Form Declaration Customs

What is the Form Declaration Customs

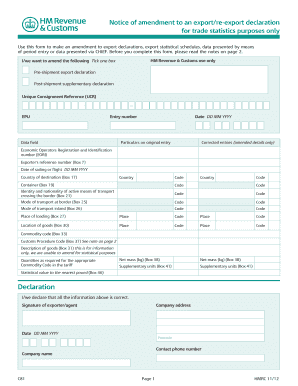

The Form Declaration Customs, commonly referred to as the C81 form, is a critical document used in the customs declaration process. It is primarily utilized for declaring goods being imported or exported, ensuring compliance with regulations set forth by HM Revenue and Customs (HMRC). This form is essential for businesses and individuals engaged in international trade, as it provides detailed information about the nature, value, and origin of the goods. Proper completion of the C81 form is necessary to avoid delays in customs clearance and potential penalties.

Steps to complete the Form Declaration Customs

Completing the C81 form requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather necessary information: Collect all relevant details about the goods, including descriptions, quantities, and values.

- Fill out the form: Enter the required information in the appropriate sections of the C81 form. Be precise to avoid errors.

- Review your entries: Double-check all information for accuracy. Incorrect details can lead to complications during customs processing.

- Submit the form: Choose your preferred submission method, whether online or via mail, and ensure it is sent to the correct HMRC address.

Legal use of the Form Declaration Customs

The C81 form is legally binding when completed correctly and submitted in accordance with HMRC regulations. It must be filled out truthfully, as any false declarations can result in significant penalties, including fines and legal action. Understanding the legal implications of the C81 form is crucial for compliance, as it serves as a formal declaration to customs authorities regarding the nature of the goods being imported or exported.

Required Documents

When completing the C81 form, several documents may be required to support your declaration. These documents typically include:

- Invoices: Proof of purchase or sale of the goods.

- Packing lists: Detailed lists of the items being shipped.

- Certificates of origin: Documentation that verifies the origin of the goods.

- Transport documents: Bills of lading or airway bills that detail the shipment process.

Form Submission Methods (Online / Mail / In-Person)

The C81 form can be submitted through various methods, depending on the preferences and capabilities of the user. The available submission methods include:

- Online submission: Many users opt for electronic submission through HMRC's online portal, which is often faster and more efficient.

- Mail submission: The form can be printed and sent via postal service to the designated HMRC address.

- In-person submission: For those who prefer face-to-face interaction, submitting the form at a local HMRC office is also an option.

Key elements of the Form Declaration Customs

Understanding the key elements of the C81 form is essential for accurate completion. Important components include:

- Goods description: A detailed account of the items being declared.

- Value of goods: The monetary worth of the goods, which is crucial for customs duties.

- Country of origin: The country where the goods were manufactured or produced.

- Customs codes: Specific codes that categorize the goods for customs purposes.

Examples of using the Form Declaration Customs

The C81 form is utilized in various scenarios, such as:

- Importing goods: Businesses bringing products into the U.S. from abroad must complete the C81 form to declare their imports.

- Exporting goods: Companies sending products overseas are required to fill out the form to comply with export regulations.

- Amending declarations: If there are changes to previously submitted declarations, the C81 form can be used to amend the information.

Quick guide on how to complete form declaration customs

Easily Prepare Form Declaration Customs on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form Declaration Customs on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to Edit and Electronically Sign Form Declaration Customs with Ease

- Find Form Declaration Customs and click Get Form to initiate.

- Use the provided tools to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the specific tools that airSlate SignNow provides for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs within just a few clicks from any device you choose. Edit and electronically sign Form Declaration Customs to ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form declaration customs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of HMRC information in document signing?

HMRC information is crucial for businesses that require tax compliance and verification during document signing. By integrating HMRC information into your workflow, you ensure that all tax-related documents adhere to legal standards, which can help avoid costly penalties.

-

How does airSlate SignNow handle HMRC information securely?

airSlate SignNow prioritizes security by implementing top-tier encryption protocols to protect HMRC information during transmission and storage. Your sensitive tax-related documents remain confidential, ensuring compliance with data protection regulations.

-

Can I integrate HMRC information with other software using airSlate SignNow?

Yes, airSlate SignNow offers various integrations that allow you to connect with other applications to manage HMRC information efficiently. This functionality ensures a seamless exchange of data, streamlining your document management process.

-

What pricing options are available for accessing HMRC information through airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including access to crucial features related to HMRC information. By choosing the right plan, you can effectively manage your document signing process without breaking your budget.

-

What features support effective management of HMRC information?

airSlate SignNow includes features such as automated reminders, document tracking, and customizable templates that enhance the management of HMRC information. These tools ensure that your documents are always up-to-date and compliant with current regulations.

-

How can airSlate SignNow improve the efficiency of handling HMRC information?

With airSlate SignNow, businesses can optimize the handling of HMRC information through automated workflows and electronic signatures. This improves efficiency by reducing the time spent on manual processes while ensuring accurate handling of tax-related documents.

-

Is there a mobile application for accessing HMRC information with airSlate SignNow?

Yes, airSlate SignNow has a mobile application that allows users to access and manage HMRC information on the go. This ensures that you can review and sign important documents anytime, anywhere, enhancing your business's flexibility.

Get more for Form Declaration Customs

Find out other Form Declaration Customs

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT