Phcci Salary Loan Requirements Form

What are the Phcci Salary Loan Requirements

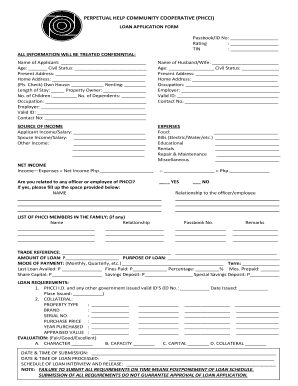

The Phcci salary loan is designed to provide financial assistance to members who meet specific criteria. To qualify, applicants typically need to demonstrate a steady income, which can be verified through pay stubs or employment verification letters. Additionally, applicants must be members of the PHCCI and have maintained their membership in good standing for a defined period. Other requirements may include a minimum length of employment and a satisfactory credit history, which helps assess the applicant's ability to repay the loan.

Steps to Complete the Phcci Salary Loan Requirements

Completing the Phcci salary loan requirements involves several key steps:

- Gather necessary documentation, including proof of income and membership verification.

- Fill out the Phcci loan application form accurately, ensuring all information is complete.

- Submit the application along with the required documents, either online or in person, depending on your preference.

- Await approval, which may take several business days, during which the PHCCI will review your application and financial history.

- If approved, review the loan terms and conditions before signing the agreement.

Eligibility Criteria for the Phcci Salary Loan

To be eligible for a Phcci salary loan, applicants must meet specific criteria. These often include:

- Must be an active member of PHCCI.

- Must have a verifiable source of income.

- Must have a good credit history, which may be assessed through a credit report.

- Must meet any minimum employment duration requirements set by PHCCI.

Required Documents for the Phcci Salary Loan

When applying for a Phcci salary loan, applicants should prepare the following documents:

- Proof of income, such as recent pay stubs or bank statements.

- Membership verification documents that confirm good standing with PHCCI.

- Identification documents, such as a driver’s license or Social Security card.

How to Obtain the Phcci Salary Loan Requirements

Obtaining the Phcci salary loan requirements is a straightforward process. Members can access the necessary forms and guidelines through the PHCCI website or by visiting a local branch. It is essential to review all requirements thoroughly to ensure compliance before submitting the application. Additionally, members may contact customer service for assistance or clarification on any specific requirements.

Legal Use of the Phcci Salary Loan Requirements

The legal use of the Phcci salary loan requirements is governed by regulations that ensure fair lending practices. Members must adhere to these guidelines when applying for a loan. This includes providing accurate information and understanding the terms of the loan agreement. Compliance with these legal standards not only protects the lender but also safeguards the borrower’s rights throughout the loan process.

Quick guide on how to complete phcci salary loan requirements

Complete Phcci Salary Loan Requirements effortlessly on any gadget

Managing documents online has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Phcci Salary Loan Requirements on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Phcci Salary Loan Requirements with ease

- Locate Phcci Salary Loan Requirements and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you choose. Modify and eSign Phcci Salary Loan Requirements and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the phcci salary loan requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are PHCCI loan offers?

PHCCI loan offers are tailored financing solutions that provide businesses with access to necessary capital. These offers are designed to meet diverse financial needs, allowing companies to invest in growth and operational improvements. With competitive rates and flexible terms, PHCCI loan offers can enhance your financial strategy.

-

How can I apply for PHCCI loan offers through airSlate SignNow?

To apply for PHCCI loan offers via airSlate SignNow, simply visit our application page and fill out the required information. The process is straightforward and can be completed online, making it convenient for you. Once submitted, our team will review your application and guide you through the next steps.

-

What features come with PHCCI loan offers?

PHCCI loan offers come with a variety of features designed to streamline your financing experience. These features include competitive interest rates, flexible repayment terms, and personalized support from our loan specialists. Additionally, the integration with airSlate SignNow simplifies the document signing process, ensuring a hassle-free experience.

-

What are the benefits of choosing PHCCI loan offers?

Choosing PHCCI loan offers provides businesses with quick access to funds, enabling you to seize growing opportunities. The tailored terms allow for better cash flow management, and our dedicated support team is always available to help navigate your financial journey. With airSlate SignNow, you can easily manage your loan documents digitally.

-

Are there any fees associated with PHCCI loan offers?

Fees may vary depending on the terms of the PHCCI loan offers you choose. However, we strive to provide transparent pricing, ensuring that you understand any applicable fees upfront. It’s important to review all details carefully to get the most out of your PHCCI loan offers.

-

Can businesses with poor credit apply for PHCCI loan offers?

Yes, businesses with poor credit may still be eligible for PHCCI loan offers. Our team evaluates applications on a case-by-case basis, considering various factors beyond credit scores. We aim to provide financial assistance to businesses looking to grow, regardless of their credit history.

-

How does airSlate SignNow simplify the loan process related to PHCCI loan offers?

airSlate SignNow simplifies the loan process by allowing digital document signing and management, which saves time and reduces paperwork. You can securely send, sign, and store documents related to your PHCCI loan offers in one centralized platform. This digital approach enhances efficiency and keeps your transactions organized.

Get more for Phcci Salary Loan Requirements

- Sacco membership application form template

- Ps form 4027

- Social security payee form filled example

- Office file number or imm 1343 case label form

- 132a form

- Correct the details of a marriage or civil partnership registration form

- Application form to correct the details of a marriage registration correct the details of a marriage registration

- Efta cl appendix 5 to annex viii switzerland schedule of specific commitments form

Find out other Phcci Salary Loan Requirements

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple