Form M60

What is the Form M60

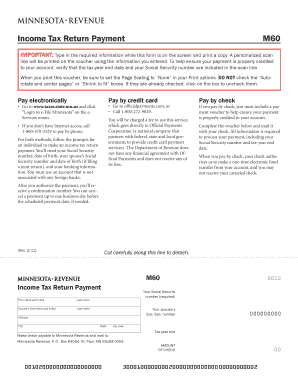

The Form M60, also known as the Minnesota Payment Voucher, is a critical document used by individuals and businesses in Minnesota to remit state income tax payments. This form is designed to facilitate the payment process for estimated taxes, ensuring that taxpayers comply with state tax obligations. The M60 form is particularly relevant for those who may not have taxes withheld from their income, such as self-employed individuals or those with additional income sources.

How to use the Form M60

To effectively use the Form M60, taxpayers must first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated amount is established, the taxpayer can fill out the M60 form, providing necessary personal information, including name, address, and Social Security number. The completed form should then be submitted along with the payment to the Minnesota Department of Revenue.

Steps to complete the Form M60

Completing the Form M60 involves several key steps:

- Gather necessary financial information, including income statements and previous tax returns.

- Calculate your estimated tax liability using the current tax rates and applicable deductions.

- Fill out the Form M60 with accurate personal and financial details.

- Double-check all entries for accuracy to avoid delays or penalties.

- Submit the form along with the payment to the Minnesota Department of Revenue by the due date.

Legal use of the Form M60

The legal use of the Form M60 is governed by Minnesota state tax laws. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Minnesota Department of Revenue. This includes submitting the form by the specified deadlines and ensuring that all information provided is accurate and complete. Failure to comply with these regulations may result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines associated with the Form M60. Typically, estimated tax payments are due quarterly, with specific dates set by the Minnesota Department of Revenue. It is crucial to mark these dates on your calendar to avoid late fees. The deadlines generally fall on the 15th of April, June, September, and January of the following year.

Form Submission Methods (Online / Mail / In-Person)

The Form M60 can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online: Taxpayers can submit the form electronically through the Minnesota Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Minnesota Department of Revenue.

- In-Person: Taxpayers may also deliver the form in person at designated state tax offices.

Quick guide on how to complete form m60

Complete Form M60 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Form M60 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign Form M60 with no hassle

- Obtain Form M60 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose how you would like to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form M60 and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m60

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form M60?

The form M60 is a document used for various business purposes, particularly for signing contracts and agreements electronically. Using airSlate SignNow, you can efficiently fill out and manage your form M60, ensuring that all necessary details are captured accurately.

-

How can I integrate form M60 with airSlate SignNow?

Integrating form M60 with airSlate SignNow is seamless. Our platform allows you to upload your form M60 and customize it for eSignature workflows, enabling quick and secure transactions with just a few clicks.

-

What are the pricing options for using airSlate SignNow with form M60?

airSlate SignNow offers various pricing plans that are budget-friendly, providing excellent value for businesses that need to handle the form M60 regularly. Our plans cater to different needs, from solo entrepreneurs to large organizations, ensuring that everyone can find a suitable option.

-

What features does airSlate SignNow offer for managing form M60?

With airSlate SignNow, you get robust features tailored for managing the form M60, such as customizable templates, advanced editing tools, and real-time tracking of the signing process. These features enhance productivity and allow for better document management.

-

What are the benefits of using airSlate SignNow for form M60?

Using airSlate SignNow for your form M60 offers numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security for your documents. This electronic signing solution streamlines your workflow, making it easier to manage contracts and agreements.

-

Does airSlate SignNow provide support for the form M60?

Yes, airSlate SignNow provides dedicated support for questions related to the form M60. Our team is available to assist you with any concerns about using the platform, ensuring you can utilize our services effectively.

-

Can I use airSlate SignNow for other forms besides M60?

Absolutely! While airSlate SignNow is great for managing the form M60, it is also capable of handling a variety of other forms and documents. You can easily adapt the platform to suit different business needs and optimize your signing processes.

Get more for Form M60

- Interstate seniors opal card application form

- Adobe cs3 activation code generator form

- 9 team single elimination bracket form

- Pdf absa bank statement template form

- Cdf loan application form

- Semesterplanering visma 404431199 form

- Form 3 high school suspension form 10 days or less docx

- Exsultet short form

Find out other Form M60

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document