Grw 4 Form

What is the Grw 4

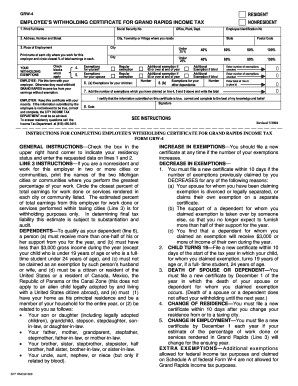

The Grw 4, also known as the Grand Rapids withholding form, is a document used by employers in the city of Grand Rapids to determine the amount of city income tax to withhold from employees' wages. This form is essential for ensuring compliance with local tax regulations and helps employees understand their tax obligations within the city. The Grw 4 is typically required for all employees working within Grand Rapids, regardless of their residency status.

How to use the Grw 4

Using the Grw 4 involves several steps to ensure accurate completion and submission. First, employers must provide the form to their employees, who will fill it out with their personal information, including name, address, and Social Security number. Employees will also indicate their filing status and any additional withholding allowances they wish to claim. Once completed, the Grw 4 should be submitted to the employer, who will then use the information to calculate the appropriate city income tax withholding from each paycheck.

Steps to complete the Grw 4

Completing the Grw 4 requires careful attention to detail. Here are the steps involved:

- Obtain the Grw 4 form from your employer or download it online.

- Fill in your personal information, including your full name, address, and Social Security number.

- Select your filing status, which may include options such as single, married, or head of household.

- Indicate any additional allowances you wish to claim, which can affect the amount withheld.

- Review the completed form for accuracy before submitting it to your employer.

Legal use of the Grw 4

The Grw 4 is legally binding when completed and submitted correctly. It complies with local tax laws and regulations, ensuring that employers withhold the appropriate amount of city income tax from employees' wages. Failure to use the Grw 4 correctly can result in penalties for both employers and employees, making it crucial to understand the legal implications of this form. Employers must keep the completed forms on file for record-keeping and auditing purposes.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Grw 4. Typically, employees should submit their completed Grw 4 forms to their employers as soon as they start a new job or when there is a change in their tax situation. Employers are responsible for ensuring that the correct withholding amounts are applied in a timely manner. Additionally, employees should be mindful of the city income tax filing deadlines to avoid any penalties or interest on unpaid taxes.

Examples of using the Grw 4

There are various scenarios in which the Grw 4 is utilized. For instance, a new employee starting a job in Grand Rapids would need to fill out the Grw 4 to ensure their employer withholds the correct amount of city income tax. Similarly, an employee who experiences a change in marital status or the number of dependents may need to update their Grw 4 to reflect these changes, ensuring accurate withholding moving forward. These examples highlight the importance of keeping the Grw 4 up to date to align with personal tax situations.

Quick guide on how to complete grw 4

Effortlessly Prepare Grw 4 on Any Device

The management of documents online has gained traction among both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Grw 4 on any device through the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign Grw 4 with Ease

- Obtain Grw 4 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your PC.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Grw 4 and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the grw 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the grw 4 feature in airSlate SignNow?

The grw 4 feature in airSlate SignNow refers to enhanced functionalities that streamline document eSigning and management. This includes intuitively designed workflows, integrations, and advanced security measures. With grw 4, businesses can efficiently handle electronic signatures within their everyday operations.

-

How does airSlate SignNow with grw 4 benefit my business?

Using airSlate SignNow's grw 4 capabilities, businesses can signNowly reduce the time spent on document processes. This feature ensures faster turnaround times for signed documents, enhances team collaboration, and improves overall workflow efficiency, making it a cost-effective solution.

-

What pricing plans are available for airSlate SignNow's grw 4 feature?

airSlate SignNow offers several pricing plans, including options that incorporate the grw 4 feature for various business sizes. Each plan is designed to provide value through cost-effective solutions focused on document management and eSigning. It's advisable to visit our pricing page for more detailed information on each plan and its included features.

-

Can I integrate airSlate SignNow with other software while using grw 4?

Yes, airSlate SignNow's grw 4 feature supports integration with numerous applications, enhancing your workflow. This allows you to connect popular tools for CRM, project management, and more, ensuring seamless document handling across platforms. Integrations are quick to set up, making it a flexible choice for organizations.

-

Is there a mobile app available for airSlate SignNow grw 4?

Absolutely! The airSlate SignNow mobile app includes the powerful grw 4 feature, allowing users to manage documents and eSign on the go. This mobile accessibility ensures that you can handle important paperwork anytime, anywhere, which is essential for today’s fast-paced business environment.

-

What security measures are in place for documents signed with grw 4?

AirSlate SignNow prioritizes security with its grw 4 feature by employing robust encryption and compliance with international data protection regulations. This ensures all documents signed using our platform are secure and confidential. Our commitment to security gives businesses peace of mind while handling sensitive documents.

-

How can grw 4 improve team collaboration in my business?

Grw 4 enhances team collaboration within airSlate SignNow by allowing multiple users to interact seamlessly on documents. Real-time updates and shared access ensure everyone is on the same page, facilitating efficient teamwork. This fosters a collaborative environment that can increase productivity and reduce delays.

Get more for Grw 4

Find out other Grw 4

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation