At T Hra Claim Form

What is the AT&T HRA Claim Form

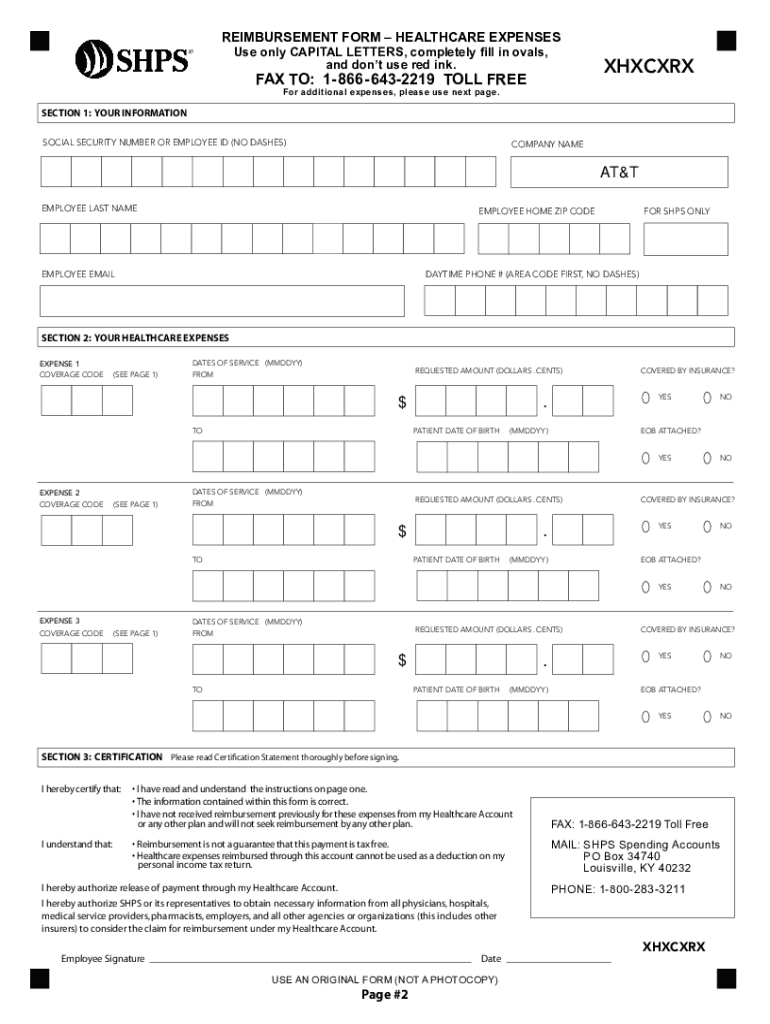

The AT&T HRA claim form is a document used by employees and retirees of AT&T to request reimbursement for eligible medical expenses. This form is essential for those enrolled in the AT&T health reimbursement arrangement (HRA), which allows participants to use funds set aside by AT&T for qualified healthcare costs. The HRA claim form ensures that all necessary information is collected for processing reimbursements efficiently and accurately.

How to Use the AT&T HRA Claim Form

Using the AT&T HRA claim form involves a few straightforward steps. First, gather all relevant documentation, including receipts for medical expenses that qualify for reimbursement. Next, fill out the form with accurate personal information, including your name, contact details, and any required identification numbers. Ensure that you clearly itemize each expense, providing the date, type of service, and amount. Finally, submit the completed form along with your receipts through the designated submission method, which may include online submission, mail, or in-person delivery.

Steps to Complete the AT&T HRA Claim Form

Completing the AT&T HRA claim form involves several key steps:

- Collect all necessary receipts and documentation for eligible expenses.

- Fill out your personal information accurately on the form.

- Itemize each medical expense, including dates and amounts.

- Review the form for completeness and accuracy.

- Submit the form along with the required documentation through the appropriate channels.

Legal Use of the AT&T HRA Claim Form

The AT&T HRA claim form must be used in compliance with applicable laws and regulations regarding health reimbursement arrangements. This includes ensuring that all submitted expenses are eligible under the terms of the HRA plan. Proper use of the form is crucial to avoid potential legal issues and to ensure that reimbursements are processed without delays.

Required Documents

When submitting the AT&T HRA claim form, it is essential to include specific documents to support your request for reimbursement. Required documents typically include:

- Receipts for each medical expense being claimed.

- Proof of payment, such as credit card statements or bank statements.

- Any additional documentation requested by the HRA administrator.

Form Submission Methods

The AT&T HRA claim form can be submitted through various methods, depending on the preferences of the individual and the guidelines set by AT&T. Common submission methods include:

- Online submission through the designated AT&T benefits portal.

- Mailing the completed form and supporting documents to the specified address.

- In-person submission at designated AT&T locations or benefits offices.

Quick guide on how to complete at t hra claim form

Complete At T Hra Claim Form effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage At T Hra Claim Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign At T Hra Claim Form with ease

- Locate At T Hra Claim Form and then click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign At T Hra Claim Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the at t hra claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AT&T reimbursement account?

An AT&T reimbursement account is a flexible spending option that allows employees to use pre-tax dollars for eligible expenses. This account is specifically designed to manage reimbursements for qualified health and dependent care expenses, streamlining the process for employees looking to save money.

-

How can airSlate SignNow facilitate AT&T reimbursement account management?

airSlate SignNow provides an efficient platform for managing documents related to your AT&T reimbursement account. With features like electronic signatures and document tracking, users can easily submit and sign reimbursement requests, ensuring a smooth and hassle-free experience.

-

Are there costs associated with setting up an AT&T reimbursement account?

Setting up an AT&T reimbursement account may involve fees, depending on your company's selected plan. It's essential to review the specifics of your employer's program to understand the cost implications and whether they cover administrative expenses associated with the account.

-

What types of expenses can be reimbursed through the AT&T reimbursement account?

Eligible expenses for an AT&T reimbursement account often include health-related costs, daycare services, and some commuting expenses. Employees should check with their HR department for a detailed list of qualifying expenses to maximize their reimbursement opportunities.

-

How do I submit a claim for my AT&T reimbursement account?

To submit a claim through your AT&T reimbursement account, gather all relevant receipts and documentation, then use the airSlate SignNow platform for quick submission and electronic signature. The straightforward process minimizes paperwork and expedites your claims.

-

Can I integrate my AT&T reimbursement account with other financial tools?

Yes, many companies opt to integrate their AT&T reimbursement account with financial management tools for better tracking and reporting. Ensure your chosen tools are compatible and can assist you in managing your account efficiently.

-

What are the benefits of using electronic signatures for AT&T reimbursement claims?

Using electronic signatures for AT&T reimbursement claims offers increased efficiency and security. airSlate SignNow provides a safe and convenient way to sign documents, speeding up the approval process and reducing paperwork.

Get more for At T Hra Claim Form

Find out other At T Hra Claim Form

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document