Gebcorp Withdrawal Form

What is the Gebcorp Withdrawal Form

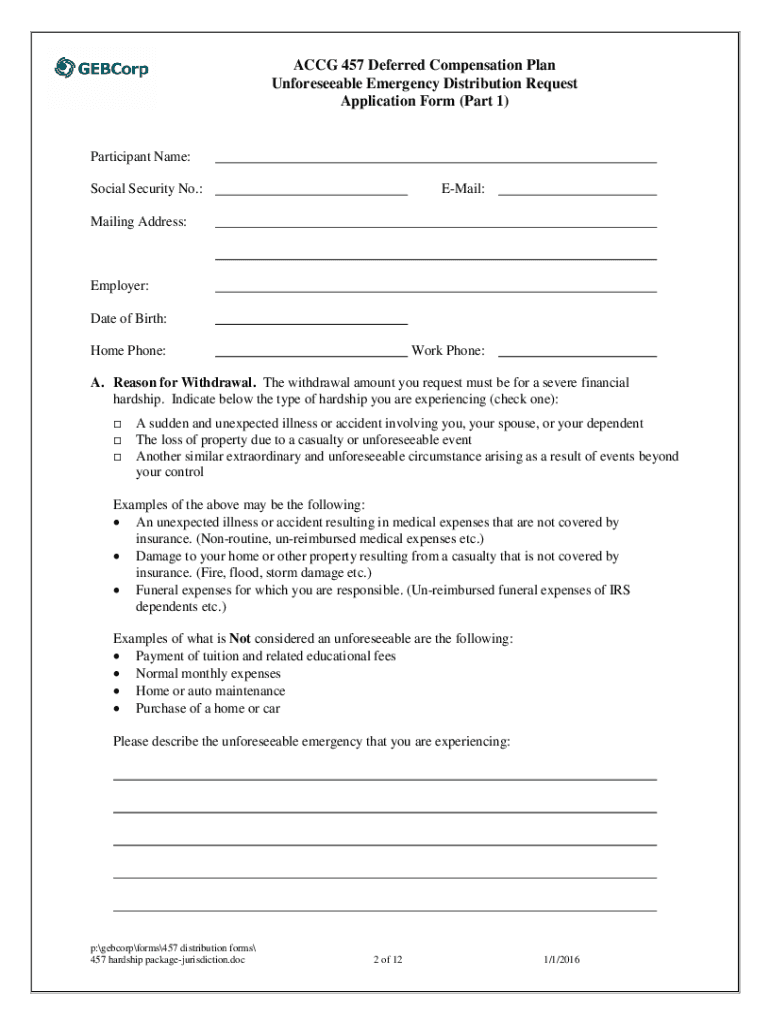

The Gebcorp Withdrawal Form is a crucial document for participants in the Georgia 457 Plan, allowing individuals to request the withdrawal of their funds from the plan. This form is specifically designed for those who need to access their retirement savings due to various circumstances, such as retirement, separation from service, or unforeseen emergencies. It is essential to understand the specific conditions under which withdrawals are permitted to ensure compliance with the plan's guidelines.

How to use the Gebcorp Withdrawal Form

Using the Gebcorp Withdrawal Form involves several key steps to ensure that the request is processed correctly. First, individuals must download the form from the appropriate source. Next, they should fill out the required information, including personal details, the reason for withdrawal, and the amount requested. It is important to review the completed form for accuracy before submission. Finally, the form can be submitted electronically or via mail, depending on the options provided by the plan administrator.

Steps to complete the Gebcorp Withdrawal Form

Completing the Gebcorp Withdrawal Form requires careful attention to detail. Here are the steps to follow:

- Download the form from the official source.

- Provide your personal information, including name, address, and Social Security number.

- Indicate the reason for the withdrawal, ensuring it aligns with the plan's guidelines.

- Specify the amount you wish to withdraw.

- Sign and date the form to certify the information provided.

- Submit the form as instructed, either online or by mailing it to the designated address.

Legal use of the Gebcorp Withdrawal Form

The Gebcorp Withdrawal Form must be used in accordance with the legal requirements set forth by the Georgia 457 Plan. This includes adhering to the eligibility criteria for withdrawals, such as age restrictions and qualifying events. Ensuring that the form is filled out accurately and submitted within the designated time frames is essential for compliance. Additionally, the form must be signed to validate the request, which can be facilitated through electronic signature options that comply with federal regulations.

Eligibility Criteria

To successfully utilize the Gebcorp Withdrawal Form, individuals must meet specific eligibility criteria established by the Georgia 457 Plan. Generally, withdrawals are permitted under circumstances such as retirement, separation from service, or financial hardship. It is important for applicants to review these criteria carefully to determine their eligibility before submitting the form. Failing to meet the necessary conditions may result in delays or denials of the withdrawal request.

Required Documents

When submitting the Gebcorp Withdrawal Form, individuals may need to provide additional documentation to support their request. Commonly required documents include proof of identity, such as a government-issued ID, and any relevant documentation that substantiates the reason for withdrawal. For example, if applying for a hardship withdrawal, applicants may need to provide evidence of the financial situation prompting the request. Ensuring that all required documents are included can help expedite the processing of the withdrawal.

Form Submission Methods (Online / Mail / In-Person)

The Gebcorp Withdrawal Form can typically be submitted through various methods, depending on the guidelines provided by the Georgia 457 Plan. Common submission options include:

- Online submission through the plan's designated portal, which may require electronic signature capabilities.

- Mailing the completed form to the specified address for processing.

- In-person submission at designated locations, if available.

Choosing the appropriate submission method is important for ensuring timely processing of the withdrawal request.

Quick guide on how to complete gebcorp withdrawal form

Effortlessly Prepare Gebcorp Withdrawal Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Gebcorp Withdrawal Form on any device with airSlate SignNow's Android or iOS applications, and streamline any document-centric process today.

The easiest way to modify and eSign Gebcorp Withdrawal Form effortlessly

- Locate Gebcorp Withdrawal Form and click Get Form to start.

- Utilize our provided tools to fill out your form.

- Select essential parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Gebcorp Withdrawal Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gebcorp withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Georgia 457 plan?

A Georgia 457 plan is a retirement savings plan specifically designed for state and local government employees in Georgia. It allows participants to set aside pre-tax income, which can grow tax-deferred until retirement. The plan helps employees save efficiently for their future.

-

How can I enroll in a Georgia 457 plan?

To enroll in a Georgia 457 plan, employees should contact their employer's benefits office or visit the official Georgia 457 plan website. The enrollment process typically involves filling out an application and selecting your contribution amount. It's an easy way to start saving for retirement.

-

What are the benefits of using a Georgia 457 plan?

A Georgia 457 plan offers several benefits, including tax savings, automatic payroll deductions, and flexible contribution limits. Enrolling in this plan allows employees to save more for retirement while reducing their taxable income. Additionally, it provides investment options tailored to meet various financial goals.

-

What investment options are available in the Georgia 457 plan?

The Georgia 457 plan offers a range of investment options, including stocks, bonds, and mutual funds. Participants can choose investments that align with their risk tolerance and retirement timeline. This flexibility allows employees to build a diversified portfolio tailored to their personal investment strategies.

-

Are there any fees associated with the Georgia 457 plan?

Yes, there may be administrative fees associated with the Georgia 457 plan, which can vary based on the chosen investment options. It's important to review the fee structure before enrolling to understand how it may affect your overall savings. Transparency in fees helps you make informed financial decisions.

-

Can I withdraw funds from my Georgia 457 plan before retirement?

Yes, participants can withdraw funds from their Georgia 457 plan before retirement under certain circumstances, such as financial hardship or separation from service. However, it’s essential to understand the potential tax implications and penalties associated with early withdrawal. Consulting a financial advisor can provide clarity on your options.

-

How does the Georgia 457 plan compare to a 401(k)?

The Georgia 457 plan differs from a 401(k) in that it is specifically designed for government employees, and it allows for different withdrawal rules. While both plans offer tax-deferred savings, a key benefit of the Georgia 457 plan is the ability to withdraw funds without a penalty upon separation from service, unlike a traditional 401(k). Each plan has its advantages depending on your employment status and retirement goals.

Get more for Gebcorp Withdrawal Form

- Cannabis clinic referral form dent neurologic institute

- Big w job application form

- Chemstrip urinalysis report form

- Apprenticeship completion form

- Standard form of ok

- Mapd prescription reimbursement request form 50745416

- Post surgery follow up soap note form

- Application for disabled license plate or parking placard kentucky form

Find out other Gebcorp Withdrawal Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online