Ky W4 Form

What is the K-4 Form?

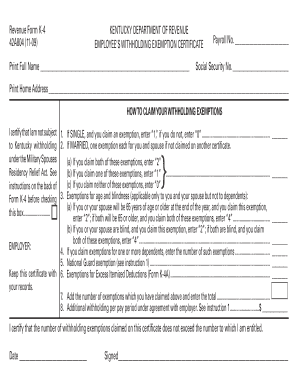

The K-4 form, also known as the Kentucky Employee Withholding Certificate, is a crucial document for employees in Kentucky. It allows individuals to indicate their tax withholding preferences to their employers. By completing this form, employees can ensure that the correct amount of state income tax is withheld from their paychecks, which helps avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the K-4 Form

Filling out the K-4 form involves several straightforward steps:

- Obtain the Form: Access the K-4 form through the Kentucky Department of Revenue website or request a copy from your employer.

- Provide Personal Information: Fill in your name, address, Social Security number, and filing status.

- Specify Allowances: Indicate the number of allowances you are claiming. This will affect your withholding amount.

- Additional Withholding: If desired, specify any additional amount to be withheld from your paycheck.

- Signature: Sign and date the form to validate your information.

Legal Use of the K-4 Form

The K-4 form is legally binding once completed and submitted to your employer. It complies with state tax laws and regulations, ensuring that your withholding preferences are officially recognized. Employers are required to keep the K-4 form on file and use it to determine the appropriate amount of state tax to withhold from your wages.

State-Specific Rules for the K-4 Form

Kentucky has specific rules regarding the K-4 form that employees must adhere to:

- Employees must submit a new K-4 form whenever their personal circumstances change, such as a change in marital status or the number of dependents.

- Employers must honor the information provided on the K-4 form and adjust withholding accordingly.

- Failure to submit a K-4 form may result in the employer withholding taxes at the highest rate.

Who Issues the K-4 Form?

The K-4 form is issued by the Kentucky Department of Revenue. This state agency oversees tax collection and ensures compliance with state tax laws. Employees can obtain the form directly from the department's website or through their employer, who may provide it as part of the onboarding process.

Penalties for Non-Compliance

Failure to submit the K-4 form or providing inaccurate information can lead to penalties. Employees may face increased withholding rates, which can result in larger tax liabilities at the end of the year. Additionally, employers may incur fines for not adhering to withholding regulations. It is essential to complete and submit the K-4 form accurately and timely to avoid these complications.

Quick guide on how to complete ky w4

Effortlessly prepare Ky W4 on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed forms, allowing you to find the necessary document and securely store it online. airSlate SignNow equips you with all the tools you require to create, amend, and eSign your documents swiftly without any holdups. Manage Ky W4 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to amend and eSign Ky W4 with ease

- Obtain Ky W4 and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious form searches, and mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Ky W4 while ensuring seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ky w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the K4 form Kentucky 2021 and why is it important?

The K4 form Kentucky 2021 is a state tax withholding form that allows employees to adjust their tax withholding based on their individual situation. It's important for ensuring that the correct amount of state income tax is withheld from employee paychecks, helping them avoid owing a large sum at tax time.

-

How can airSlate SignNow help with the K4 form Kentucky 2021?

AirSlate SignNow simplifies the process of filling out and eSigning the K4 form Kentucky 2021. Our platform enables businesses to easily send the form for electronic signatures, ensuring quick and compliant submission while streamlining record-keeping.

-

Is there a cost associated with using airSlate SignNow for the K4 form Kentucky 2021?

AirSlate SignNow offers competitive pricing plans, making it a cost-effective solution for handling the K4 form Kentucky 2021. Users can choose a plan that matches their needs, and the platform ensures you save time and resources in managing documents.

-

Can I integrate airSlate SignNow with my existing payroll software for the K4 form Kentucky 2021?

Yes, airSlate SignNow integrates seamlessly with various payroll software systems, allowing for efficient management of the K4 form Kentucky 2021. This integration helps businesses streamline their processes and maintain accurate tax records without manual entry.

-

What features does airSlate SignNow offer for processing the K4 form Kentucky 2021?

AirSlate SignNow offers features like easy document editing, eSignature capabilities, cloud storage, and tracking for the K4 form Kentucky 2021. These features enhance user experience and ensure compliance while managing tax forms efficiently.

-

How does eSigning the K4 form Kentucky 2021 benefit both employers and employees?

eSigning the K4 form Kentucky 2021 benefits employers by speeding up the document collection process and reducing paper waste. For employees, it offers convenience and security, ensuring their information is handled professionally and stored safely.

-

What is the turnaround time for processing the K4 form Kentucky 2021 with airSlate SignNow?

With airSlate SignNow, the turnaround time for processing the K4 form Kentucky 2021 is signNowly reduced, often completed in just a few hours. This allows companies to stay compliant and ensure their employees' tax situations are handled promptly.

Get more for Ky W4

Find out other Ky W4

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation