Tr320 Form

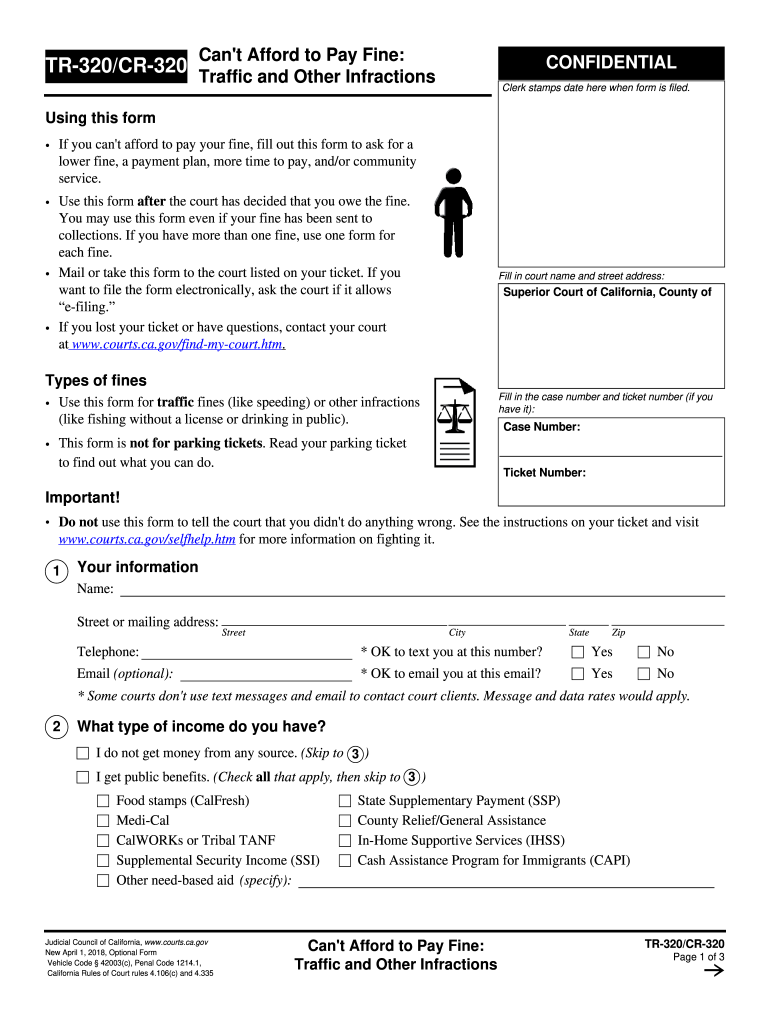

What is the Tr320 Form

The Tr320 form is a specific document used primarily for tax purposes in the United States. This form is essential for individuals and businesses who need to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Tr320 form is crucial for ensuring compliance with tax regulations. This form may be required for various situations, including income reporting, deductions, or credits.

How to use the Tr320 Form

Using the Tr320 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it thoroughly to avoid errors. Finally, submit the form according to the specified guidelines, which may include electronic submission or mailing it to the appropriate IRS address.

Steps to complete the Tr320 Form

Completing the Tr320 form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, including W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all figures match your supporting documents.

- List any deductions or credits you are eligible for, providing necessary explanations.

- Double-check all entries for accuracy and completeness before submission.

Legal use of the Tr320 Form

The Tr320 form is legally binding when completed and submitted according to IRS regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The use of electronic signatures and digital submission methods is recognized under U.S. law, provided that the chosen platform complies with relevant eSignature laws, such as the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Tr320 form vary depending on the specific tax year and the taxpayer's circumstances. Typically, individual taxpayers must submit their forms by April 15 of the following year. However, if you are a business entity, different deadlines may apply. It is essential to stay informed about these dates to avoid late fees and penalties.

Who Issues the Form

The Tr320 form is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines and resources for taxpayers to understand how to properly complete and submit the form. It is important to refer to the IRS website or official publications for the most current version of the form and any updates regarding its use.

Quick guide on how to complete tr320 form

Effortlessly prepare Tr320 Form on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage Tr320 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Tr320 Form with ease

- Locate Tr320 Form and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tr320 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tr320 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TR 320 form and how is it used?

The TR 320 form is a specific document required for various transactions and compliance purposes within certain industries. It helps streamline the process by ensuring that all necessary information is captured efficiently and accurately. Using airSlate SignNow, you can easily fill out and eSign the TR 320 form, enhancing your workflow and document management.

-

How does airSlate SignNow support the TR 320 form?

airSlate SignNow provides an intuitive platform for completing and signing the TR 320 form electronically. Our solution simplifies the process, allowing users to quickly fill in the necessary fields and secure signatures. This not only speeds up document processing but also ensures compliance with relevant regulations.

-

Is there a cost associated with using airSlate SignNow for the TR 320 form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that suits your organization’s size and the volume of documents, including the TR 320 form, you need to manage. Our pricing is designed to be cost-effective while providing powerful features to streamline your document processes.

-

What features are available for filling out the TR 320 form in airSlate SignNow?

When using airSlate SignNow for the TR 320 form, you’ll have access to features like auto-fill, templates, and customizable fields. These tools help ensure accuracy and save time when preparing your documents. Additionally, you can track the status of your TR 320 form in real-time, enhancing your overall document management experience.

-

Can I integrate airSlate SignNow with other software for TR 320 form handling?

Absolutely! airSlate SignNow offers integrations with numerous software applications, allowing for seamless handling of the TR 320 form alongside your existing tools. Whether you use CRM systems, document management software, or cloud storage solutions, our integrations ensure that you can manage documents easily and efficiently.

-

What are the benefits of electronically signing the TR 320 form?

Electronically signing the TR 320 form with airSlate SignNow offers numerous benefits, including increased speed and convenience. You can sign from anywhere, eliminating the need for printing and scanning. Moreover, digital signatures are legally binding and secure, ensuring the integrity of your documents.

-

Is the TR 320 form secure when using airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. We utilize encryption and secure access methods to protect your TR 320 form and other sensitive documents. Our platform complies with industry standards, ensuring that your information remains confidential and safe during the signing process.

Get more for Tr320 Form

Find out other Tr320 Form

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word