15h Form PDF

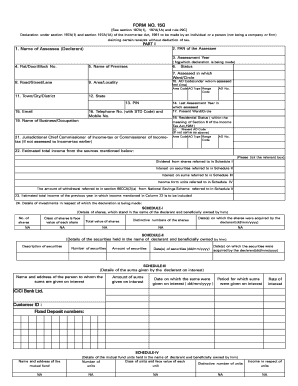

What is the 15h Form PDF?

The 15h Form PDF is a tax document used in the United States, primarily for individuals who wish to claim exemption from withholding on certain types of income. It is often utilized by taxpayers who meet specific criteria under the Internal Revenue Code, allowing them to avoid unnecessary tax withholding on their earnings. This form is crucial for those who want to ensure that their income is not taxed at source, particularly in cases where they expect to owe no federal income tax for the year.

How to Obtain the 15h Form PDF

To obtain the 15h Form PDF, individuals can visit the official IRS website where tax forms are made available for download. The form can be easily found by searching for "15h Form" in the forms section. Once located, users can download the PDF directly to their device. It is advisable to ensure that the most recent version of the form is being used to comply with current tax regulations.

Steps to Complete the 15h Form PDF

Completing the 15h Form PDF involves several key steps:

- Download the Form: Access the IRS website and download the 15h Form PDF.

- Fill in Personal Information: Enter your name, address, and Social Security number accurately.

- Claim Exemption: Indicate the specific reason you are claiming exemption from withholding.

- Sign and Date: Ensure to sign and date the form to validate it.

After completing these steps, the form can be submitted to the relevant financial institution or employer as required.

Legal Use of the 15h Form PDF

The legal use of the 15h Form PDF is governed by IRS regulations. It is essential that the form is filled out correctly and submitted to ensure compliance with tax laws. Misuse or incorrect filing can lead to penalties or issues with the IRS. The form must be used only by eligible taxpayers who meet the criteria for exemption from withholding, as outlined in the IRS guidelines.

Eligibility Criteria for the 15h Form PDF

To qualify for using the 15h Form PDF, taxpayers must meet specific eligibility criteria, which include:

- Being a resident alien or a citizen of the United States.

- Expecting to owe no federal income tax for the current tax year.

- Having income that is not subject to withholding, such as certain types of interest or dividends.

It is important for individuals to review these criteria carefully to ensure they are eligible before submitting the form.

Form Submission Methods

The 15h Form PDF can be submitted through various methods depending on the requirements of the entity requesting it. Common submission methods include:

- Online Submission: Some employers or financial institutions may allow electronic submission of the form.

- Mail: The completed form can be printed and mailed to the appropriate address as specified by the requesting entity.

- In-Person: Individuals may also deliver the form in person to their employer or financial institution.

Choosing the appropriate method of submission is essential to ensure timely processing and compliance.

Quick guide on how to complete 15h form pdf

Complete 15h Form Pdf effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to develop, modify, and electronically sign your documents efficiently without delays. Handle 15h Form Pdf on any platform with airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

How to alter and eSign 15h Form Pdf effortlessly

- Find 15h Form Pdf and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign 15h Form Pdf to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 15h form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form no 15h rule 29c 1a and why is it important?

Form no 15h rule 29c 1a is a vital document used by taxpayers to ensure that no tax is deducted at source on certain types of income. Understanding how to fill it out correctly is essential for availing tax benefits and ensuring compliance with tax regulations. airSlate SignNow simplifies this process with templates and guidance.

-

How can airSlate SignNow help me with form no 15h rule 29c 1a how to full fill?

airSlate SignNow offers intuitive tools that guide you through filling out form no 15h rule 29c 1a. With the platform's smart templates, you can easily enter your information, ensuring that you correctly complete the form. This not only saves time but also reduces the chances of errors.

-

What features does airSlate SignNow provide for filling forms?

airSlate SignNow provides features like customizable templates, eSigning capabilities, and document sharing, making it an excellent choice for managing form no 15h rule 29c 1a how to full fill. The platform allows you to organize multiple documents and streamline the entire process of submission.

-

Is there a cost associated with using airSlate SignNow for form no 15h rule 29c 1a?

Yes, airSlate SignNow offers various pricing plans based on your needs. Each plan includes features that facilitate the completion of documents like form no 15h rule 29c 1a. You can choose a plan that fits your budget while benefiting from all the essential features.

-

Can I integrate airSlate SignNow with other platforms?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications including Google Drive and Dropbox. This integration allows users to easily access and manage form no 15h rule 29c 1a how to full fill from their preferred platforms, enhancing overall efficiency.

-

Is it secure to use airSlate SignNow for sensitive documents?

Yes, airSlate SignNow prioritizes your privacy and security. The platform utilizes state-of-the-art encryption and security protocols to protect sensitive information, including form no 15h rule 29c 1a data. You can trust that your documents are safe while using the service.

-

What are the benefits of using airSlate SignNow for business?

Using airSlate SignNow for your business increases efficiency, reduces paperwork, and simplifies the document management process. It can help businesses remain compliant with required forms like form no 15h rule 29c 1a how to full fill while enhancing workflow productivity. This saves time and streamlines operations.

Get more for 15h Form Pdf

Find out other 15h Form Pdf

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free