Michigan Form 165

What is the Michigan Form 165?

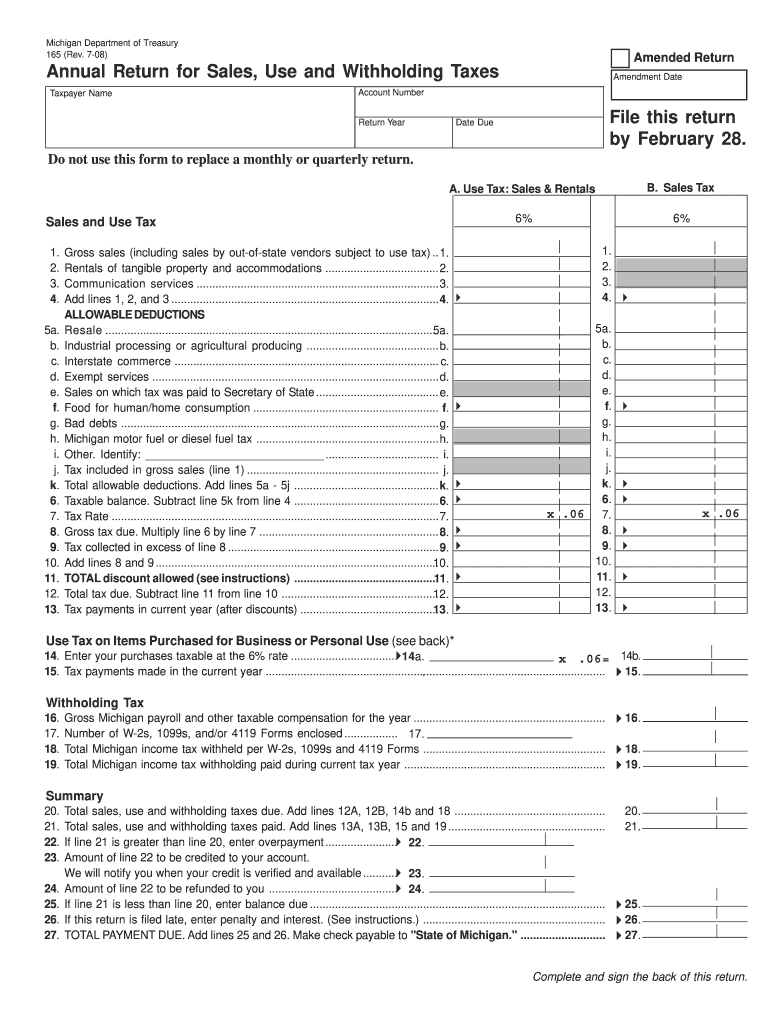

The Michigan Form 165, also known as the Michigan Annual Return for Sales, is a crucial document used by businesses in Michigan to report their sales tax obligations. This form is issued by the Michigan Department of Treasury and is essential for ensuring compliance with state tax regulations. Businesses must accurately complete and submit this form to report their sales and calculate the amount of sales tax owed to the state.

How to Use the Michigan Form 165

To effectively use the Michigan Form 165, businesses must gather all necessary sales data for the reporting period. This includes total sales, exempt sales, and any sales tax collected. The form requires detailed information about the business, including its name, address, and Michigan tax identification number. After filling out the required sections, businesses can calculate their total tax liability and submit the form to the Michigan Department of Treasury.

Steps to Complete the Michigan Form 165

Completing the Michigan Form 165 involves several key steps:

- Gather all relevant sales data for the reporting period.

- Fill in the business information section, including the name and tax ID.

- Report total sales and any exempt sales accurately.

- Calculate the total sales tax owed based on the sales figures provided.

- Review the completed form for accuracy before submission.

Legal Use of the Michigan Form 165

The Michigan Form 165 is legally binding when completed and submitted in accordance with state laws. It is essential for businesses to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or audits. The form must be signed and dated by an authorized representative of the business, affirming that the information is correct and complete.

Filing Deadlines / Important Dates

Businesses must be aware of specific filing deadlines for the Michigan Form 165. Typically, the form is due annually, but the exact date may vary based on the business's fiscal year. It is crucial to check the Michigan Department of Treasury's guidelines for any changes to deadlines, as late submissions may incur penalties or interest on unpaid taxes.

Form Submission Methods

The Michigan Form 165 can be submitted through various methods, including:

- Online submission via the Michigan Department of Treasury's e-filing system.

- Mailing a physical copy of the completed form to the appropriate address.

- In-person submission at designated treasury offices.

Penalties for Non-Compliance

Failure to file the Michigan Form 165 on time or submitting inaccurate information can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential audits. It is essential for businesses to adhere to all filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete michigan form 165

Complete Michigan Form 165 seamlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct format and safely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without interruptions. Handle Michigan Form 165 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

How to modify and eSign Michigan Form 165 effortlessly

- Obtain Michigan Form 165 and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of your documents or redact confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choosing. Edit and eSign Michigan Form 165 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan form 165

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is michigan form 165 pdf and who needs it?

The Michigan Form 165 PDF is a crucial document used for corporate tax filing in Michigan. Businesses operating in the state must complete this form to report their annual tax obligations. By using the airSlate SignNow platform, you can easily fill, sign, and submit your michigan form 165 pdf efficiently.

-

How can I fill out the michigan form 165 pdf using airSlate SignNow?

Filling out the michigan form 165 pdf with airSlate SignNow is simple. After uploading the PDF to the platform, you can use the editing tools to input your information, add text fields, and place your signature. SignNow's user-friendly interface ensures that completing the michigan form 165 pdf is a smooth process.

-

Is there a cost associated with using airSlate SignNow for michigan form 165 pdf?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Pricing is competitive and ensures you receive a cost-effective solution for managing your documents, including the michigan form 165 pdf. You can choose a plan that best suits your volume of document handling.

-

What are the benefits of using airSlate SignNow for michigan form 165 pdf?

Using airSlate SignNow for your michigan form 165 pdf provides numerous benefits, including ease of use, secure storage, and quick document turnaround. The ability to eSign documents eliminates the need for mailing and physical signatures, saving time and resources for your business. Additionally, you'll stay compliant with filing deadlines.

-

Can I integrate airSlate SignNow with other tools for managing michigan form 165 pdf?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications such as Google Drive, Microsoft Office, and CRM systems. This allows for smooth document management and workflow optimization when working with the michigan form 165 pdf and other important business documents.

-

Is my data safe when using airSlate SignNow to manage michigan form 165 pdf?

Yes, security is a top priority for airSlate SignNow. The platform employs state-of-the-art encryption and complies with industry standards to protect your data. When you manage your michigan form 165 pdf, you can be confident that your sensitive information is secure and protected from unauthorized access.

-

Can I track the status of my michigan form 165 pdf after sending it with airSlate SignNow?

Yes, airSlate SignNow provides tracking features to monitor the status of your sent documents, including the michigan form 165 pdf. You will receive real-time updates when the document is viewed, signed, or completed. This feature enhances communication and ensures you stay informed about your document’s progress.

Get more for Michigan Form 165

- Printable 2 step tb test form

- 60 month asq se form

- Lesson 2 extra practice complex fractions and unit rates answers form

- Job vehicle parking registration form

- Letter of waiver form tradecert com

- To brampton board of trade form

- Aggressive incident reporting form d25 osstf

- B959 department of home affairs form

Find out other Michigan Form 165

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement