Appendix D 1 CPA, CA Form

What is the Appendix D 1 CPA, CA

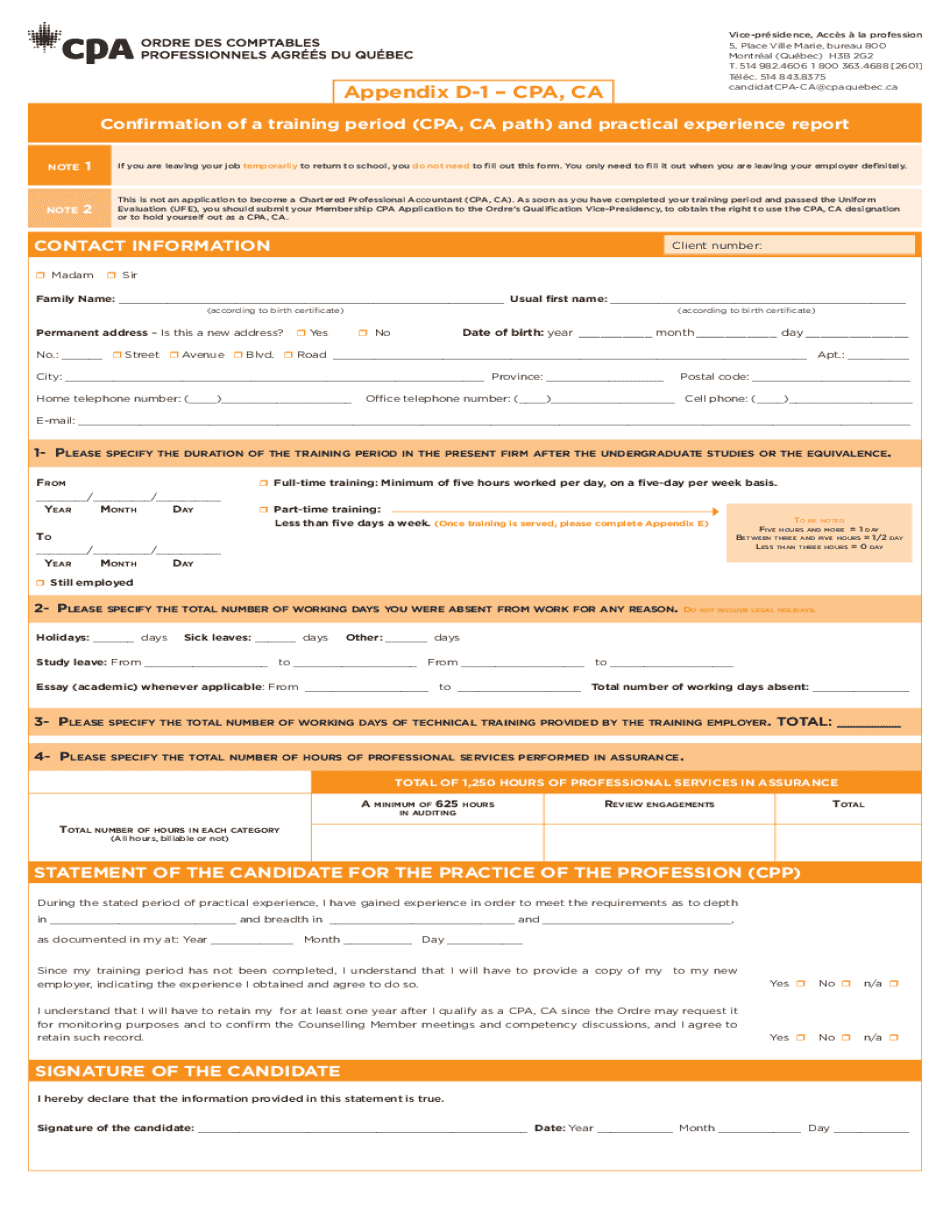

The Appendix D 1 CPA, CA is a specialized form used primarily in the context of accounting and financial reporting. This document serves as a crucial tool for Certified Public Accountants (CPAs) and Chartered Accountants (CAs) to provide detailed disclosures related to financial statements. It ensures compliance with relevant regulatory requirements and helps maintain transparency in financial reporting.

How to use the Appendix D 1 CPA, CA

Using the Appendix D 1 CPA, CA involves several steps to ensure accurate completion. First, gather all necessary financial data and supporting documents required for the disclosures. Next, carefully fill out the form by following the provided guidelines, ensuring that all information is accurate and complete. Once completed, the form should be reviewed for any discrepancies before submission to the appropriate regulatory body or included in financial statements.

Steps to complete the Appendix D 1 CPA, CA

Completing the Appendix D 1 CPA, CA requires a systematic approach:

- Collect all relevant financial information, including income statements and balance sheets.

- Review the specific disclosure requirements outlined in the form.

- Accurately fill in each section, ensuring that all numbers and details are correct.

- Double-check the form against the guidelines to confirm compliance.

- Submit the completed form as part of the financial reporting package.

Legal use of the Appendix D 1 CPA, CA

The legal use of the Appendix D 1 CPA, CA is essential for maintaining compliance with financial reporting standards. This form must be used by licensed professionals to ensure that all disclosures meet the requirements set forth by governing bodies. Failure to use the form correctly can result in penalties or legal repercussions, highlighting the importance of accurate and timely submissions.

Key elements of the Appendix D 1 CPA, CA

Key elements of the Appendix D 1 CPA, CA include:

- Disclosure of significant accounting policies.

- Details on estimates and judgments made in financial reporting.

- Information regarding related party transactions.

- Any contingent liabilities that may impact financial statements.

Examples of using the Appendix D 1 CPA, CA

Examples of using the Appendix D 1 CPA, CA can include scenarios such as:

- A CPA preparing year-end financial statements for a corporation.

- A CA providing disclosures for a nonprofit organization’s financial report.

- Accountants ensuring compliance during audits by including the necessary disclosures.

Quick guide on how to complete appendix d 1 cpa ca

Complete Appendix D 1 CPA, CA effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without unnecessary delays. Handle Appendix D 1 CPA, CA on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign Appendix D 1 CPA, CA with ease

- Obtain Appendix D 1 CPA, CA and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Appendix D 1 CPA, CA and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the appendix d 1 cpa ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Appendix D 1 CPA, CA and how does it relate to airSlate SignNow?

Appendix D 1 CPA, CA refers to specific compliance requirements for Canadian accountants. airSlate SignNow provides a streamlined solution for eSigning documents that meet these compliance standards, ensuring that your business remains compliant while saving time and resources.

-

How does airSlate SignNow help with the compliance of Appendix D 1 CPA, CA?

airSlate SignNow offers features that ensure your documents are securely signed and stored, which is crucial for compliance with Appendix D 1 CPA, CA. The platform provides audit trails and secure storage, making it easier for accountants to manage their documentation in accordance with these regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you are a small firm or a large corporation, you can find a plan that fits your budget while ensuring compliance with standards like Appendix D 1 CPA, CA.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking of document status. These features not only enhance efficiency but also help ensure that your documents comply with Appendix D 1 CPA, CA requirements.

-

Can airSlate SignNow integrate with other software I use?

Yes, airSlate SignNow integrates seamlessly with various software applications, including CRM and accounting tools. This integration capability is essential for professionals needing to maintain compliance with Appendix D 1 CPA, CA while streamlining their workflows.

-

What are the benefits of using airSlate SignNow for accountants?

Using airSlate SignNow allows accountants to enhance their productivity by automating the eSigning process. This not only saves time but also ensures that all signed documents adhere to Appendix D 1 CPA, CA, providing peace of mind regarding compliance.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow employs advanced security measures, including encryption and secure access controls. This level of security is vital for handling sensitive documents, especially those related to Appendix D 1 CPA, CA compliance.

Get more for Appendix D 1 CPA, CA

- Sdr1 form

- Cd 415 emergency contact information

- Ps 515 f1 form

- Bdvr 154 record request for non account individual form

- Out of state resident application for duplicate drivers license or state id andor drivers license reinstatement bdvr 162 form

- Instructions for form 9465 rev july

- Form 8853 archer msas and long term care insurance contracts

- Impounded vehicle pick up notarized letter city of waco texas form

Find out other Appendix D 1 CPA, CA

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free