T1032 2013

What is the T1032

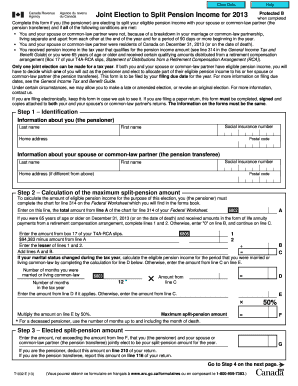

The T1032 form, also known as the pension splitting form, is a tax document used in the United States to facilitate the division of pension income between spouses or common-law partners. This form is particularly relevant during divorce or separation proceedings, allowing individuals to allocate a portion of their pension benefits to their partner. By completing the T1032, both parties can ensure that their tax obligations are accurately reflected, which can lead to potential savings and a fair distribution of retirement assets.

How to use the T1032

Using the T1032 form involves several steps to ensure proper completion and submission. First, both parties must gather necessary information regarding their pension plans, including account numbers and details about the pension provider. Next, the individual who will be transferring a portion of their pension must fill out the form accurately, specifying the amount to be split. Once completed, the T1032 should be signed by both parties to validate the agreement. Finally, the form must be submitted to the appropriate tax authorities, ensuring that both individuals understand their new tax responsibilities.

Steps to complete the T1032

Completing the T1032 form requires careful attention to detail. Follow these steps:

- Gather all relevant pension documentation, including account details and any prior agreements.

- Fill out the T1032 form, clearly indicating the percentage or amount of pension income to be split.

- Ensure both parties review the form for accuracy before signing.

- Submit the completed form to the relevant tax agency, either electronically or by mail.

- Keep a copy of the submitted form for personal records and future reference.

Legal use of the T1032

The T1032 form is legally binding when executed correctly. It complies with U.S. tax laws regarding the division of pension income. To ensure its legal validity, both parties must agree to the terms outlined in the form and follow the prescribed procedures for submission. This includes adhering to any state-specific regulations that may apply. The form must be filed in accordance with IRS guidelines to avoid potential penalties or disputes regarding the division of pension assets.

Filing Deadlines / Important Dates

Filing deadlines for the T1032 form can vary depending on individual circumstances, such as the date of separation or divorce. Generally, it is advisable to submit the form as part of the tax return for the year in which the pension income is to be split. Key dates to remember include:

- Tax return filing deadline: Typically April 15 of the following year.

- State-specific deadlines: These may differ, so it is essential to check local regulations.

Required Documents

To complete the T1032 form, several documents are necessary to support the information provided. These may include:

- Pension plan statements, detailing account balances and benefits.

- Previous tax returns, which may provide context for income levels.

- Any legal documents related to divorce or separation agreements.

Quick guide on how to complete t1032

Prepare T1032 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Process T1032 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign T1032 without any hassle

- Find T1032 and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign T1032 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1032

Create this form in 5 minutes!

How to create an eSignature for the t1032

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t1032 in relation to airSlate SignNow?

t1032 refers to a specific document or feature within the airSlate SignNow platform. It allows users to handle electronic signatures efficiently, ensuring compliance and streamlined workflows. Understanding t1032 can enhance your document management capabilities.

-

How does airSlate SignNow's t1032 feature improve my document workflow?

The t1032 feature is designed to simplify the document signing process. By utilizing airSlate SignNow, you can quickly send, track, and manage documents, thereby reducing turnaround time and improving overall efficiency in your workflow.

-

Is there a cost associated with using t1032 in airSlate SignNow?

Yes, using the t1032 feature comes with various pricing plans tailored to meet different business needs. airSlate SignNow offers competitive pricing structures that allow you to select a plan that best fits your budget while benefiting from the t1032 integration.

-

What are the benefits of using airSlate SignNow’s t1032?

The benefits of using t1032 in airSlate SignNow include enhanced security, ease of use, and faster document turnaround. This feature is particularly helpful for businesses looking to streamline their eSignature processes while ensuring their documents are legally compliant.

-

Can t1032 be integrated with other software?

Absolutely! The t1032 feature in airSlate SignNow can be easily integrated with various business tools and software. This capability allows users to connect their existing workflows, making it more effective and seamless for document management.

-

How secure is the t1032 feature in airSlate SignNow?

The security of the t1032 feature is a top priority for airSlate SignNow. It employs advanced encryption protocols and complies with industry standards to ensure that all documents signed through t1032 remain confidential and secure.

-

Who can benefit from the t1032 feature in airSlate SignNow?

Businesses of all sizes can benefit from using the t1032 feature in airSlate SignNow. Whether you're a small startup or a large corporation, this feature provides the tools necessary to efficiently manage your eSignature processes and improve overall operational productivity.

Get more for T1032

- Form 884 pdf

- Outbreak movie worksheet form

- Eviews 11 serial number form

- Service particulars format

- Akc litter application form

- Pediatric patient registration form template

- Instutition funded special bursary application revised27072015 docx form

- Get the low emission zone registration form transport for pdffiller

Find out other T1032

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself