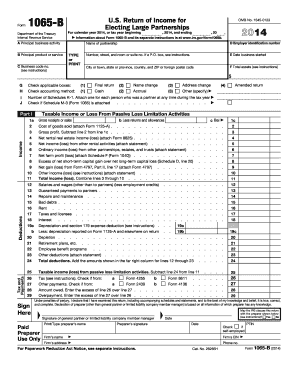

Form 1065 B Internal Revenue Service Irs

What is the Form 1065 B?

The Form 1065 B is a tax document used by partnerships to report income, deductions, gains, and losses to the Internal Revenue Service (IRS). This form is specifically designed for certain types of partnerships, including those classified as "small partnerships." It serves as a means for the IRS to assess the tax obligations of these entities and ensure compliance with federal tax laws. The information provided on the form is crucial for determining each partner's share of income and deductions, which they will report on their individual tax returns.

Steps to Complete the Form 1065 B

Completing the Form 1065 B requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary information: Collect all financial data related to the partnership, including income, expenses, and partner contributions.

- Fill out basic information: Enter the partnership's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report income: Detail all sources of income on the designated lines, ensuring accuracy in the amounts reported.

- Deduct expenses: List all allowable deductions, which may include operating expenses, salaries, and other costs incurred by the partnership.

- Calculate net income: Subtract total deductions from total income to determine the partnership's net income.

- Allocate income to partners: Distribute the net income among partners based on the partnership agreement, noting each partner's share on the form.

- Review and sign: Ensure all information is accurate, then have the designated partners sign the form before submission.

Filing Deadlines / Important Dates

The deadline for filing Form 1065 B is typically March 15 of the year following the tax year being reported. If the partnership requires additional time, it can file for an extension, which extends the deadline by six months. It is important to adhere to these deadlines to avoid penalties and ensure timely processing of the tax return.

Required Documents

To complete the Form 1065 B, several documents are essential:

- Financial statements: Profit and loss statements, balance sheets, and other relevant financial reports.

- Partnership agreement: Documentation outlining the terms of the partnership, including profit-sharing ratios.

- Records of income and expenses: Detailed records that support the amounts reported on the form.

- Previous tax returns: Copies of prior year returns may be helpful for reference and consistency.

Legal Use of the Form 1065 B

The Form 1065 B is legally binding when completed and submitted according to IRS regulations. It is crucial for partnerships to ensure compliance with tax laws to avoid potential audits or penalties. The form must be filled out accurately, reflecting the true financial status of the partnership. Proper use of this form helps maintain transparency with the IRS and ensures that each partner meets their tax obligations.

Digital vs. Paper Version

Partnerships have the option to file Form 1065 B either digitally or via paper submission. Digital filing is often preferred due to its efficiency and faster processing times. Electronic submissions can reduce errors and provide immediate confirmation of receipt. However, some partnerships may choose to file a paper version for various reasons, including lack of access to electronic filing options. Regardless of the method chosen, it is essential to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete 2014 form 1065 b internal revenue service irs

Complete Form 1065 B Internal Revenue Service Irs effortlessly on any device

Digital document management has gained signNow popularity among organizations and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without any delays. Manage Form 1065 B Internal Revenue Service Irs on any device using airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The simplest way to edit and eSign Form 1065 B Internal Revenue Service Irs without any hassle

- Find Form 1065 B Internal Revenue Service Irs and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or shareable link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Modify and eSign Form 1065 B Internal Revenue Service Irs to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

Internal Revenue Service (IRS): How many W-2s were issued in 2012? How many Forms 1099-MISC?

I don't have an answer as I was also unable to find this statistic anywhere. I can tell you that the Social Security Administration actually processes W2's and forwards the information to the IRS. 1099's however are processed by the IRS directly.The closest statistic I can find is that in 2010 there were 117,820,074 tax returns processed that showed salaries and wages (W2 income) on them. That does not allow for returns where the taxpayers have multiple W2's nor does it allow for people who received a W2 and did not file a tax return, so all I can say is the number of W2's is something larger than 117M.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Internal Revenue Service (IRS): What does "Unreported social security and Medicare tax from Form: a 4137 b 8919" mean?

If your employer is not taking out your share of Social Security and Medicare taxes for you (or if you are earning tips), then you will be taking home wages that have not yet been taxed by these programs and are therefore “unreported.” These wages must be reported to the IRS when filing taxes so that the proper amount of Medicare and Social Security taxes can be taken out.Form 4137 is used by service employees and any other workers who receive tips. Tip money is subject to state and federal taxes just like any other income and Form 4137 is where that money is reported when filing your taxes.Form 8919 is for workers who are paid as independent contractors and therefore did not have Social Security and Medicare taxes taken out by the employer.If either scenario applies to you, you must use the appropriate form to report your income for tax purposes. Not doing so may not only put you in hot water with the IRS but you can put your Medicare eligibility in jeopardy as well. In order for most people to qualify for Medicare benefits, a minimum of at least 40 quarters (roughly 10 years) of reported taxes is required.

-

Internal Revenue Service (IRS): Why do so many companies wait until the last second to give employees their W2 forms?

WWEELLL consider that most small businesses do not prepare their own W-2s. Being a CPA and today is 1/18/17 I still have about 10 or so businesses that I’ve W-2s to prepare for them.Now as to the second part of the question you are aware that the IRS does not even accept a return for electronic filing until 1/23/17?Why such a hurry? Additionally, with the new security procedures in place you are probably looking at 4 -6 weeks to get your refund (even filing electronically) - AANNDD truthfully no one really knows because this is the first year for these new security measures.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

Internal Revenue Service (IRS): How to expensify a payment for a foreign contractor?

Absolutely. That's the way we used to do it back in the old days before computers :)Seriously, the IRS does not require any specific method of record keeping; all that you are required to do in the event of an audit is to produce documentation that substantiates the deductions that you claim. A paper invoice with a signed paper receipt attached certainly meets the requirements. Refer to IRS Publication 583, http://www.irs.gov/publications/... for more information.

-

Internal Revenue Service (IRS): How are deductions to taxable income applied between ordinary income and capital gains?

There are a lot of possible answers depending on specific situations, but in general deductions apply to ordinary income first. Look at the Schedule D Tax Worksheet on the last page of the Instructions for Schedule D (http://www.irs.gov/pub/irs-pdf/i...). This is the worksheet used to calculate your tax when you have a mix of ordinary income and taxable gains.It starts by taking the number from Form 1040 Line 43, which is your taxable income after adjustments, exemptions, and deductions. It then basically computes the tax separately on the ordinary income and capital gains/qualifying dividends portions of your income, finally summing those categories to find your total tax.Suppose, therefore, that you have $125,000 in total income, of which $25,000 is qualified investment income. If you have $40,000 in deductions, adjustments, and exemptions, leaving $85,000 in taxable income, then the worksheet will calculate tax on your $25,000 of qualified investment income at the preferred rates, and tax on the other $60,000 using the regular tax tables or formulas. So, if you suddenly discovered another deduction, the tax on your qualified investment income would stay the same, while the tax calculated using the regular rates would decrease.

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1065 b internal revenue service irs

How to generate an electronic signature for the 2014 Form 1065 B Internal Revenue Service Irs online

How to create an electronic signature for the 2014 Form 1065 B Internal Revenue Service Irs in Google Chrome

How to make an electronic signature for signing the 2014 Form 1065 B Internal Revenue Service Irs in Gmail

How to generate an eSignature for the 2014 Form 1065 B Internal Revenue Service Irs right from your smart phone

How to create an electronic signature for the 2014 Form 1065 B Internal Revenue Service Irs on iOS devices

How to make an eSignature for the 2014 Form 1065 B Internal Revenue Service Irs on Android OS

People also ask

-

What is a form 1065 excel template?

A form 1065 excel template is a pre-designed spreadsheet that simplifies the process of preparing partnership tax returns. It provides a structured format for inputting financial information required by the IRS, making it easier for businesses to complete their filings accurately and efficiently.

-

How can I use the form 1065 excel template for my business?

You can use the form 1065 excel template to organize your partnership's financial data before submitting your tax return. This template helps ensure that all necessary information is included, reducing errors and saving time during the tax preparation process.

-

Is the form 1065 excel template compatible with other software?

Yes, the form 1065 excel template is designed to be compatible with popular spreadsheet applications, allowing you to easily integrate data from different sources. This versatility ensures that you can use it alongside your existing accounting software for streamlined workflow.

-

Are there any costs associated with the form 1065 excel template?

The form 1065 excel template is available for free, but depending on your needs, you might want to explore additional paid features offered by airSlate SignNow that enhance document management and eSigning capabilities. Investing in these features could offer signNow time savings and improved accuracy.

-

What are the benefits of using the form 1065 excel template?

The primary benefits of using the form 1065 excel template include improved accuracy, reduced preparation time, and a clear organizational structure for your finances. By using this template, businesses can also minimize the risk of errors that could lead to tax penalties.

-

Can I edit the form 1065 excel template to suit my needs?

Absolutely! The form 1065 excel template is fully editable, allowing you to customize fields as necessary to reflect your business's specific financial situation. This flexibility ensures that you can tailor the template to meet your unique requirements while maintaining compliance.

-

How does airSlate SignNow enhance the use of the form 1065 excel template?

airSlate SignNow enhances the use of the form 1065 excel template by allowing you to eSign and send documents securely within a single platform. This integration facilitates quick signatures and document exchanges, making the tax filing process more efficient for partnerships.

Get more for Form 1065 B Internal Revenue Service Irs

Find out other Form 1065 B Internal Revenue Service Irs

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online