pdf and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minority loan application form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to minority loan apply online?

To minority loan apply online, start by visiting our website and navigating to the application section. Fill out the required information including your personal details and loan amount. Once submitted, our system will review your application and provide feedback promptly.

-

What documents do I need to minority loan apply online?

When you minority loan apply online, you will typically need a government-issued ID, proof of income, and additional documentation such as tax returns. Make sure all documents are up-to-date and clearly scanned to ensure a smooth application process.

-

Are there any fees associated with the minority loan apply online?

Yes, there may be some processing fees when you minority loan apply online, depending on the amount requested and your financial profile. However, we strive to keep our costs low to provide you with a cost-effective solution.

-

How long does it take to get approved after I minority loan apply online?

Once you minority loan apply online, approval can take as little as a few hours to a couple of days. Our team works diligently to process applications quickly, ensuring you receive timely updates on your loan status.

-

What are the benefits of using airSlate SignNow for minority loan application?

Using airSlate SignNow to minority loan apply online offers a hassle-free experience with easy document management and eSigning capabilities. Our platform is user-friendly and helps streamline the application process, saving you time and effort.

-

Is my personal information secure when I minority loan apply online?

Absolutely! When you minority loan apply online with airSlate SignNow, your personal information is protected by industry-standard security measures. We prioritize your privacy and ensure that your data is encrypted and securely stored.

-

Can I track my loan application status after I minority loan apply online?

Yes, after you minority loan apply online, you can easily track your application status through your user dashboard. We provide real-time updates so you can stay informed about your loan process at every step.

Get more for Minority Loan Application Form Pdf

- Abc order template form

- Kaiser dependent certification form

- N1 form examples

- Advanced beneficiary notice pdf form

- Coast guard dental form

- Pengeluaran duit kwsp akaun 2 form

- Toll 1 800 667 7551 fax 306 787 8951 form

- Ga11 renunciation members of the public or their lawyers complete this form for a person who may be entitled to apply for a

Find out other Minority Loan Application Form Pdf

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself