Perrysburg Ohio Income Tax Forms 2011

What is the Perrysburg Ohio Income Tax Form?

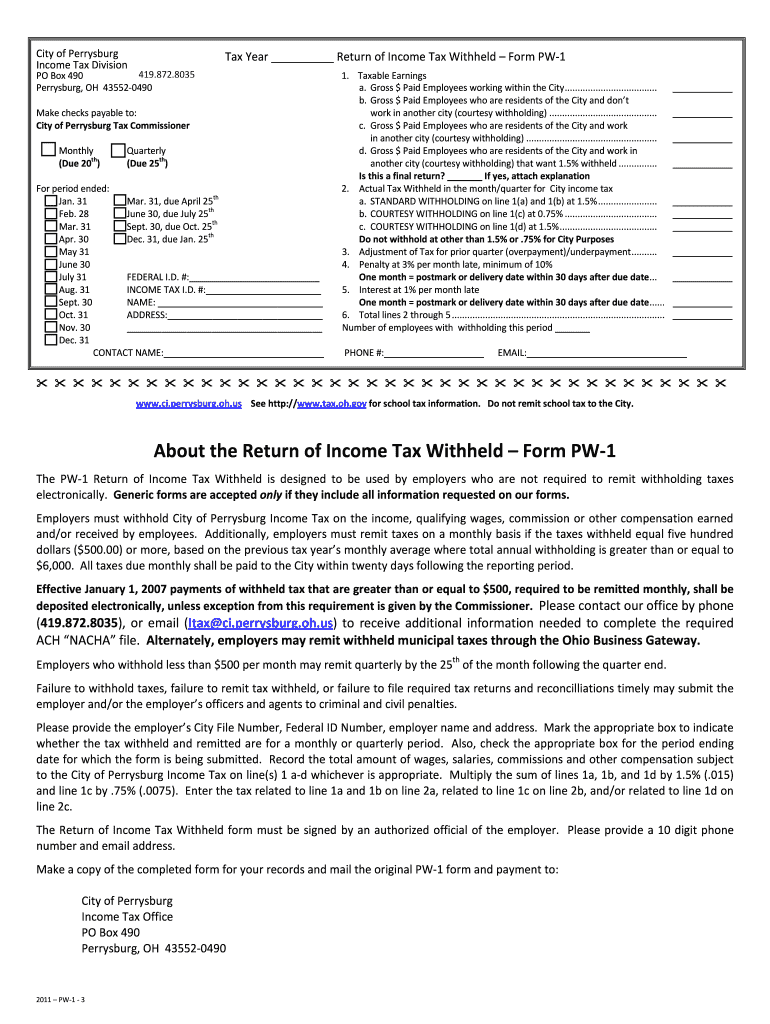

The Perrysburg Ohio income tax form is a document required for residents and businesses to report their income and calculate their tax obligations to the city of Perrysburg. This form is essential for ensuring compliance with local tax regulations. It includes sections for personal information, income details, deductions, and credits applicable to the city’s tax structure. The form is designed to facilitate accurate reporting and timely submission of taxes owed to the city.

How to Obtain the Perrysburg Ohio Income Tax Form

Residents and businesses can obtain the Perrysburg Ohio income tax form through several avenues. The most direct method is to visit the official website of the city of Perrysburg, where the form is available for download in a printable format. Additionally, physical copies can be requested from the city’s tax division office. It is advisable to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Steps to Complete the Perrysburg Ohio Income Tax Form

Completing the Perrysburg Ohio income tax form involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and other income statements.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Apply any eligible deductions and credits specific to Perrysburg.

- Review the completed form for accuracy before submission.

Form Submission Methods

There are multiple methods for submitting the Perrysburg Ohio income tax form. Taxpayers can file their forms online through the city’s designated portal, ensuring a quick and efficient process. Alternatively, forms can be mailed to the city’s tax division office. For those who prefer in-person interactions, visiting the office allows for direct submission and immediate assistance if needed. Each method has its own advantages, depending on the taxpayer's preferences.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Perrysburg Ohio income tax form to avoid penalties. Typically, the deadline for filing is April fifteenth of each year, aligning with federal tax deadlines. However, it is important to check for any updates or extensions that may apply, especially in light of changes due to special circumstances like the COVID-19 pandemic. Taxpayers should mark their calendars and prepare their documents well in advance of these dates.

Key Elements of the Perrysburg Ohio Income Tax Form

The key elements of the Perrysburg Ohio income tax form include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Detailed sections for reporting various income types.

- Deductions and Credits: Areas to claim applicable deductions and credits.

- Signature Section: Required for validating the form, either electronically or manually.

Quick guide on how to complete perrysburg income tax form 2015

Your assistance manual on how to get ready your Perrysburg Ohio Income Tax Forms

If you’re curious about how to finalize and submit your Perrysburg Ohio Income Tax Forms, here are some concise guidelines on making tax processing considerably simpler.

To begin, you simply need to create your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that allows you to edit, generate, and complete your income tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revert to adjust details as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and easy sharing.

Execute the steps outlined below to achieve your Perrysburg Ohio Income Tax Forms in a matter of minutes:

- Establish your account and start handling PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to open your Perrysburg Ohio Income Tax Forms in our editor.

- Complete the necessary fillable sections with your details (text, numbers, checkmarks).

- Use the Sign Tool to incorporate your legally-valid eSignature (if required).

- Review your document and correct any mistakes.

- Preserve changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to electronically submit your taxes with airSlate SignNow. Be aware that filing on paper can increase return mistakes and procrastinate refunds. Of course, before e-filing your taxes, consult the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct perrysburg income tax form 2015

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Which income tax form housewives should fill for Fy 2015-16?

Anyone who doesn’t have Income from Business or Profession, shall use ITR -2 for filing Income tax returns.If in addition, the individual doesn’t have Capital gains too in the Financial year , he/she shall use ITR -2A. i.e, When he/she doesn’t have Business income as well as Capital gain, he/she shall use ITR-2A.Hope this helps. :)

-

Which ITR (Income Tax Return) form should I fill for AY 2015-16?

If you have not redeemed your SIP till April 2015 and Salary is the only source of your Income then you have to file ITR-1.Let me recommend you to use http://mytaxcafe.com for filing your Income Tax Return as it automatically selects the type of ITR applicable on you. Further tax filing is free at http://mytaxcafe.comIf you have any doubts then please mail us at support@mytaxcafe.com

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

Create this form in 5 minutes!

How to create an eSignature for the perrysburg income tax form 2015

How to make an eSignature for your Perrysburg Income Tax Form 2015 in the online mode

How to generate an electronic signature for your Perrysburg Income Tax Form 2015 in Chrome

How to create an electronic signature for signing the Perrysburg Income Tax Form 2015 in Gmail

How to generate an eSignature for the Perrysburg Income Tax Form 2015 straight from your smartphone

How to make an eSignature for the Perrysburg Income Tax Form 2015 on iOS

How to create an eSignature for the Perrysburg Income Tax Form 2015 on Android OS

People also ask

-

What is the airSlate SignNow solution for managing income tax forms in Perrysburg?

AirSlate SignNow provides a robust platform for electronically signing and managing income tax forms in Perrysburg. Our easy-to-use interface simplifies the process of collecting signatures, ensuring you can complete your tax documents quickly and efficiently.

-

How much does using airSlate SignNow for income tax forms in Perrysburg cost?

The pricing for airSlate SignNow varies based on the plan you choose. We offer affordable options that cater to different business needs, making it a cost-effective solution for handling income tax forms in Perrysburg without sacrificing functionality.

-

Can I integrate airSlate SignNow with other software for income tax form management in Perrysburg?

Yes, airSlate SignNow offers seamless integrations with popular software solutions, allowing for a streamlined process when managing income tax forms in Perrysburg. This capability helps enhance your workflow by connecting with systems you already use.

-

What features does airSlate SignNow offer for signing income tax forms in Perrysburg?

Our platform includes features such as custom templates, automatic reminders, and real-time tracking for your income tax forms in Perrysburg. These tools promote efficiency, ensuring your documents are signed and submitted on time.

-

Is airSlate SignNow secure for filing income tax forms in Perrysburg?

Absolutely! AirSlate SignNow prioritizes the security of your documents, employing encryption and compliance with industry standards to protect your income tax forms in Perrysburg. You can trust us to keep your sensitive information safe throughout the signing process.

-

How does airSlate SignNow benefit small businesses handling income tax forms in Perrysburg?

For small businesses in Perrysburg, airSlate SignNow offers a user-friendly and budget-friendly solution to manage income tax forms. By automating the signing process, businesses can save time and reduce the risk of errors, enhancing overall productivity.

-

Can I use airSlate SignNow on mobile devices for income tax forms in Perrysburg?

Yes, airSlate SignNow is optimized for both desktop and mobile devices, allowing you to manage your income tax forms in Perrysburg conveniently from anywhere. This flexibility ensures that you can access and sign documents on-the-go.

Get more for Perrysburg Ohio Income Tax Forms

- Agreement between publisher author form

- Affidavit loss form

- Agreement invention 497330455 form

- Release and waiver of liability given in favor of owner of stable and owner of horses kept at stable by those who ride horses form

- Disclaimer form sample 497330457

- Finders agreement form

- Writing courts form

- Sale goods 497330460 form

Find out other Perrysburg Ohio Income Tax Forms

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application