Pinnacle Bank 2014-2026

What is the Pinnacle Bank?

Pinnacle Bank is a financial institution that offers a variety of banking services to individuals and businesses. It provides products such as checking and savings accounts, loans, mortgages, and investment services. As a community-focused bank, Pinnacle Bank aims to meet the financial needs of its customers while promoting local economic growth. Understanding the services offered by Pinnacle Bank can help customers make informed decisions regarding their financial management.

How to use the Pinnacle Bank

Using Pinnacle Bank involves several straightforward steps. Customers can open an account online or in person by providing necessary identification and personal information. Once the account is established, individuals can access their accounts through online banking, mobile apps, or by visiting a local branch. Customers can manage their finances by checking balances, transferring funds, and applying for loans. Understanding how to navigate these services effectively enhances the banking experience.

Steps to complete the Pinnacle Bank

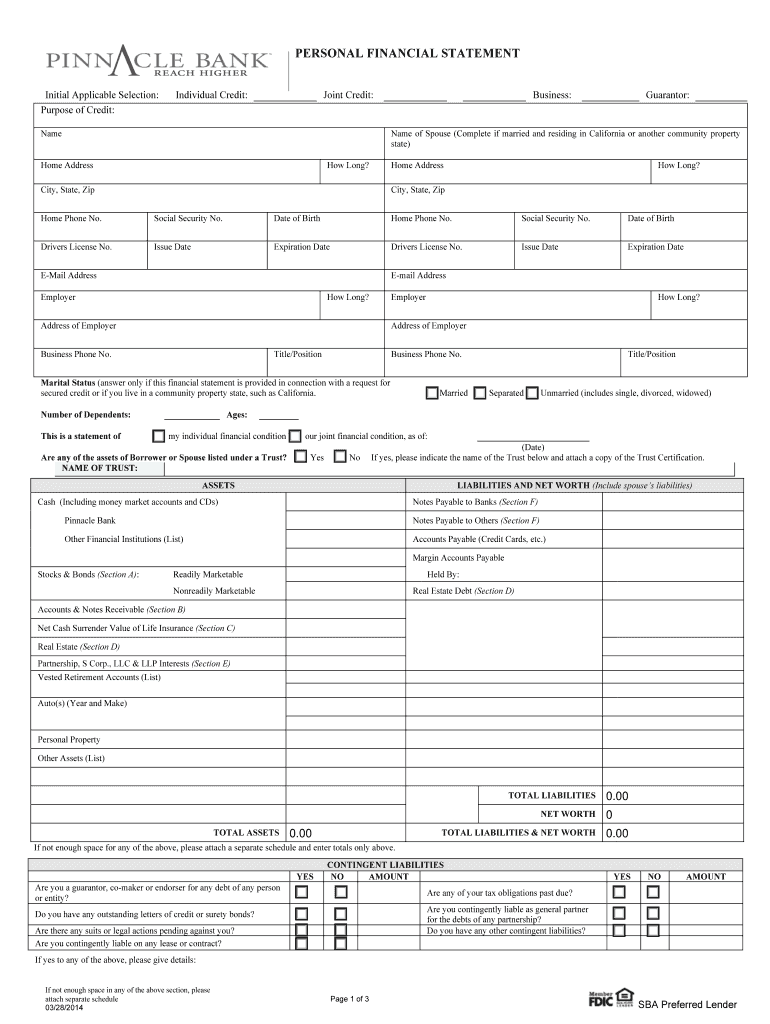

Completing transactions or applications with Pinnacle Bank requires following specific steps. First, gather all necessary documentation, such as identification and financial statements. Next, access the appropriate form, whether it is for opening an account, applying for a loan, or requesting a statement. Fill out the form accurately, ensuring all required fields are completed. Finally, submit the form electronically or in person at a branch. This process ensures that all transactions are processed smoothly and efficiently.

Legal use of the Pinnacle Bank

Utilizing Pinnacle Bank's services legally involves adhering to federal and state regulations. Customers must provide accurate information when filling out forms and comply with all requirements set forth by the bank. Additionally, understanding the legal implications of banking transactions, such as loans and mortgages, is essential. Pinnacle Bank ensures that its operations comply with laws such as the Bank Secrecy Act and the USA PATRIOT Act, which aim to prevent fraud and protect consumers.

Required Documents

When engaging with Pinnacle Bank, certain documents are typically required. For account openings, customers may need to provide a government-issued ID, Social Security number, and proof of address. If applying for loans or mortgages, additional documentation such as income verification, tax returns, and financial statements may be necessary. Having these documents prepared in advance can streamline the process and facilitate quicker approvals.

Form Submission Methods (Online / Mail / In-Person)

Pinnacle Bank offers multiple methods for submitting forms, catering to customer preferences. Forms can be submitted online through the bank's secure portal, allowing for quick processing. Alternatively, customers may choose to mail their forms to the appropriate department or deliver them in person at a local branch. Each method has its advantages, and selecting the right one can depend on the urgency and nature of the request.

Quick guide on how to complete pinnacle bank personal financial statement form

The simplest method to locate and approve Pinnacle Bank

At the level of an entire organization, ineffective procedures related to document approval can take up a signNow amount of work hours. Approving documents such as Pinnacle Bank is an intrinsic part of operations in any enterprise, which is why the productivity of each contract’s lifespan holds great importance for the overall effectiveness of the organization. With airSlate SignNow, endorsing your Pinnacle Bank can be as straightforward and quick as it can be. You will discover on this platform the latest version of nearly any document. Even better, you can approve it immediately without needing to install external applications on your computer or printing anything as physical copies.

Steps to obtain and approve your Pinnacle Bank

- Browse our collection by category or make use of the search bar to locate the document you require.

- View the document preview by clicking Learn more to confirm it is the correct one.

- Hit Get form to start editing immediately.

- Fill out your document and include any essential information using the toolbar.

- Once finished, click the Sign tool to endorse your Pinnacle Bank.

- Select the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to conclude editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to manage your documents effectively. You can discover, complete, modify, and even send your Pinnacle Bank in a single tab effortlessly. Enhance your processes by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the dd form for SBI bank?

Write the name of the beneficiary in the space after “in favour of “ and the branch name where the beneficiary would encash it in the space “payable at”.Fill in the amount in words and figures and the appropriate exchange .Fill up your name and address in “Applicant's name” and sign at “ applicant's signature”

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

-

How do I fill out the Axis Bank account closure form?

How To Fill Axis Bank Account Closure FormTo close your axis bank account, first you have to download the bank account closure form then submit it to your bank branch.Click the link and download the form:http://bit.ly/accntclosurepdfAfter downloading the account closure form, you have to fill up exactly as I have show below with detail. Kindly go through the filled form below and after filling the form, take all the kit like credit card, debit card, passbook and etc and submit it to your bank with the filled form.Source: How To Fill Axis Bank Account Closure Form

Create this form in 5 minutes!

How to create an eSignature for the pinnacle bank personal financial statement form

How to generate an electronic signature for the Pinnacle Bank Personal Financial Statement Form in the online mode

How to make an electronic signature for your Pinnacle Bank Personal Financial Statement Form in Chrome

How to generate an electronic signature for putting it on the Pinnacle Bank Personal Financial Statement Form in Gmail

How to make an electronic signature for the Pinnacle Bank Personal Financial Statement Form from your smartphone

How to make an eSignature for the Pinnacle Bank Personal Financial Statement Form on iOS devices

How to create an electronic signature for the Pinnacle Bank Personal Financial Statement Form on Android

People also ask

-

What are the pricing options for airSlate SignNow when using Pinnacle Bank Financial?

airSlate SignNow offers flexible pricing plans that are suitable for Pinnacle Bank Financial customers. You can choose from monthly or annual subscriptions, each designed to provide an excellent value based on your specific business needs. Additionally, volume discounts are available for larger organizations.

-

What features does airSlate SignNow offer for Pinnacle Bank Financial?

airSlate SignNow includes a rich set of features tailored for Pinnacle Bank Financial users. These features encompass electronic signatures, document templates, and advanced security options to ensure compliance and protect sensitive information. The platform is built to streamline document workflows efficiently.

-

How can airSlate SignNow benefit Pinnacle Bank Financial clients?

Pinnacle Bank Financial clients can benefit from airSlate SignNow’s ability to reduce turnaround times for document approvals signNowly. The easy-to-use interface allows users to quickly send and receive signed documents, enhancing productivity and ensuring a smoother customer experience. It's a cost-effective solution that allows businesses to focus on growth.

-

Is airSlate SignNow compliant with financial regulations for Pinnacle Bank Financial?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that it meets the regulatory requirements applicable to Pinnacle Bank Financial. The platform employs industry-leading security measures, including encryption and secure authentication, to protect all electronic signatures and documents against unauthorized access.

-

What integrations does airSlate SignNow support for Pinnacle Bank Financial?

airSlate SignNow seamlessly integrates with various platforms that Pinnacle Bank Financial may already be using, such as CRM tools, cloud storage services, and document management systems. These integrations enable users to automate workflows and ensure that documents flow smoothly across different applications. This interoperability enhances productivity.

-

Can I access airSlate SignNow on mobile devices for Pinnacle Bank Financial?

Absolutely! airSlate SignNow offers a mobile-friendly version that is compatible with both iOS and Android devices, making it convenient for Pinnacle Bank Financial customers to manage their documents on the go. Users can easily send, sign, and track documents from anywhere, improving efficiency for busy professionals.

-

How does airSlate SignNow ensure the security of documents for Pinnacle Bank Financial?

airSlate SignNow employs top-notch security protocols to safeguard documents for Pinnacle Bank Financial users. This includes features like document encryption, secure cloud storage, and strict access controls to prevent unauthorized access. This ensures that sensitive financial documents remain protected throughout their lifecycle.

Get more for Pinnacle Bank

- Assignment beneficiary form

- Assignment trust form 497329764

- Landlord waiver form

- Release of landlord waiver of liability and assumption of all risks of personal bodily injury regarding use of swimming pool form

- Motion paternity 497329767 form

- Beneficiary income 497329768 form

- Termination date before form

- Acceptance appointment trustee form

Find out other Pinnacle Bank

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now