Us Bank Direct Deposit Form

What is the Us Bank Direct Deposit Form

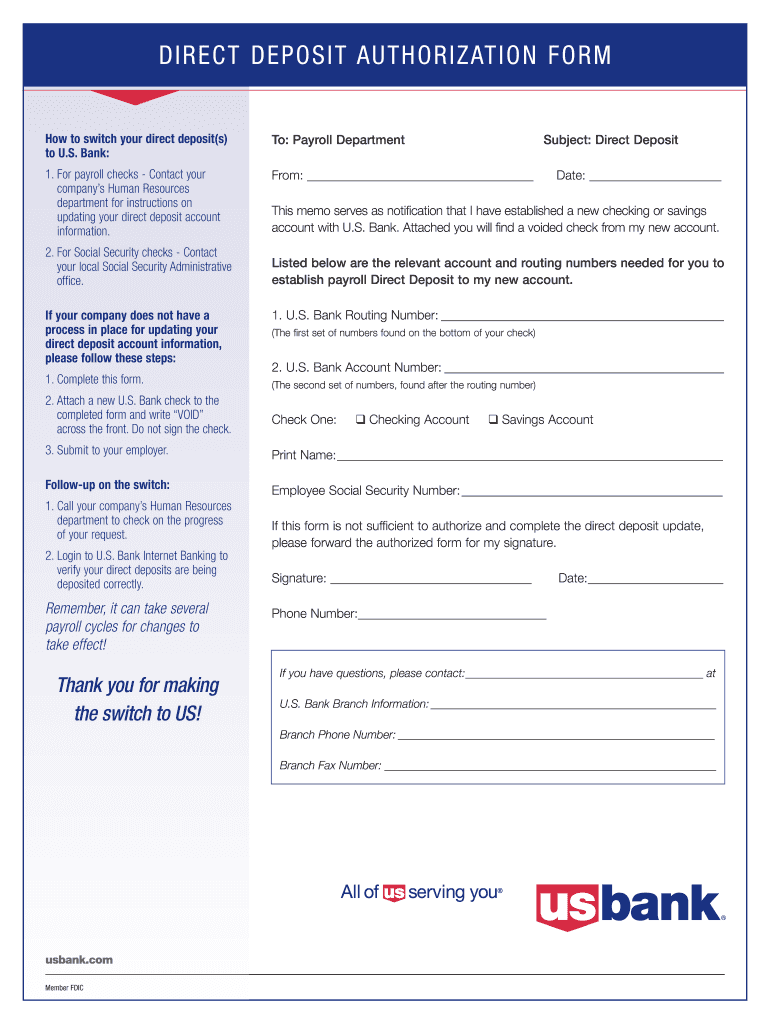

The Us Bank Direct Deposit Form is a document used to authorize the direct deposit of funds into a bank account. This form is essential for employees or individuals who wish to receive payments, such as salaries or government benefits, directly into their bank accounts. By completing this form, you provide your bank with the necessary information to facilitate electronic transfers, ensuring timely and secure payment delivery.

How to use the Us Bank Direct Deposit Form

Using the Us Bank Direct Deposit Form involves a few straightforward steps. First, obtain the form from your employer or directly from the Us Bank website. Next, fill in your personal details, including your name, address, and account number. Ensure that you provide accurate information to avoid any delays in processing. After completing the form, submit it to your employer or the relevant department responsible for payroll processing. This will initiate the setup for direct deposits into your bank account.

Steps to complete the Us Bank Direct Deposit Form

Completing the Us Bank Direct Deposit Form requires careful attention to detail. Follow these steps:

- Obtain the form from your employer or Us Bank.

- Enter your personal information, including your full name and address.

- Provide your bank account number and the Us Bank routing number.

- Indicate the type of account (checking or savings).

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer or payroll department.

Key elements of the Us Bank Direct Deposit Form

The Us Bank Direct Deposit Form contains several key elements that are crucial for processing your request. These include:

- Personal Information: Your name, address, and contact details.

- Bank Account Details: Your account number and the Us Bank routing number.

- Account Type: Specification of whether the account is a checking or savings account.

- Authorization Signature: Your signature confirming your consent for direct deposits.

Legal use of the Us Bank Direct Deposit Form

The Us Bank Direct Deposit Form is legally binding once completed and signed. It serves as an authorization for your employer or payment provider to deposit funds directly into your bank account. It is important to ensure that all information provided is accurate to prevent any legal issues or delays in payment. Additionally, maintaining a copy of the signed form for your records can be beneficial for future reference.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Us Bank Direct Deposit Form can be done through various methods, depending on your employer's policies. Common submission methods include:

- Online: Many employers allow you to submit the form electronically through their payroll systems.

- Mail: You can send the completed form via postal mail to your employer's payroll department.

- In-Person: Delivering the form directly to your employer or HR department is often an option as well.

Quick guide on how to complete us bank direct deposit authorization form

The simplest method to obtain and endorse Us Bank Direct Deposit Form

On a company-wide scale, ineffective workflows related to document approvals can consume signNow labor hours. Signing papers such as Us Bank Direct Deposit Form is a standard aspect of operations in any business, which is why the effectiveness of each contract’s lifecycle signNowly impacts the overall performance of the organization. With airSlate SignNow, endorsing your Us Bank Direct Deposit Form can be incredibly straightforward and quick. This platform provides you with the most recent version of nearly any document. Even better, you can sign it immediately without the need to install external software on your PC or produce physical copies.

Steps to obtain and endorse your Us Bank Direct Deposit Form

- Browse through our collection by category or use the search bar to find the document you require.

- Check the document preview by clicking Learn more to ensure it’s the correct one.

- Click Get form to start editing right away.

- Fill in your document and include any necessary information using the toolbar.

- After completion, click the Sign tool to endorse your Us Bank Direct Deposit Form.

- Select the signing method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to conclude editing and proceed to sharing options as required.

With airSlate SignNow, you have everything needed to manage your documents efficiently. You can search, fill out, modify, and even distribute your Us Bank Direct Deposit Form in one tab with no complications. Enhance your workflows with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Is it fishy if a company wants you to fill out the direct deposit form before you receive any paper work about being hired?

Hi, To give a little more context, if you are worried about completing a direct deposit form, which should be for receiving remuneration of your wages, then request a your employment contract and tell them you will complete the direct deposit form after the employment has been received. Always be open and honest with a potential em0ployer and set parameters for your employment relationship from the get go. you would like to follow procedures. Every Employer will respect you more for that. I do not think it is fishy but a little odd

-

Is it legal to fill out a deposit slip and deposit a DD in someone else's bank account without seeking permission/authorization? Does it constitute operating a bank account without authorization and what liabilities (civil/criminal) would it attract?

Banks accept deposits from a third party either in cash or through bank draft if the instrument is in order otherwise. However, if any suspicious deposit is made, the account holder should bring it to the notice of bank for such irregular transactions. If he withdraws the money or fails to file details in IT returns if any he will be liable for consequences for such deposits.

-

How do I fill out a bank deposit slip?

You would have to show up in person at a branch location that belongs to your bank where your bank account is open. Most banks have a lines for the customers to get in line and wait for their turn to talk to the bank teller. Most banks will have a section in the middle of this section where they have a bunch of blank documents and a deposit slip is included there.There is specific information that you need to know in order to fill the bank deposit slip correctly and you don't have to spend time memorizing it or take documents of that information with you. All you have to do is just write it down in a piece of paper and then reap into pieces the paper when you are done. The information that you need to fill out the deposit slip is your account number. What is it that you are depositing a check or cash and what is the exact amount to be deposited. The deposit slip should include your name and your signature.In type of deposit slip, you would have to also check whether you are depositing the funds into your bank checkings account or into your bank savings account and your address. The signature section is a part that can only be signed in the presence of a bank teller. You would also have to write the date on which this deposit takes place.Some deposit slips differ in one or two things from the others but for the most part they all are very similar in many ways. In this deposit slip, you would not have to write the date or your address or whether it goes to a savings or checking accounts but all other information still applies.Note that in the two types of the deposits samples there is a section that says “subtotal” and another that says “less cash”. Those two sections are only applicable when you present a check to be cash but you also want part of that check to deposit into your account. For example, let us say that you present a check with the total funds of 1458 but you want to receive 800 in cash and the remaining balance is two be deposited. In that case, the subtotal would say “1458” and the “less cash” section would say “800” the the “total” section would say “658”. Those types of deposit slips are provided to you free of charge at the bank.The deposit slip shown above is another type of bank deposit slip which is more convenient and you have less possibilities of making entry errors because those types of deposit slips are already personalized and they already have your bank account, name and address printed on them. All you have to do is fill out the amount that you depositing into your bank account and whether it is a check or cash. However, the personalized deposit slips costs money.At the end of the successful deposit transaction, you should received from the bank teller a deposit receipt which summarizes the how much was deposited and your new bank account balance. Some advanced banks will even print a receipt with an image of the check that was deposited.

-

How do I deposit a personal check written out to me to my online bank account without a direct deposit?

Dear M. Anonymous,Good question. It can be confusing when you are new to online banking (or to checking accounts in general), so I totally understand. For years, I used a local bank. I deposited checks by going to the physical bank. Once I was at the bank, I would give the check to the teller to deposit, or I would put the check (and deposit slip) in the slot outside. This was long before online banking had been invented.My local bank once made a serious mistake in my account, which I resolved after spending many hours at a bank executive’s desk. The executive could not figure out the problem, but I was able to see that it had been my bank’s error that had caused the discrepancy. This sour experience prompted me to look elsewhere for another bank. I decided to use a bank that is primarily online and that is connected with a world-class organization that also provides car and home insurance to U.S. military officers and their dependents. I had done my research long before I ever selected this organization for my banking and car and home insurance.I currently have a bank account at this organization’s excellent online bank based in San Antonio, Texas (I’m in the D.C. area), and the way I prefer to deposit checks to my bank is by regular mail.For a good long while, my bank had a contract with a UPS Store that could scan checks and deposit them electronically into someone’s bank account, but I always felt a little uneasy doing that, and only used this service a few times. It certainly did not feel too secure to have a non-bank-related person touch my checks. Eventually, my bank stopped offering that as an option. (I would love to know the back story of what prompted my bank to stop doing this.)There are at least six ways to deposit checks including using electronic means (see this WikiHow: How to Deposit Checks).PRO TIP: Of course, the best thing for you to do is to go on your bank’s website and find out their process. Their website might even have a generic deposit ticket you can print out if you want to mail it in.Below are the steps I take to deposit checks by mail to my online bank.Endorse the check (that is, write your signature on the back). Under your signature, write “Deposit to” and then write your bank account number. NOTE: Make sure the check is valid.Fill out a deposit ticket (these are included with your checkbook). If you don’t have paper checks or deposit slips, contact your bank to find out how to get one.Put both the endorsed check and deposit ticket in an envelope addressed to the bank. Seal the envelope. My bank provides me with preaddressed envelopes that do not need postage.MAIL the envelope.Wait a few days, and you should see that deposit showing up in your account online.—Sarah M. 9/12/2018ORIGINAL QUESTION: How do I deposit a personal check written out to me to my online bank account without a direct deposit?

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Can a paycheck be deposited directly into a PayPal account?

Can a paycheck be deposited directly into your Paypal account? most definitely. and we are going to examine how it is done, along with other features below: you can deposit all or some of your paycheck or other income checks directly into your PayPal Cash account for no cost, and in as little as 1-2 pay periods.That depends on which country in the world that you live in:Can I direct deposit to my PayPal account?Direct Deposit is only available on PayPal accounts in the US for customers who have signed up for the PayPal Cash Card debit card. If you have the PayPal Cash Card, you can find Direct Deposit information by going to your Profile.Keep in mind, the account and routing number associated with Direct Deposit is for incoming payments only and cannot be used for outgoing purchases or payments.How long does direct deposit take with PayPal?The PayPal Prepaid Mastercard can be most useful if: You're looking to access your paycheck or government benefits faster. Direct deposits through a bank can take up to two days. Speed up direct deposits directly to your PayPal Prepaid Mastercard.The benefits of direct deposit are fairly obvious: Having payments go right into your account saves you time and hassle, as you don't have to make a special trip to the bank. You also know that your money is safe and will appear predictably in your balance. Moreover, electronic deposits often mean that your money is available the same day, as opposed to having to wait an extra day or two as with paper deposits.PayPal Direct DepositYet another option is to have funds deposited directly into your PayPal account. First, you will need a PayPal Cash Card—which is a form of a debit card—so that you have an account and routing number to fill out the direct deposit paperwork. The rest of the process works the same as any other direct deposit. PayPal doesn't charge any extra fees to either set up the card or have your checks directly deposited into the account.Note that once you submit the direct deposit authorization form, it may take several pay cycles for your check to begin appearing in your account. If you feel it's taking too long, there's no harm in following up to make sure things are proceeding accordingly—it's better to find out earlier than later if there was a mistake in the information you provided. Then, once the direct deposit process is completed, you can enjoy sitting back and waiting for your money to appear.Connect your PayPal with your bank or card. Click the Wallet link at the top of the page, then click Link a card or bank. From there, you can choose to link a credit or debit card or to link your PayPal directly to your bank account. You’ll need to enter the number for your card, or the account number and routing number for your account.Confirm your card or account if prompted. For security purposes, PayPal will sometimes need you to confirm that you’re the owner of your card or linked account. Go to your PayPal Wallet and click the Confirm Credit Card link if you see one. PayPal will confirm your linked payment method by charging a small fee to your card. Once the account or card is confirmed, you’ll be refunded right away. Your account is now ready to use. If you’re asked to enter a 4-digit code, look for the PayPal charge on your debit or credit card statement. It will look something like PayPal*1234 CODE or PP*1234 CODE.[8]On your PayPal account, click Wallet, then click on the card you want to confirm. Enter the 4 digits (in this case, 1234) and submit.Spending Money Via PayPal[Deposit money. Even if your PayPal is empty, PayPal can draw from your bank to make payments. However, some people prefer to have money in their PayPal account itself. To put money in your PayPal account, log onto your account and then click "Transfer Money." You can then transfer money to your PayPal account through the bank account linked to your account.Send money to others via PayPal. If you owe someone money, it's easy to send it via PayPal. Simply click the "Transfer Money" option. Enter the amount and the e-mail address of the person who's receiving the money. Then, hit "Send."Make sure you use the correct e-mail address. The e-mail address you use should be the e-mail the other person uses for PayPal.Transfer money into your bank account. Once the money is in your PayPal account, you can withdraw it at any time. Hit the "Transfer" button and then transfer your money directly into the bank account linked with your PayPal. This takes about one business day.You can also choose to transfer your money using a linked debit card for a $0.25 fee. This form of transfer is typically completed within 30 minutes.I hope that you find this to be helpful information.

-

How can I get a direct deposit form for Bank of America?

When you opened your checking account that form should have been given to you. If not simply go into your local bank and ask to speak with a Banking Relationship Manager and they should be able to give you the form.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

Create this form in 5 minutes!

How to create an eSignature for the us bank direct deposit authorization form

How to create an eSignature for the Us Bank Direct Deposit Authorization Form in the online mode

How to make an eSignature for your Us Bank Direct Deposit Authorization Form in Chrome

How to make an eSignature for signing the Us Bank Direct Deposit Authorization Form in Gmail

How to make an electronic signature for the Us Bank Direct Deposit Authorization Form from your mobile device

How to generate an eSignature for the Us Bank Direct Deposit Authorization Form on iOS

How to create an eSignature for the Us Bank Direct Deposit Authorization Form on Android OS

People also ask

-

What is a US Bank direct deposit form?

A US Bank direct deposit form is a document used to authorize the electronic transfer of funds into your bank account. This form typically includes your bank account details and is required by your employer or payee to set up the direct deposit. Using a US Bank direct deposit form streamlines your payments and ensures timely access to your funds.

-

How can I obtain a US Bank direct deposit form?

You can easily obtain a US Bank direct deposit form from your employer or directly from the US Bank website. Many companies provide a pre-filled version, but you can also request a blank form to fill out yourself. Remember to provide accurate information to avoid any payment delays.

-

What are the benefits of using a US Bank direct deposit form?

Using a US Bank direct deposit form simplifies the payment process by allowing funds to be deposited directly into your account without the need for paper checks. This method is not only faster but also more secure, reducing the risk of lost checks. Furthermore, you can enjoy the convenience of immediate access to your funds upon deposit.

-

Can I use the US Bank direct deposit form for multiple accounts?

Yes, the US Bank direct deposit form can be utilized for multiple accounts, depending on your employer’s policies. Some employers may allow you to split your deposit amount across different accounts for better budgeting. However, it's essential to confirm with your HR department or payroll provider about their specific guidelines for setting up multiple direct deposits.

-

How does airSlate SignNow assist with US Bank direct deposit forms?

airSlate SignNow provides a user-friendly platform to send and eSign documents, including US Bank direct deposit forms. Our solution is secure, making it easy to manage electronically signed forms without the hassle of printing or faxing. With airSlate SignNow, you can streamline your entire direct deposit setup process efficiently.

-

Are there any costs associated with using the US Bank direct deposit form?

There are typically no costs directly associated with obtaining or submitting a US Bank direct deposit form. However, if you use airSlate SignNow to send or eSign your form, there may be subscription charges for accessing premium features. It's advisable to review the pricing tiers on the airSlate SignNow website for detailed information.

-

Is my information safe when using a US Bank direct deposit form with airSlate SignNow?

Yes, your information is secure when using a US Bank direct deposit form with airSlate SignNow. Our platform employs state-of-the-art encryption to protect your data during transmission and storage. We prioritize your privacy and ensure that your sensitive information is handled with the utmost care.

Get more for Us Bank Direct Deposit Form

Find out other Us Bank Direct Deposit Form

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure