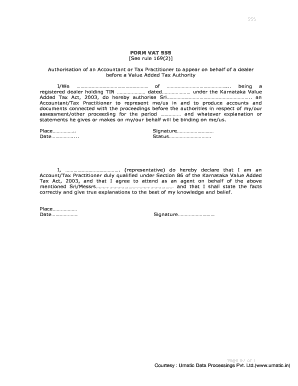

Form 555

What is the Form 555

The Form 555, also known as the VAT 555, is a crucial document used in specific tax reporting contexts. It serves to report value-added tax (VAT) transactions and is essential for businesses that engage in VAT-related activities. Understanding the purpose of this form is vital for compliance with tax regulations. It ensures that businesses accurately report their VAT obligations to the IRS, thereby avoiding potential penalties.

How to use the Form 555

Using the Form 555 effectively involves several steps. First, gather all necessary financial records related to VAT transactions. This includes invoices, receipts, and any other documentation that supports the reported figures. Next, carefully fill out the form, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors before submission. Proper use of this form can help ensure compliance with tax laws and facilitate smoother financial operations.

Steps to complete the Form 555

Completing the Form 555 requires attention to detail. Begin by downloading the form in the desired format, such as PDF or Word. Follow these steps:

- Enter your business information, including name, address, and tax identification number.

- Detail your VAT transactions, including sales and purchases, ensuring that all amounts are accurate.

- Calculate the total VAT owed or refundable based on the provided figures.

- Sign and date the form to validate it.

After completing these steps, ensure that the form is submitted by the appropriate deadline to avoid any compliance issues.

Legal use of the Form 555

The legal use of the Form 555 hinges on its compliance with federal tax regulations. To be considered valid, the form must be filled out accurately and submitted on time. The IRS recognizes eSignatures as legally binding, provided they adhere to the ESIGN and UETA acts. Utilizing a reliable eSignature tool can enhance the legal standing of your submitted form, ensuring that it meets all necessary legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 555 are essential to ensure compliance and avoid penalties. Typically, the form must be submitted by the end of the tax year, but specific deadlines can vary based on business type and tax situation. It is advisable to check the IRS guidelines for the most current deadlines. Marking these dates on your calendar can help in timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Form 555 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer submitting the form electronically through the IRS website, which can expedite processing.

- Mail Submission: You can print the completed form and send it via postal mail to the designated IRS address.

- In-Person Submission: For those who prefer face-to-face interaction, visiting a local IRS office is an option.

Choosing the right submission method can depend on your business's specific needs and preferences.

Quick guide on how to complete form 555

Complete Form 555 effortlessly on any device

Online document management has gained traction with companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 555 on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Form 555 effortlessly

- Locate Form 555 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature through the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about mislaid or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from your preferred device. Modify and eSign Form 555 to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 555

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat 555 in relation to airSlate SignNow?

Vat 555 refers to the value-added tax guidelines that businesses must consider when using airSlate SignNow for document signing. Understanding vat 555 can help ensure compliance with local tax laws while utilizing our eSignature platform.

-

How does airSlate SignNow simplify documents related to vat 555?

airSlate SignNow streamlines the signing of documents that involve vat 555 by providing an intuitive platform for eSigning. This efficiency reduces paperwork and helps businesses manage their tax-related documents effectively.

-

What pricing options are available for airSlate SignNow regarding vat 555?

Our pricing options for airSlate SignNow are competitive and designed to meet various business needs, including those dealing with vat 555 compliance. By choosing the right plan, businesses can ensure they are covered for all their eSignature needs.

-

Are there any key features of airSlate SignNow that assist with vat 555 compliance?

Yes, airSlate SignNow includes features such as customizable templates and automatic notifications that help maintain records relevant to vat 555. These tools enable businesses to manage their signing processes efficiently and ensure proper documentation.

-

What benefits do users gain from using airSlate SignNow to handle vat 555 documents?

Using airSlate SignNow for vat 555 documents provides benefits like reduced turnaround time for signatures and enhanced tracking of document status. This leads to improved compliance and overall better management of tax-related processes.

-

Can airSlate SignNow integrate with other tools to assist with vat 555?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and management software that consider vat 555. This integration ensures that your eSignature process aligns with your overall business operations, enhancing efficiency.

-

Is it easy to get started with airSlate SignNow for vat 555-related tasks?

Yes, getting started with airSlate SignNow for vat 555 tasks is straightforward. Users can sign up, choose a plan that fits their needs, and begin integrating their documents seamlessly into the system, simplifying their signing process.

Get more for Form 555

- Safety concern reporting form

- Pinehurst elementary pta officer nomination form

- Equipment failure report template form

- Evaluation for social work supervision doc form

- Superbill for plastic surgery form

- 41 1 2 2 dog license required license tax on dogs and kennels form

- Party room rental agreement template form

- Pasture rental agreement template form

Find out other Form 555

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form