Fillable Partner Identification and Cost Share Worksheet Form

What is the fillable partner identification and cost share worksheet?

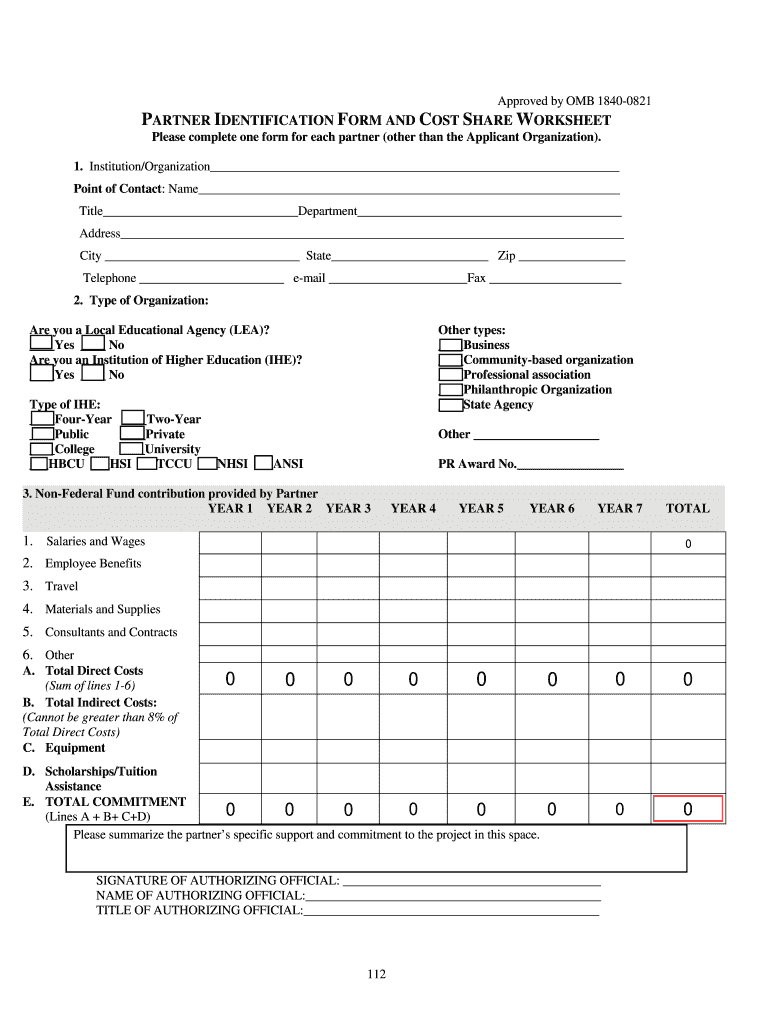

The fillable partner identification and cost share worksheet is a structured document designed to gather essential information about partners involved in a business arrangement. This worksheet serves multiple purposes, including identifying partners, detailing their contributions, and outlining the cost-sharing mechanisms among them. By standardizing this information, businesses can ensure clarity and transparency in their partnerships, which is crucial for effective collaboration and compliance with legal requirements.

How to use the fillable partner identification and cost share worksheet

Using the fillable partner identification and cost share worksheet involves several straightforward steps. First, download the template from a reliable source. Next, fill in the required fields, which typically include partner names, contact information, and specific roles within the partnership. Additionally, detail the contributions each partner will make, whether financial, material, or service-based. Finally, review the completed worksheet for accuracy before saving or submitting it as needed. This process ensures that all partners are on the same page regarding their responsibilities and contributions.

Steps to complete the fillable partner identification and cost share worksheet

Completing the fillable partner identification and cost share worksheet can be broken down into several key steps:

- Download the template: Access the fillable form from a trusted platform.

- Enter partner information: Fill in the names, addresses, and contact details of all partners involved.

- Specify contributions: Clearly outline what each partner is contributing to the partnership.

- Detail cost-sharing arrangements: Describe how costs will be shared among partners, including percentages or fixed amounts.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Save and distribute: Save the completed form and share it with all partners for their records.

Legal use of the fillable partner identification and cost share worksheet

The legal use of the fillable partner identification and cost share worksheet is essential for establishing a formal partnership agreement. This document can serve as evidence in legal disputes, ensuring that all parties are aware of their roles and responsibilities. To maintain its legal validity, it is crucial to comply with relevant laws and regulations, such as the Uniform Partnership Act and any state-specific requirements. Additionally, using electronic signatures can enhance the document's enforceability, provided it adheres to eSignature laws like ESIGN and UETA.

Key elements of the fillable partner identification and cost share worksheet

Several key elements should be included in the fillable partner identification and cost share worksheet to ensure it is comprehensive and effective:

- Partner details: Names, addresses, and contact information of all partners.

- Roles and responsibilities: A clear description of each partner's role within the partnership.

- Contributions: Specific contributions from each partner, whether in cash, services, or goods.

- Cost-sharing details: A breakdown of how costs will be shared among partners.

- Signatures: Space for partners to sign, indicating their agreement to the terms outlined in the worksheet.

Examples of using the fillable partner identification and cost share worksheet

Examples of using the fillable partner identification and cost share worksheet can vary based on the nature of the partnership. For instance, in a real estate partnership, the worksheet may outline financial contributions for property acquisition and maintenance costs. In a service-based partnership, it might specify the distribution of labor and resources among partners. By tailoring the worksheet to specific partnership scenarios, businesses can ensure that all aspects of the partnership are clearly defined and agreed upon, reducing the potential for misunderstandings.

Quick guide on how to complete partner identification form and cost share worksheet www2 palomar

Uncover how to smoothly navigate the Fillable Partner Identification And Cost Share Worksheet completion with this simple guide

eFiling and authenticating documents online is becoming increasingly favored and the preferred function for numerous users. It offers various benefits over outdated printed documentation, such as convenience, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can locate, modify, validate, and send your Fillable Partner Identification And Cost Share Worksheet without being hindered by constant printing and scanning. Follow this concise tutorial to initiate and finalize your form.

Follow these instructions to obtain and complete Fillable Partner Identification And Cost Share Worksheet

- Begin by clicking the Get Form button to access your form in our editor.

- Refer to the green indicator on the left that highlights mandatory fields to ensure you don’t overlook them.

- Utilize our advanced features to mark up, modify, sign, secure, and enhance your form.

- Safeguard your document or convert it into a fillable format using the tools on the right panel.

- Review the form and verify it for mistakes or inconsistencies.

- Select DONE to complete the editing process.

- Rename your form or keep it as is.

- Select the storage service where you wish to retain your form, send it via USPS, or click the Download Now button to save your file.

If Fillable Partner Identification And Cost Share Worksheet isn't what you were looking for, you can explore our comprehensive library of pre-filled forms that you can complete with minimal hassle. Visit our platform now!

Create this form in 5 minutes or less

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How do I safely go about finding a partner to share in a Kickstarter project where the idea is original and obviously should have some form of protection where I need help in areas out of my own realm of expertise?

If you only have an idea for a product, you really don’t have anything of value… yet.Kickstarter Lesson #204: Your Idea Is Brilliant, Your Idea Is WorthlessI’d suggest finding a place where these people hang out. In my case, I go to board game conventions to meet both players and people in the industry.Regarding IP protection, unless you have data to suggest that you’ll generate more than $100k in revenue, it’s definitely not worth it. You get copyright for free without doing anything. Trademarks and parents are expensive and only worth it at higher revenues.

Create this form in 5 minutes!

How to create an eSignature for the partner identification form and cost share worksheet www2 palomar

How to create an eSignature for the Partner Identification Form And Cost Share Worksheet Www2 Palomar in the online mode

How to generate an eSignature for the Partner Identification Form And Cost Share Worksheet Www2 Palomar in Google Chrome

How to create an eSignature for signing the Partner Identification Form And Cost Share Worksheet Www2 Palomar in Gmail

How to make an eSignature for the Partner Identification Form And Cost Share Worksheet Www2 Palomar straight from your smart phone

How to make an eSignature for the Partner Identification Form And Cost Share Worksheet Www2 Palomar on iOS

How to create an eSignature for the Partner Identification Form And Cost Share Worksheet Www2 Palomar on Android

People also ask

-

What is a partner identification form template and how can it benefit my business?

A partner identification form template is a structured document that helps businesses identify and vet potential partners. By using this template, you streamline your onboarding process, ensuring that you gather all the necessary information from your partners efficiently. This ultimately saves time and improves collaboration.

-

How can I customize the partner identification form template?

The partner identification form template is fully customizable to suit your business's unique needs. You can easily modify the fields to include specific information relevant to your partnerships, such as qualifications, experience, and references. This flexibility ensures you gather the right data effectively.

-

Is there a cost associated with using the partner identification form template?

The airSlate SignNow platform offers competitive pricing plans that include access to the partner identification form template. Depending on the plan you choose, you can benefit from various features, making it a cost-effective solution for document management and eSigning needs. Check our pricing page for more detailed information.

-

What features are included with the partner identification form template?

The partner identification form template includes features like customizable fields, easy sharing options, and eSignature capabilities. This enhances document integrity and speeds up the review process. With airSlate SignNow, you can ensure that your partner identification process is efficient and secure.

-

How does the partner identification form template integrate with other tools?

airSlate SignNow's partner identification form template seamlessly integrates with various CRM and project management tools. This ensures data flows smoothly between platforms, eliminating the need for manual data entry. You can automate processes and maintain consistent information across your business applications.

-

Can I use the partner identification form template on mobile devices?

Yes, the partner identification form template is fully responsive and can be used on mobile devices. This allows you and your partners to fill out the necessary information anytime, anywhere, enhancing convenience and accessibility. Mobile compatibility ensures you never miss a partnership opportunity.

-

What are the advantages of using airSlate SignNow's partner identification form template over traditional methods?

Using airSlate SignNow's partner identification form template offers several advantages compared to traditional paper methods. It minimizes the risk of errors, saves time, and offers a more streamlined process with eSignature capabilities. Additionally, it ensures better organization and retrieval of documents digitally.

Get more for Fillable Partner Identification And Cost Share Worksheet

Find out other Fillable Partner Identification And Cost Share Worksheet

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation