Professional Tax Challan PDF Form

What is the Professional Tax Challan PDF?

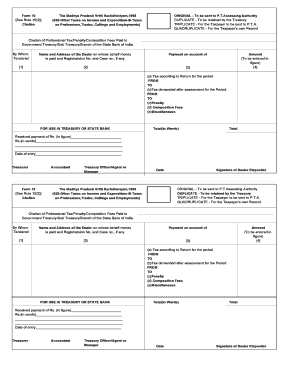

The professional tax challan form 10 in MP PDF is a government-issued document used for the payment of professional tax in Madhya Pradesh, India. This form is essential for individuals and businesses that are liable to pay professional tax as per state regulations. The form serves as a receipt for the tax payment and is crucial for maintaining compliance with local tax laws. It includes details such as the taxpayer's information, the amount due, and the payment period.

How to Obtain the Professional Tax Challan PDF

To obtain the professional tax challan form 10 in MP PDF, individuals can visit the official website of the Madhya Pradesh government or the local tax office. The form is typically available for download in a PDF format, making it easy to access and print. Users may also request a physical copy from the tax office if they prefer not to download it online. Ensuring that you have the latest version of the form is important for accurate submissions.

Steps to Complete the Professional Tax Challan PDF

Completing the professional tax challan form 10 in MP PDF involves several key steps. First, download the form and open it using a PDF reader. Fill in the required fields, including your name, address, and professional details. Next, enter the amount of tax due based on your income or business revenue. After completing the form, review all entries for accuracy. Finally, print the form for submission, ensuring to keep a copy for your records.

Legal Use of the Professional Tax Challan PDF

The professional tax challan form 10 in MP PDF is legally binding when filled out correctly and submitted to the appropriate tax authorities. To ensure its legal validity, it is essential to comply with local regulations regarding professional tax payments. This includes submitting the form within the stipulated deadlines and retaining proof of payment. Using a reliable digital solution for filling and signing the form can further enhance its legal standing.

Key Elements of the Professional Tax Challan PDF

Key elements of the professional tax challan form 10 in MP PDF include the taxpayer's identification details, the professional tax amount due, and the payment period. Additionally, the form may contain sections for penalties in case of late payment, as well as instructions for submission. Understanding these elements is crucial for accurate completion and compliance with tax obligations.

Form Submission Methods

The professional tax challan form 10 in MP can be submitted through various methods. Taxpayers have the option to submit the form online via the official government portal, which often allows for immediate payment through electronic means. Alternatively, the form can be mailed to the local tax office or submitted in person. Each method has its own set of requirements, so it is advisable to check the local guidelines before proceeding.

Penalties for Non-Compliance

Failure to submit the professional tax challan form 10 in MP PDF on time can result in penalties. These penalties may include fines or additional interest on the unpaid tax amount. It is important for taxpayers to be aware of the deadlines for submission to avoid these penalties. Regularly checking for updates on tax regulations can help ensure compliance and avoid unnecessary costs.

Quick guide on how to complete professional tax challan pdf

Complete Professional Tax Challan Pdf effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it on the internet. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Professional Tax Challan Pdf on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Professional Tax Challan Pdf with ease

- Locate Professional Tax Challan Pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Professional Tax Challan Pdf and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the professional tax challan pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the professional tax challan form 10 in m p pdf?

The professional tax challan form 10 in m p pdf is a government document used for the payment of professional tax in Madhya Pradesh. It serves as a receipt for taxpayers and includes vital information about the amount paid and the taxpayer's details.

-

How can I download the professional tax challan form 10 in m p pdf?

You can easily download the professional tax challan form 10 in m p pdf from the official Madhya Pradesh government website or other authorized portals. Ensure that you have the latest version to avoid any discrepancies during submission.

-

What are the benefits of using the professional tax challan form 10 in m p pdf?

Using the professional tax challan form 10 in m p pdf simplifies the process of tax payment, ensuring compliance with state regulations. It helps businesses maintain accurate records and is essential for smooth tax audits.

-

Is there a fee associated with the professional tax challan form 10 in m p pdf?

The professional tax itself varies based on the income level of the taxpayer, but there is no fee for accessing the professional tax challan form 10 in m p pdf. Be sure to check the state guidelines for precise tax rates.

-

Can I integrate the professional tax challan form 10 in m p pdf into my accounting software?

Yes, many accounting software tools allow integration with the professional tax challan form 10 in m p pdf. This integration can help streamline your bookkeeping processes and ensure timely tax payments.

-

How does airSlate SignNow help with the professional tax challan form 10 in m p pdf?

airSlate SignNow allows users to electronically sign and send the professional tax challan form 10 in m p pdf securely. It offers an easy-to-use interface that enhances document management for businesses, making the tax submission process more efficient.

-

Who should use the professional tax challan form 10 in m p pdf?

The professional tax challan form 10 in m p pdf should be used by all professionals and businesses in Madhya Pradesh liable to pay professional tax. This includes freelancers, contractors, and small to large enterprises operating within the state.

Get more for Professional Tax Challan Pdf

- Roof inspection letter sample form

- Broker of record letter form

- Editable commonwealth bank statement template form

- The little old lady who was not afraid of anything pdf form

- Intercept eft direct deposit form

- Complaint form a

- Practice exam flash cards flashcardschegg com form

- Privacy policy acknowledgement form 648748591

Find out other Professional Tax Challan Pdf

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure