Fidelity Qdro Form

What is the Fidelity Qdro?

The Fidelity QDRO, or Qualified Domestic Relations Order, is a legal document that allows for the division of retirement assets during divorce proceedings. This form is specifically designed for accounts held by Fidelity Investments, facilitating the transfer of retirement funds to an alternate payee, typically a former spouse. The Fidelity QDRO ensures that both parties can access their rightful share of retirement benefits without incurring penalties or taxes that would ordinarily apply to early withdrawals.

How to Obtain the Fidelity Qdro

To obtain the Fidelity QDRO, individuals must first consult with their divorce attorney to ensure that the order meets legal requirements. Fidelity provides a QDRO request form that can be accessed through their website or by contacting their customer service. It is essential to provide accurate information about the retirement account and the parties involved to avoid delays in processing.

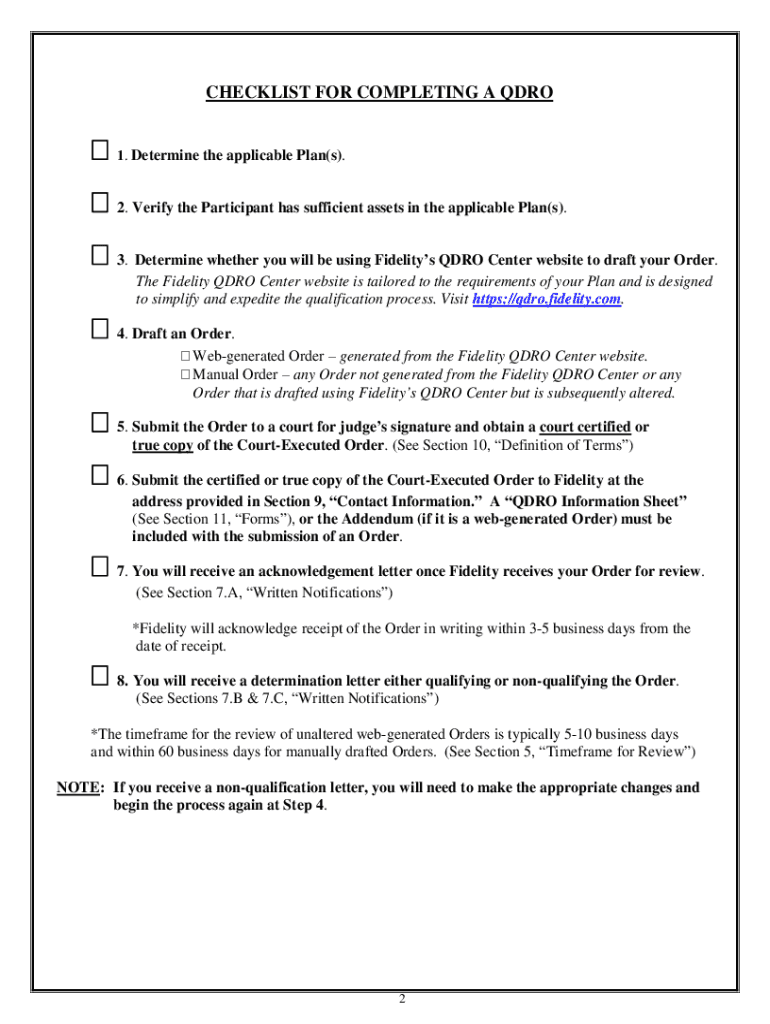

Steps to Complete the Fidelity Qdro

Completing the Fidelity QDRO involves several key steps:

- Gather necessary information, including account numbers and details about the parties involved.

- Consult with a legal professional to draft the QDRO, ensuring it complies with state laws and Fidelity’s guidelines.

- Review the document for accuracy before submission.

- Submit the completed QDRO to Fidelity for approval, either online or via mail.

- Monitor the status of the QDRO to ensure it is processed in a timely manner.

Legal Use of the Fidelity Qdro

The legal use of the Fidelity QDRO is governed by federal and state laws, which dictate how retirement assets can be divided in divorce cases. It is crucial that the QDRO is drafted correctly to meet the requirements set forth by the Employee Retirement Income Security Act (ERISA) and state-specific regulations. A properly executed QDRO allows the alternate payee to receive their share of the retirement benefits without facing tax penalties.

Key Elements of the Fidelity Qdro

Several key elements must be included in the Fidelity QDRO for it to be valid:

- The name and last known address of both the participant and the alternate payee.

- The specific retirement plan to which the QDRO applies.

- The amount or percentage of the benefits to be paid to the alternate payee.

- A statement that the order is a QDRO under applicable law.

Form Submission Methods

The Fidelity QDRO can be submitted through multiple methods:

- Online: If Fidelity offers an online submission portal, users can upload their completed QDRO directly.

- Mail: Completed forms can be sent to Fidelity's designated address for processing.

- In-Person: Some individuals may choose to deliver the form in person at a Fidelity branch, if available.

Quick guide on how to complete fidelity qdro 37233403

Complete Fidelity Qdro effortlessly on any device

Digital document management has surged in popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Manage Fidelity Qdro on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Fidelity Qdro effortlessly

- Obtain Fidelity Qdro and select Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Fidelity Qdro to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity qdro 37233403

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fidelity QDRO form and why is it important?

A fidelity QDRO form, or Qualified Domestic Relations Order, is a legal document that allows for the division of retirement plan assets during divorce proceedings. This form is crucial as it ensures that both parties receive their fair share of retirement benefits, complying with federal laws and regulations.

-

How can I access the fidelity QDRO form using airSlate SignNow?

You can easily access the fidelity QDRO form by logging into your airSlate SignNow account and navigating to the document templates. We provide a range of customizable options to help you create and sign your fidelity QDRO form efficiently.

-

What features does airSlate SignNow offer for creating a fidelity QDRO form?

airSlate SignNow offers features like document templates, eSignature capabilities, and automated workflows to streamline the creation of a fidelity QDRO form. These tools make it user-friendly, allowing you to focus on the legal aspects rather than the paperwork.

-

Is there a cost associated with using airSlate SignNow for a fidelity QDRO form?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing plans tailored for different needs. Our plans provide access to various document management features, ensuring you can create your fidelity QDRO form without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for my fidelity QDRO form?

Absolutely! airSlate SignNow offers integration with a wide range of applications, such as Google Drive and Dropbox. This allows you to easily store, retrieve, and manage your fidelity QDRO form alongside other important documents.

-

How does airSlate SignNow ensure the security of my fidelity QDRO form?

airSlate SignNow prioritizes your security by utilizing advanced encryption protocols to protect your fidelity QDRO form and all associated documents. Additionally, we comply with regulatory standards to ensure your information remains confidential.

-

What are the benefits of using airSlate SignNow for my fidelity QDRO form?

Using airSlate SignNow for your fidelity QDRO form provides numerous benefits, including enhanced document security, faster turnaround times, and an easy-to-use interface. These advantages can help simplify the complexities of legal documentation during partnership transitions.

Get more for Fidelity Qdro

- Dr 1106 form

- Archery scorecard template form

- Gewofag selbstauskunft form

- Declaration of caregiver services form

- Open share small group discussion worksheet seven reasons form

- Fedex air waybill attention aluminum extru form

- 21 motion and order to incur debt vehicle direct doc form

- Low vision tutorial form

Find out other Fidelity Qdro

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template