Form C 245

What is the Form C 245

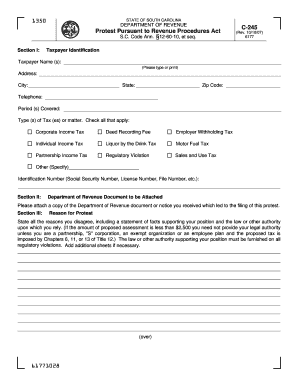

The Form C 245 is a legal document used in South Carolina, primarily for requesting a review of a tax appeal. This form is essential for individuals or businesses seeking to contest decisions made by the South Carolina Department of Revenue regarding tax assessments or disputes. Understanding the purpose and requirements of this form is crucial for ensuring that your appeal is processed correctly and efficiently.

How to use the Form C 245

Using the Form C 245 involves several steps to ensure that your request for appeal is valid. First, gather all necessary information related to your tax assessment. This includes details about your property, the assessment notice, and any supporting documentation. Next, accurately complete the form, ensuring that all sections are filled out clearly and legibly. After completing the form, submit it according to the guidelines provided by the South Carolina Department of Revenue.

Steps to complete the Form C 245

Completing the Form C 245 requires careful attention to detail. Follow these steps:

- Start by writing your personal information, including your name, address, and contact details.

- Provide the tax year and the specific assessment you are contesting.

- Clearly state the reason for your appeal, supported by relevant facts or evidence.

- Attach any documents that support your claim, such as previous tax returns or property appraisals.

- Review the form for accuracy and completeness before submission.

Legal use of the Form C 245

The legal use of the Form C 245 is governed by South Carolina tax laws. To ensure your appeal is valid, it is important to comply with all relevant legal requirements. This includes filing the form within the specified timeframe and providing accurate information. The completed form must be submitted to the appropriate tax authority, and it should be accompanied by any necessary documentation to substantiate your appeal.

Filing Deadlines / Important Dates

Filing deadlines for the Form C 245 are critical to the success of your appeal. Typically, the form must be submitted within a specific period following the receipt of your tax assessment notice. It is essential to check the exact dates for the current tax year, as these can vary. Missing the deadline may result in the forfeiture of your right to appeal, making timely submission crucial.

Required Documents

When submitting the Form C 245, certain documents are required to support your appeal. These may include:

- A copy of the tax assessment notice you are contesting.

- Any relevant documentation that supports your case, such as property appraisals or tax returns.

- Proof of identity, if necessary, to verify your claim.

Ensuring that all required documents are included will help facilitate a smoother review process.

Who Issues the Form

The Form C 245 is issued by the South Carolina Department of Revenue. This state agency is responsible for administering tax laws and overseeing the appeals process. For any questions regarding the form or the appeal process, individuals can contact the Department of Revenue directly for assistance.

Quick guide on how to complete form c 245

Prepare Form C 245 effortlessly on any device

Web-based document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without interruptions. Manage Form C 245 on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form C 245 with ease

- Locate Form C 245 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign feature, which takes moments and carries the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form C 245 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form c 245

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is c 245 and how does it relate to airSlate SignNow?

C 245 refers to a specific document standard that can be efficiently managed using airSlate SignNow. Our platform streamlines the process of sending and eSigning documents that adhere to this standard, ensuring compliance and ease of use.

-

How does airSlate SignNow ensure compliance with c 245?

AirSlate SignNow is designed to meet various regulatory standards, including c 245. Our platform implements robust security measures and audit trails, guaranteeing that all signed documents are compliant and securely stored.

-

What are the pricing options for using airSlate SignNow with c 245?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage c 245 documents. You can choose from monthly or annual subscriptions depending on your needs, and we provide a free trial to explore our features.

-

What key features does airSlate SignNow offer for c 245 document management?

With airSlate SignNow, you get comprehensive features for c 245 document management, including customizable templates, real-time tracking, and automated workflows. This ensures that you can eSign and send documents efficiently and securely.

-

Can airSlate SignNow integrate with other tools for c 245 documentation?

Yes, airSlate SignNow integrates seamlessly with a variety of productivity and business applications to facilitate c 245 documentation. Popular integrations include Google Workspace and Salesforce, enhancing your workflow and document management capabilities.

-

What benefits can businesses expect when using airSlate SignNow for c 245?

Businesses using airSlate SignNow for c 245 can expect increased efficiency, reduced turnaround time, and enhanced security. Our platform simplifies the signing process, allowing users to focus on what matters most while ensuring compliance.

-

How user-friendly is airSlate SignNow for handling c 245 documents?

AirSlate SignNow is designed with user experience in mind, making it easy for anyone to manage c 245 documents. Our intuitive interface allows users to send, sign, and track documents without technical expertise.

Get more for Form C 245

Find out other Form C 245

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors