How to Split Your Pension Income 2022-2026

Understanding the t1032 Form

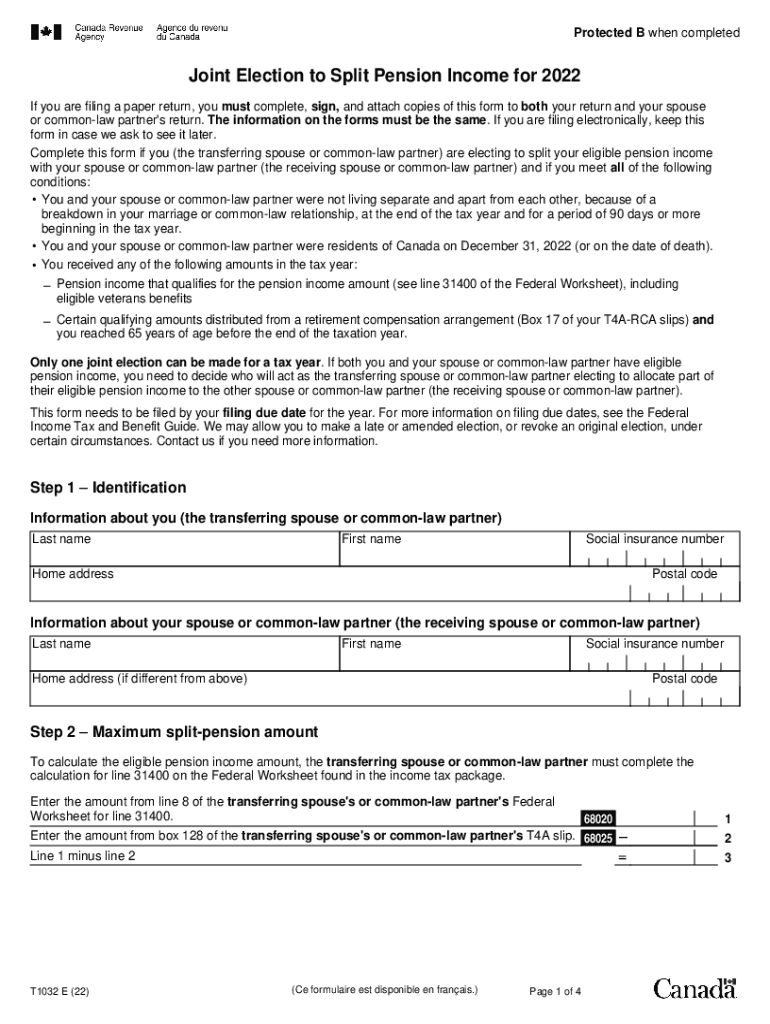

The t1032 form, also known as the "Form T1032," is utilized for splitting pension income between spouses or common-law partners in Canada. This form allows individuals to allocate a portion of their eligible pension income to their partner, potentially reducing the overall tax burden for both parties. Understanding the purpose and implications of this form is essential for effective tax planning and compliance.

Steps to Complete the t1032 Form

Completing the t1032 form involves several key steps to ensure accuracy and compliance with tax regulations:

- Gather necessary information, including your pension income details and your spouse's information.

- Fill out the identification section with your name, address, and Social Security number.

- Indicate the amount of pension income you wish to split with your partner.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority along with your tax return.

Legal Use of the t1032 Form

The t1032 form is legally binding when completed correctly and submitted in accordance with IRS guidelines. It is essential to ensure that both parties understand the implications of splitting pension income, as it can affect tax liabilities and eligibility for certain benefits. Accurate completion and adherence to legal requirements help safeguard against potential disputes or penalties.

Required Documents for the t1032 Form

To successfully complete the t1032 form, you will need several documents:

- Your most recent tax return, which provides context for your income.

- Documentation of your pension income, such as statements from your pension provider.

- Your spouse's or partner's tax information, if applicable, to ensure accurate income splitting.

Filing Deadlines for the t1032 Form

Filing deadlines for the t1032 form align with the general tax return deadlines. Typically, individuals must submit their tax returns by April 15 of the following year. It is crucial to file the t1032 form alongside your tax return to ensure that the income splitting is recognized for the relevant tax year.

IRS Guidelines for the t1032 Form

The IRS has specific guidelines regarding the use of the t1032 form. It is important to familiarize yourself with these rules to ensure compliance:

- Both partners must agree to the income split and sign the form.

- The form must be submitted with the tax return for the year in which the income is being split.

- Keep copies of the completed form and supporting documents for your records.

Quick guide on how to complete how to split your pension income

Effortlessly Prepare How To Split Your Pension Income on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Access How To Split Your Pension Income on any platform through the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Modify and Electronically Sign How To Split Your Pension Income with Ease

- Acquire How To Split Your Pension Income and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements with just a few clicks from your chosen device. Modify and electronically sign How To Split Your Pension Income to ensure effective communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to split your pension income

Create this form in 5 minutes!

How to create an eSignature for the how to split your pension income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t1032 form and why do I need it?

The t1032 form is a crucial document used in Canada for tax-related purposes, specifically for electing to split certain income between spouses. Understanding its significance can help you minimize the overall tax burden. Using airSlate SignNow, you can easily send and eSign your t1032 form, making the process quick and efficient.

-

How does airSlate SignNow simplify the t1032 form signing process?

With airSlate SignNow, the t1032 form can be securely signed and shared digitally, eliminating the hassle of printing and mailing documents. Our platform allows for real-time collaboration, making it easier for all parties involved to review and approve the form. Experience a streamlined process that saves time and ensures accuracy.

-

What are the pricing options for using airSlate SignNow for my t1032 form?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that best fits your needs, whether you are handling one t1032 form or hundreds. Our competitive pricing ensures that you receive excellent value for a powerful eSigning solution.

-

Can I integrate airSlate SignNow with other software to manage my t1032 form?

Yes, airSlate SignNow seamlessly integrates with various software platforms, enabling you to manage your t1032 form alongside other business processes. Whether you use CRM systems, cloud storage, or other applications, our integrations enhance workflow efficiency. This makes it easy to keep all your documents synchronized in one place.

-

What security measures does airSlate SignNow employ for my t1032 form?

When handling sensitive documents like the t1032 form, airSlate SignNow prioritizes security. We implement encryption, secure user authentication, and comply with industry standards to protect your information. You can confidently eSign and store your documents knowing they are secure.

-

Is it possible to track the status of my t1032 form with airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time status updates for your t1032 form, so you can easily track who has signed and when. This feature allows you to manage your document workflow effectively and ensures that nothing slips through the cracks.

-

How can I ensure compliance with regulations using airSlate SignNow for t1032 forms?

AirSlate SignNow ensures compliance with legal standards for electronic signatures, making it a reliable choice for your t1032 form. Our solution is designed to meet the requirements set by various regulatory bodies, giving you peace of mind as you handle your documentation. Stay compliant while saving time and resources.

Get more for How To Split Your Pension Income

- Cell phone reimbursement policy template form

- Sena 1 blm form

- Consecutive integers worksheet with answers pdf form

- Motores y vehiculos nj form

- City of flint building department form

- Id assignmentlicense agreement reinmls com form

- Forms registrars office

- Transient application west liberty university westliberty form

Find out other How To Split Your Pension Income

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe