Labour Payment Receipt Form

What is the Labour Payment Receipt

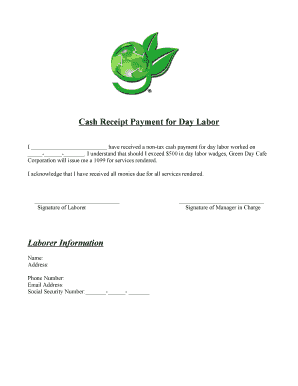

The labour payment receipt is a formal document that serves as proof of payment for services rendered by an employee or contractor. This receipt outlines the details of the transaction, including the amount paid, the date of payment, and the nature of the work performed. It is essential for both employers and employees, as it provides a record that can be used for tax purposes and financial documentation.

In the United States, this document is particularly important for maintaining accurate employee records and ensuring compliance with tax regulations. It can be used to substantiate income during tax filing and may be required for various financial transactions.

Key elements of the Labour Payment Receipt

A well-structured labour payment receipt includes several critical components to ensure clarity and legality. These elements typically consist of:

- Employee Information: Name, address, and identification number of the employee or contractor.

- Employer Information: Name, address, and contact details of the employer or business entity.

- Payment Details: Amount paid, payment method, and date of payment.

- Description of Services: A brief summary of the work performed or services rendered.

- Signatures: Signatures of both the employer and employee, which validate the transaction.

Including these elements ensures that the receipt is comprehensive and meets legal standards, making it a reliable document for both parties involved.

How to use the Labour Payment Receipt

The labour payment receipt can be utilized in various ways, primarily for record-keeping and tax purposes. Employers should issue this receipt to employees upon payment for services rendered, ensuring that both parties retain a copy for their records. Employees can use the receipt to report income accurately during tax season, as it serves as proof of earnings.

Additionally, the receipt may be required when applying for loans or financial assistance, as it demonstrates a reliable income source. It is advisable to keep these receipts organized and accessible for future reference.

Steps to complete the Labour Payment Receipt

Completing a labour payment receipt involves several straightforward steps to ensure all necessary information is accurately captured:

- Gather Information: Collect the relevant details of both the employee and employer, including names, addresses, and identification numbers.

- Detail the Payment: Clearly state the amount paid, the payment method, and the date of the transaction.

- Describe the Services: Write a brief description of the work performed to provide context for the payment.

- Sign the Receipt: Both the employer and employee should sign the receipt to confirm the transaction.

- Distribute Copies: Provide a copy of the completed receipt to the employee and retain one for the employer’s records.

Following these steps ensures that the labour payment receipt is completed correctly and serves its intended purpose.

Legal use of the Labour Payment Receipt

The legal use of the labour payment receipt is crucial for compliance with tax regulations and employment laws. In the United States, this document can be used as evidence in case of disputes regarding payment or employment status. It is essential to ensure that the receipt meets the requirements set forth by the IRS and other regulatory bodies.

Employers must keep accurate records of all payments made to employees, as failure to do so can result in penalties. Additionally, employees should maintain these receipts to substantiate their income and ensure proper tax reporting. Understanding the legal implications of this document helps both parties protect their rights and responsibilities.

Examples of using the Labour Payment Receipt

Labour payment receipts can be applied in various scenarios, demonstrating their versatility and importance. Common examples include:

- Freelance Work: A freelancer providing services to a client can issue a labour payment receipt upon receiving payment, ensuring both parties have a record of the transaction.

- Contract Work: Contractors hired for specific projects can use the receipt to document payments made for their services, which is essential for tax reporting.

- Temporary Employment: Temporary workers can receive a labour payment receipt from employers, providing proof of income for future employment or loan applications.

These examples highlight the practical applications of the labour payment receipt in various employment contexts, emphasizing its importance for both employers and employees.

Quick guide on how to complete labour payment receipt

Complete Labour Payment Receipt effortlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without any delays. Manage Labour Payment Receipt on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and electronically sign Labour Payment Receipt with ease

- Locate Labour Payment Receipt and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Labour Payment Receipt and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the labour payment receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are employees records and why are they important?

Employees records refer to the documentation that contains information about an employee's history, performance, and other relevant details. These records are crucial for managing compliance, tracking performance, and ensuring a smooth workflow. By keeping accurate employees records, businesses can enhance productivity and protect themselves during audits.

-

How does airSlate SignNow manage employees records?

airSlate SignNow simplifies the management of employees records by allowing businesses to collect, store, and share important documents securely. The platform enables electronic signatures and enhances collaboration among teams. This streamlined process ensures that employees records remain organized and easily accessible.

-

What features does airSlate SignNow offer for employees records management?

AirSlate SignNow offers several features tailored for employees records management, including customizable templates, document workflows, and instant eSignatures. These features not only save time but also reduce human error, ensuring the integrity of your employees records. Additionally, the platform's automation capabilities help you maintain up-to-date records without the fuss.

-

Is airSlate SignNow cost-effective for managing employees records?

Yes, airSlate SignNow is a cost-effective solution for managing employees records. The platform eliminates the need for paper-based processes, reducing overall operational costs. With various pricing plans available, businesses of all sizes can find an option that fits their budget while ensuring efficient employees records management.

-

Can airSlate SignNow integrate with other HR systems for employees records?

Absolutely! airSlate SignNow seamlessly integrates with popular HR systems, ensuring that your employees records are synchronized across platforms. This integration allows for a smooth transfer of data, reducing duplication and improving overall efficiency. With these integrations, maintaining accurate employees records becomes effortless.

-

What security measures does airSlate SignNow have for employees records?

AirSlate SignNow prioritizes the security of your employees records with advanced encryption and robust data protection measures. The platform complies with industry standards to ensure that all documents are safe from unauthorized access. You can trust that your sensitive employees records are handled with the utmost care and security.

-

How user-friendly is airSlate SignNow for teams managing employees records?

AirSlate SignNow is designed with user-friendliness in mind, allowing teams of all technical skill levels to manage employees records efficiently. The intuitive interface and straightforward navigation facilitate quick onboarding and help teams adopt the solution with minimal training. This accessibility ensures that every team member can contribute to employees records management effectively.

Get more for Labour Payment Receipt

- Form cg1 59843696

- Cheerleading demerit form template 424208315

- 3 on 3 basketball tournament registration form amp waiver 404311331

- Transamerica dime worksheet form

- Dmv order mv 465 form

- Level 80 the missing link form

- Speditionsauftrag gebrder weiss 348237014 form

- App 202 appellants reply brief judicial council forms

Find out other Labour Payment Receipt

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer