for the Application of the Double Taxation Convention between Greece and 2003

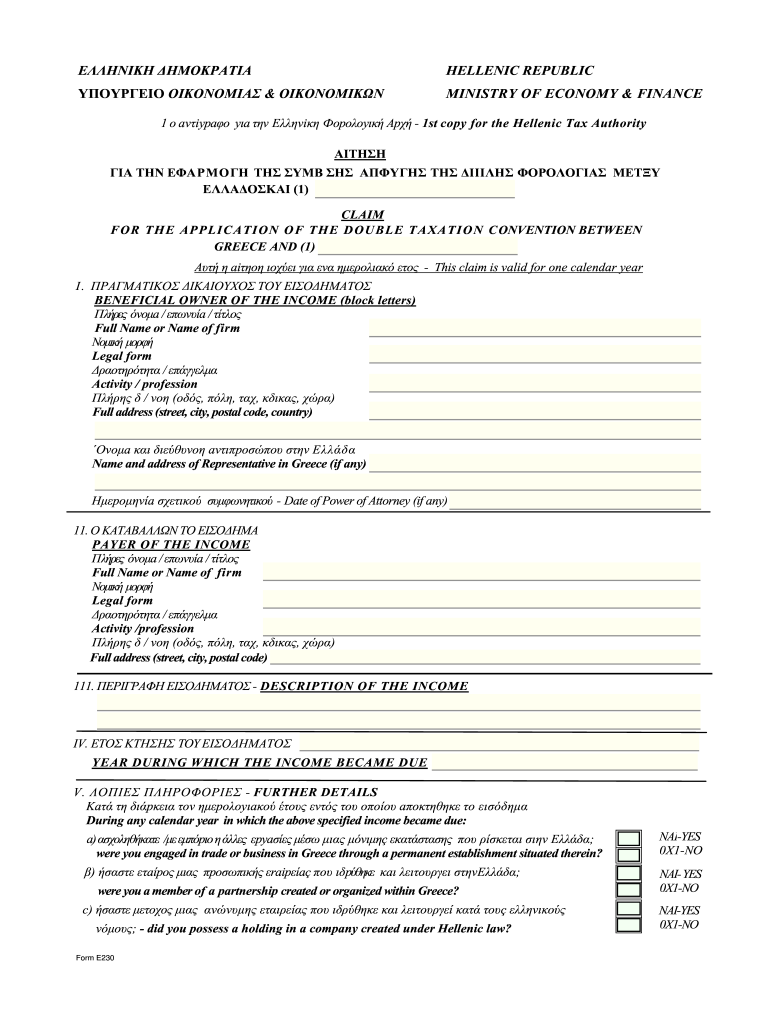

What is the form E230?

The form E230 is a crucial document used in the context of international taxation, specifically for the application of the double taxation convention between Greece and other countries. This form is typically utilized by individuals or entities seeking to claim relief from double taxation on income earned in Greece. It serves as a formal request to the Hellenic Republic Ministry of Finance to apply the provisions of the double taxation agreement, ensuring that taxpayers do not pay tax on the same income in multiple jurisdictions.

Steps to complete the form E230

Completing the form E230 involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of residency and income details. Next, fill out the form with precise information regarding your personal details, the income in question, and the relevant tax treaty provisions. It is essential to review the completed form for any errors before submission. Finally, submit the form to the appropriate tax authority, ensuring that you keep a copy for your records.

Required documents for form E230

When submitting the form E230, certain documents are required to support your claim for double taxation relief. These typically include:

- Proof of residency in the country where the taxpayer resides.

- Documentation of income earned in Greece.

- Any relevant tax identification numbers.

- Previous tax returns or assessments, if applicable.

Having these documents ready will facilitate a smoother application process and help substantiate your claim.

Eligibility criteria for form E230

To be eligible to use the form E230, taxpayers must meet specific criteria outlined in the double taxation convention between Greece and their country of residence. Generally, the applicant must be a resident of a country that has a tax treaty with Greece and must have earned income that is subject to taxation in both jurisdictions. Additionally, the income must fall under the categories specified in the treaty, such as dividends, interest, or royalties.

Form submission methods for E230

The form E230 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the Hellenic Republic Ministry of Finance. Common submission methods include:

- Online submission through the official tax authority portal.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if required.

Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your situation.

Legal use of form E230

The legal use of the form E230 is governed by the double taxation conventions established between Greece and other countries. These treaties are designed to prevent double taxation and promote international trade and investment. When properly completed and submitted, the form E230 serves as a legally binding document that allows taxpayers to claim tax relief, ensuring compliance with both Greek tax laws and the laws of their country of residence.

Quick guide on how to complete for the application of the double taxation convention between greece and

Complete For The Application Of The Double Taxation Convention Between Greece And effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It provides an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage For The Application Of The Double Taxation Convention Between Greece And on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign For The Application Of The Double Taxation Convention Between Greece And with ease

- Locate For The Application Of The Double Taxation Convention Between Greece And and then click Get Form to initiate.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign For The Application Of The Double Taxation Convention Between Greece And and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for the application of the double taxation convention between greece and

Create this form in 5 minutes!

How to create an eSignature for the for the application of the double taxation convention between greece and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form e230 and how does it work?

Form e230 is a specific document template designed for efficient electronic signing and management. With airSlate SignNow, users can easily fill out and send form e230 for signatures, streamlining the process and ensuring compliance. The platform allows real-time tracking and management of the document, making it simple for businesses to handle important paperwork.

-

What are the benefits of using form e230 with airSlate SignNow?

Using form e230 with airSlate SignNow provides businesses with a cost-effective solution for document management. It enhances efficiency by reducing the time spent on manual paperwork while ensuring secure electronic signatures. Additionally, the platform's features allow for easy customization of form e230 to fit various business needs.

-

How much does it cost to use form e230 on airSlate SignNow?

Pricing for using form e230 on airSlate SignNow varies based on the subscription plan chosen. airSlate SignNow offers flexible pricing options that cater to different business sizes and needs. To get the most accurate pricing details, it's best to visit the pricing page on the airSlate SignNow website.

-

Can I integrate form e230 with other software solutions?

Yes, airSlate SignNow allows you to integrate form e230 with various third-party applications to enhance your workflow. Popular integrations include CRM systems, project management tools, and cloud storage services. This flexibility means you can automate processes and keep your documents organized efficiently.

-

Is form e230 secure for sensitive information?

Absolutely! Form e230 processed through airSlate SignNow employs top-notch security measures, including encryption and secure data storage. Your sensitive information is protected throughout the entire signing process, ensuring compliance with industry regulations such as GDPR and HIPAA.

-

How can businesses customize form e230 for their specific needs?

Businesses can easily customize form e230 using airSlate SignNow's user-friendly editor. You can modify fields, add checkboxes, or include company logos to create a personalized document. This level of customization ensures that form e230 meets the unique requirements of various industries.

-

What types of businesses can benefit from using form e230?

Form e230 is versatile and can benefit a wide range of industries, including real estate, healthcare, and finance. Any business that requires signature collection and document management can streamline their processes with airSlate SignNow. The ease of use and adaptability make it a great choice for small and large organizations alike.

Get more for For The Application Of The Double Taxation Convention Between Greece And

Find out other For The Application Of The Double Taxation Convention Between Greece And

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation