Form 538 S

What is the Form 538 S

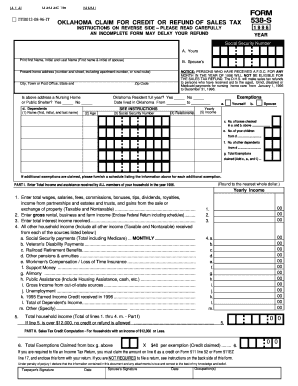

The Form 538 S is a specific document used for claiming sales tax relief in Oklahoma. This form is essential for individuals or businesses seeking a refund on sales tax paid during a particular tax year. The 2018 version of the form is particularly relevant for those who made purchases in that year and are eligible for a refund. Understanding the purpose and requirements of the Form 538 S is crucial for ensuring compliance with state tax regulations.

How to use the Form 538 S

Using the Form 538 S involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant documentation, including receipts and proof of sales tax paid. Next, fill out the form with your personal details, including your name, address, and taxpayer identification number. Be sure to detail the items for which you are claiming a refund, including the amount of sales tax paid. After completing the form, review it for accuracy before submission.

Steps to complete the Form 538 S

Completing the Form 538 S requires careful attention to detail. Follow these steps:

- Download the printable 538 S 2018 form from a reliable source.

- Fill in your personal information, including your name and contact details.

- List the items purchased and the corresponding sales tax paid.

- Calculate the total refund amount you are requesting.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form 538 S

The Form 538 S is legally binding when completed and submitted according to Oklahoma tax laws. It is essential to ensure that all information provided is truthful and accurate, as submitting false information can lead to penalties. The form must be submitted within the designated time frame to be considered valid for a refund. Compliance with legal requirements not only protects your rights as a taxpayer but also facilitates a smoother refund process.

Filing Deadlines / Important Dates

When filing the Form 538 S, it is crucial to be aware of specific deadlines to ensure your refund request is processed in a timely manner. Generally, the deadline to submit the form is within three years from the date of purchase. For the 2018 tax year, this means that claims must be filed by the end of 2021. Keeping track of these dates helps prevent missed opportunities for refunds.

Form Submission Methods (Online / Mail / In-Person)

The Form 538 S can be submitted through various methods, depending on your preference and convenience. You can file the form online through the Oklahoma Tax Commission's website, ensuring a quicker processing time. Alternatively, you may print the completed form and mail it to the appropriate address provided by the state. In-person submissions are also an option at designated tax offices. Each method has its own advantages, so choose the one that best suits your needs.

Quick guide on how to complete form 538 s

Effortlessly Prepare Form 538 S on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hesitation. Manage Form 538 S on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The ultimate way to modify and electronically sign Form 538 S with ease

- Obtain Form 538 S and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 538 S to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 538 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the printable 538s 2018 form and how can I use it?

The printable 538s 2018 form is a document used for specific tax-related purposes. You can easily download and print this form from the airSlate SignNow platform, allowing you to fill it out and submit your information efficiently.

-

Is there a cost associated with accessing the printable 538s 2018 form?

Accessing the printable 538s 2018 form through airSlate SignNow is part of our subscription plan. We offer various pricing tiers that include full access to document templates and eSignature capabilities, ensuring you get great value for your needs.

-

Can I fill out the printable 538s 2018 form electronically?

Yes, airSlate SignNow allows you to fill out the printable 538s 2018 form electronically. Our platform ensures that you can complete the form digitally, streamlining the process and eliminating the need for printing and scanning.

-

What features does airSlate SignNow offer for the printable 538s 2018 form?

With airSlate SignNow, you gain access to features like customizable templates, electronic signatures, and easy collaboration. These tools make handling the printable 538s 2018 form more efficient and user-friendly.

-

Can I integrate airSlate SignNow with other software when using the printable 538s 2018 form?

Absolutely! airSlate SignNow supports multiple integrations with popular software applications. This allows you to seamlessly incorporate the printable 538s 2018 form into your existing workflow for enhanced productivity.

-

What are the benefits of using airSlate SignNow for the printable 538s 2018 form?

Using airSlate SignNow for the printable 538s 2018 form provides numerous benefits, including time savings, enhanced accuracy, and secure document management. Our solution is designed to simplify the signing process, making it convenient for users.

-

Is it easy to share the completed printable 538s 2018 form with others?

Yes, sharing your completed printable 538s 2018 form is simple with airSlate SignNow. You can send the document directly via email or share a secure link, making it easy to collaborate and gather necessary approvals.

Get more for Form 538 S

- Words their way spelling test template form

- Residency affidavit form

- Sajili laini kenya form

- Printable womens ministry survey form

- Shared housing form

- Passport application form 15987537

- Payroll report sample form

- S cd 401s web corporation tax return submit forms in the following order cd v nc 478v cd 479 nc 478 nc 478 series cd 401s

Find out other Form 538 S

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal