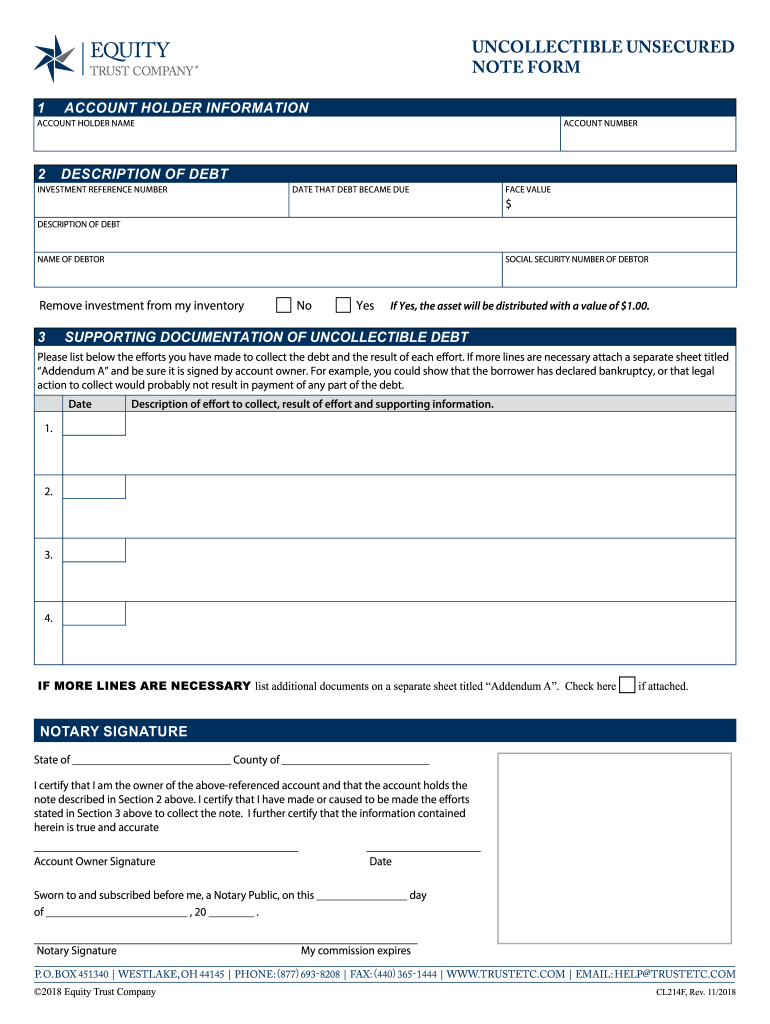

COLCTIBL SCED OT FO Amazon S3 Form

Understanding an uncollectible unsecured loan

An uncollectible unsecured loan refers to a type of debt that cannot be recovered due to various circumstances, such as the borrower's inability to pay. These loans typically do not have collateral backing them, making them riskier for lenders. When a loan is classified as uncollectible, it indicates that the lender has exhausted all reasonable efforts to collect the debt. This classification can impact both the lender's financial statements and the borrower's credit report.

Key elements of uncollectible unsecured loans

Several key elements define uncollectible unsecured loans:

- Loan Type: These are loans without collateral, meaning lenders have no physical asset to reclaim if the borrower defaults.

- Borrower's Financial Status: The borrower's inability to repay the loan often stems from financial difficulties, such as job loss or medical expenses.

- Collection Efforts: Lenders must demonstrate that they have made reasonable attempts to collect the debt before classifying it as uncollectible.

- Impact on Credit: An uncollectible loan can severely affect a borrower's credit score, making future borrowing more difficult.

IRS Guidelines for uncollectible unsecured loans

The Internal Revenue Service (IRS) provides guidelines regarding the treatment of uncollectible unsecured loans for tax purposes. Lenders may be able to write off these loans as bad debt, which can provide some tax relief. It is essential for lenders to keep detailed records of the loan, collection efforts, and any correspondence with the borrower. Proper documentation is crucial for substantiating the claim of uncollectibility during tax reporting.

Filing deadlines for uncollectible unsecured loans

When dealing with uncollectible unsecured loans, lenders must be aware of specific filing deadlines for tax purposes. Generally, lenders should report bad debts on their tax returns for the year in which the debt becomes uncollectible. This often requires careful tracking of the loan's status and timely filing to avoid penalties. It is advisable to consult a tax professional to ensure compliance with IRS regulations and deadlines.

Eligibility criteria for claiming uncollectible loans

To claim an uncollectible unsecured loan as a bad debt, certain eligibility criteria must be met. The borrower must be unable to pay the debt, and the lender must have made reasonable efforts to collect the amount owed. Additionally, the loan must be considered a legitimate debt, meaning it was made in the course of business or as a personal loan. Meeting these criteria is essential for lenders to successfully claim the debt on their tax returns.

Examples of uncollectible unsecured loans

Common examples of uncollectible unsecured loans include personal loans, credit card debts, and medical bills. For instance, if an individual takes out a personal loan and later faces financial hardship, the lender may find it impossible to collect the outstanding amount. Similarly, credit card companies often face uncollectible debts when cardholders default on their payments. In both cases, the lenders may need to classify these debts as uncollectible after exhausting collection efforts.

Quick guide on how to complete colctibl sced ot fo amazon s3

Effortlessly Prepare COLCTIBL SCED OT FO Amazon S3 on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage COLCTIBL SCED OT FO Amazon S3 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign COLCTIBL SCED OT FO Amazon S3 Seamlessly

- Find COLCTIBL SCED OT FO Amazon S3 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet-ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or by downloading it to your computer.

Purge yourself of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign COLCTIBL SCED OT FO Amazon S3 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colctibl sced ot fo amazon s3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an uncollectible unsecured loan?

An uncollectible unsecured loan refers to a type of debt that cannot be recovered due to the borrower's inability to repay. These loans are not backed by collateral, making them riskier for lenders. Understanding this concept is crucial for businesses managing their finances and assessing potential risks.

-

How can airSlate SignNow help with uncollectible unsecured loans?

airSlate SignNow provides a streamlined process for documenting loan agreements, which can help reduce the chances of uncollectible unsecured loans. By ensuring that all parties eSign necessary documents, businesses can maintain clear records and enforce agreements more effectively. This can ultimately lead to better loan management and recovery strategies.

-

What features does airSlate SignNow offer for managing loans?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are essential for managing loans. These tools help businesses create legally binding agreements and monitor their status, which is particularly important when dealing with uncollectible unsecured loans. The platform's user-friendly interface makes it easy for all parties to navigate the loan process.

-

Is airSlate SignNow cost-effective for small businesses dealing with loans?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing loans, including uncollectible unsecured loans. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing essential features. This affordability allows small businesses to implement effective document management without breaking the bank.

-

Can airSlate SignNow integrate with other financial software?

Absolutely! airSlate SignNow integrates seamlessly with various financial software, enhancing your ability to manage uncollectible unsecured loans. These integrations allow for better data synchronization and streamlined workflows, making it easier to track loan agreements and payments. This connectivity is vital for maintaining accurate financial records.

-

What are the benefits of using airSlate SignNow for loan documentation?

Using airSlate SignNow for loan documentation offers numerous benefits, especially when dealing with uncollectible unsecured loans. The platform ensures that all documents are securely stored and easily accessible, reducing the risk of lost paperwork. Additionally, the eSigning feature speeds up the process, allowing for quicker loan approvals and better cash flow management.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security through advanced encryption and compliance with industry standards. This is particularly important when handling sensitive information related to uncollectible unsecured loans. By ensuring that all documents are secure, businesses can protect themselves from potential fraud and maintain trust with their clients.

Get more for COLCTIBL SCED OT FO Amazon S3

- Blank bls card form

- Reg 65 form

- Esol level 1 reading exam practice form

- Http vidhyadeep org pdf job application form pdf

- Tfn registration online form

- Fcat area worksheet dranglin form

- Minor children program release form grand valley state

- Form te7 application to file a statement out of timeextension of time dart form te7 application to file a statement out of

Find out other COLCTIBL SCED OT FO Amazon S3

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement