Homestead Exemption Brandon Ms Fill Online, Printable, Form

Understanding the Homestead Exemption in Brandon, MS

The homestead exemption in Brandon, Mississippi, is a legal provision that allows homeowners to reduce their property tax burden. This exemption applies to the primary residence of the homeowner, providing significant financial relief. To qualify, the property must be owned by the applicant and used as their principal residence. The exemption can result in lower assessed property values, thereby decreasing the overall tax liability.

Eligibility Criteria for the Homestead Exemption in Brandon, MS

To qualify for the homestead exemption in Brandon, applicants must meet specific eligibility requirements. These include:

- The applicant must be the legal owner of the property.

- The property must serve as the applicant's primary residence.

- Applicants must be at least twenty-one years old or legally emancipated.

- There may be income limitations based on household income levels.

Understanding these criteria is essential for homeowners seeking to benefit from the exemption.

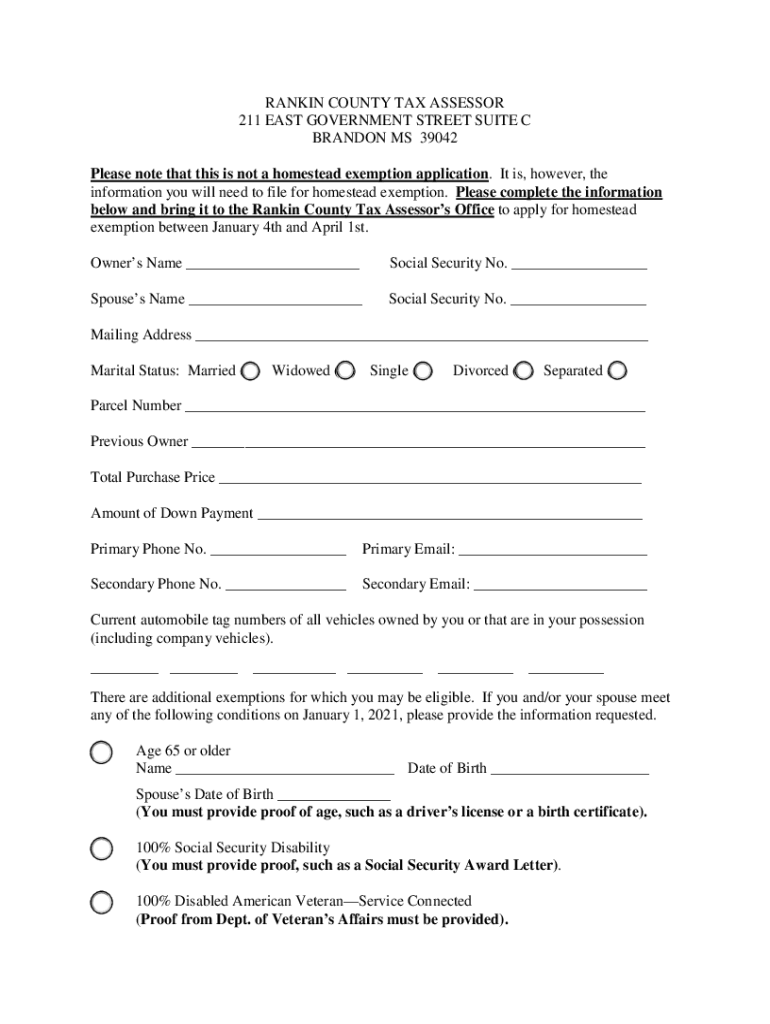

Steps to Complete the Homestead Exemption Application

Filing for the homestead exemption involves several steps:

- Gather necessary documentation, including proof of ownership and identification.

- Complete the homestead exemption application form, ensuring all information is accurate.

- Submit the application to the appropriate local tax assessor's office by the specified deadline.

- Await confirmation of approval or any additional requirements from the tax assessor's office.

Following these steps can help ensure a smooth application process.

Required Documents for the Homestead Exemption

When applying for the homestead exemption in Brandon, certain documents are typically required:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership, like a deed or mortgage statement.

- Any additional documents requested by the local tax assessor's office.

Having these documents ready can facilitate a more efficient application process.

Form Submission Methods for the Homestead Exemption

Homeowners in Brandon can submit their homestead exemption applications through various methods:

- Online submission via the local tax assessor's website, if available.

- Mailing the completed application to the tax assessor's office.

- In-person submission at the local tax assessor's office.

Choosing the most convenient method can help streamline the application process.

Legal Use of the Homestead Exemption

The homestead exemption provides legal protection for homeowners against certain creditors and may limit the amount of property tax owed. It is essential for applicants to understand the legal implications, including how the exemption can impact property ownership and tax obligations. Misuse of the exemption can lead to penalties, so it is crucial to adhere to the guidelines set forth by local authorities.

Quick guide on how to complete homestead exemption brandon ms fill online printable

Effortlessly Prepare Homestead Exemption Brandon Ms Fill Online, Printable, on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional paper documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your files swiftly without unnecessary delays. Manage Homestead Exemption Brandon Ms Fill Online, Printable, on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Homestead Exemption Brandon Ms Fill Online, Printable, Seamlessly

- Obtain Homestead Exemption Brandon Ms Fill Online, Printable, and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal value as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or an invitation link—or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Homestead Exemption Brandon Ms Fill Online, Printable, to ensure smooth communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homestead exemption brandon ms fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the homestead exemption in Brandon, MS?

The homestead exemption in Brandon, MS, is a tax benefit that reduces the taxable value of your primary residence. This exemption can lead to signNow savings on property taxes, making it an essential consideration for homeowners in the area.

-

How do I apply for the homestead exemption in Brandon, MS?

To apply for the homestead exemption in Brandon, MS, you need to complete an application form and submit it to the local tax assessor's office. Ensure you provide all necessary documentation, such as proof of residency and ownership, to qualify for the exemption.

-

What are the eligibility requirements for the homestead exemption in Brandon, MS?

Eligibility for the homestead exemption in Brandon, MS, typically requires that the property be your primary residence and that you meet certain income criteria. Additionally, you must be a legal resident of Mississippi and file your application by the specified deadline.

-

How much can I save with the homestead exemption in Brandon, MS?

The savings from the homestead exemption in Brandon, MS, can vary based on the assessed value of your home and local tax rates. Homeowners can often see reductions of several hundred dollars annually, depending on their property's value.

-

Can I apply for the homestead exemption in Brandon, MS, if I own multiple properties?

In Brandon, MS, the homestead exemption is only applicable to your primary residence. If you own multiple properties, you must designate one as your primary home to qualify for the exemption on that property.

-

What documents do I need to provide for the homestead exemption in Brandon, MS?

When applying for the homestead exemption in Brandon, MS, you typically need to provide proof of ownership, such as a deed, and evidence of residency, like a utility bill or driver's license. It's essential to check with the local tax assessor for any additional requirements.

-

How often do I need to renew my homestead exemption in Brandon, MS?

In Brandon, MS, once you are granted the homestead exemption, it generally remains in effect as long as you continue to meet the eligibility requirements. However, it's advisable to check with the local tax office periodically to ensure your exemption remains valid.

Get more for Homestead Exemption Brandon Ms Fill Online, Printable,

- Ct 1040 2016 form

- Illinois form tax 2016

- Application for an exemption to site alteration by law grand valley form

- Grand commandery knights templar of oklahoma bokdemolaybbcomb form

- Ct 1041 2016 form

- Notice of examination station agent exam no form

- Raps manual institute for research and reform in education irre

- Pinewood derby certificate template 8 form

Find out other Homestead Exemption Brandon Ms Fill Online, Printable,

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word