Virginia St 9 Form

What is the Virginia ST-9?

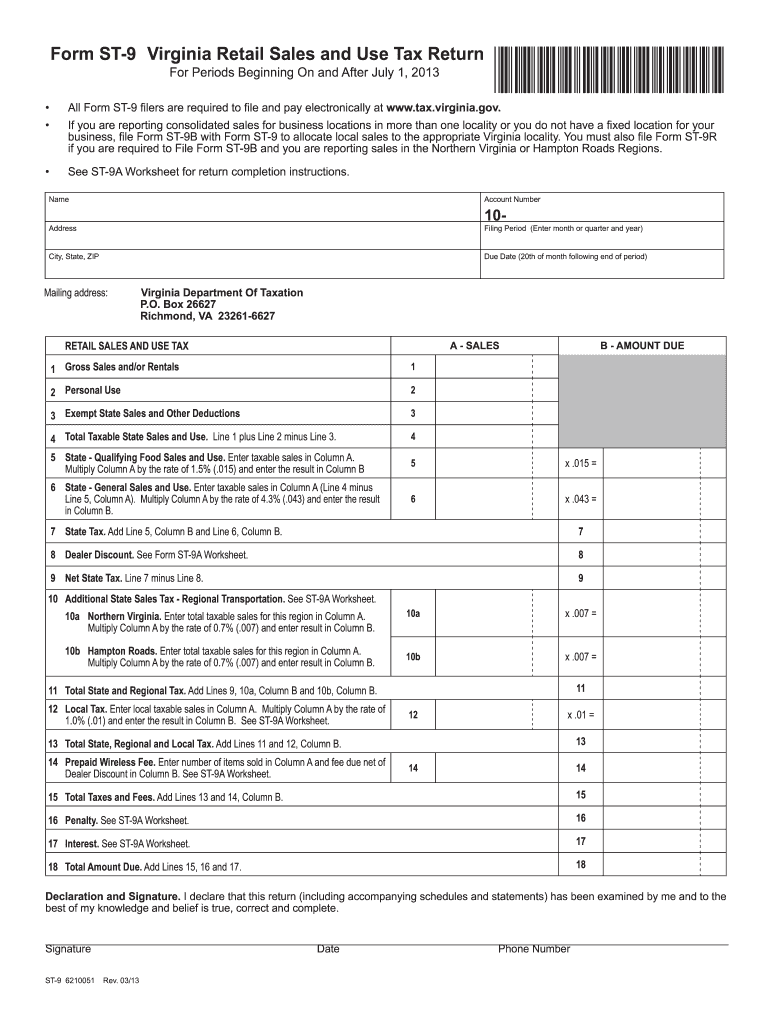

The Virginia ST-9 form, also known as the Virginia Sales and Use Tax Certificate of Exemption, is a document used by businesses and individuals to claim exemption from sales tax on certain purchases. This form is essential for those who qualify for tax-exempt status under specific categories, such as non-profit organizations, government entities, and certain educational institutions. By submitting the ST-9, buyers can avoid paying sales tax on eligible purchases, ensuring compliance with Virginia tax regulations.

Steps to Complete the Virginia ST-9

Completing the Virginia ST-9 form involves several straightforward steps. First, gather necessary information, including the name and address of the purchaser, the type of exemption being claimed, and details about the seller. Next, accurately fill out the form, ensuring that all required fields are completed. It is crucial to specify the reason for exemption clearly. After completing the form, sign and date it to validate the exemption claim. Finally, provide a copy of the ST-9 to the seller to facilitate tax-exempt purchases.

Legal Use of the Virginia ST-9

The Virginia ST-9 form is legally binding when completed correctly. It allows purchasers to make tax-exempt purchases as long as they meet the criteria outlined by Virginia tax laws. The form must be used solely for legitimate tax-exempt purposes. Misuse of the ST-9 can lead to penalties, including back taxes owed and potential fines. Therefore, it is essential to understand the legal implications and ensure that the form is used in compliance with state regulations.

Key Elements of the Virginia ST-9

Several key elements must be included in the Virginia ST-9 form for it to be valid. These elements include:

- Name and Address: The legal name and address of the purchaser must be clearly stated.

- Type of Exemption: The specific reason for claiming the exemption should be indicated, such as non-profit status or government agency.

- Seller Information: The name and address of the seller must be included to establish the transaction context.

- Signature and Date: The form must be signed and dated by the purchaser to confirm its authenticity.

How to Obtain the Virginia ST-9

The Virginia ST-9 form can be obtained through various methods. It is available for download from the Virginia Department of Taxation's website, where users can access the most current version of the form. Additionally, businesses may request physical copies through local tax offices or by contacting the Virginia Department of Taxation directly. Ensuring that you have the correct and updated form is crucial for compliance and successful exemption claims.

Form Submission Methods

Once the Virginia ST-9 form is completed, it can be submitted to the seller in different ways. Typically, the form is provided in person during the purchase transaction. However, it can also be sent via email or fax if the seller accepts electronic submissions. It is important to confirm with the seller their preferred method of receiving the ST-9 to ensure that the exemption is honored at the point of sale.

Quick guide on how to complete st 9 2013 form

Complete Virginia St 9 effortlessly on any device

Web-based document management has become favored by both companies and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Handle Virginia St 9 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to modify and eSign Virginia St 9 without hassle

- Locate Virginia St 9 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools available through airSlate SignNow designed specifically for that purpose.

- Produce your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Virginia St 9 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the st 9 2013 form

How to make an electronic signature for the St 9 2013 Form online

How to make an electronic signature for your St 9 2013 Form in Chrome

How to generate an electronic signature for signing the St 9 2013 Form in Gmail

How to generate an eSignature for the St 9 2013 Form from your mobile device

How to create an electronic signature for the St 9 2013 Form on iOS

How to generate an electronic signature for the St 9 2013 Form on Android devices

People also ask

-

What is airSlate SignNow's pricing structure for businesses located at Virginia St 9?

At airSlate SignNow, we offer flexible pricing plans tailored for businesses at Virginia St 9. Our plans range from basic to advanced features, ensuring that you can choose a package that meets your specific needs without overspending. Additionally, we often provide discounts for annual subscriptions, making it even more cost-effective for your Virginia St 9 business.

-

How does airSlate SignNow ensure document security for users at Virginia St 9?

Security is a top priority for airSlate SignNow, especially for businesses at Virginia St 9. We employ industry-leading encryption protocols and comply with regulations such as GDPR to protect your documents. This commitment ensures that all eSignatures and documents are securely handled, providing peace of mind for your Virginia St 9 operations.

-

What features does airSlate SignNow offer that benefit businesses at Virginia St 9?

Businesses at Virginia St 9 can take advantage of a variety of features offered by airSlate SignNow, including customizable templates, real-time collaboration, and mobile access. These tools streamline the signing process, making it easier for teams to work efficiently and effectively. Our platform is designed to enhance productivity and reduce turnaround times for your Virginia St 9 documents.

-

Can airSlate SignNow integrate with other software for companies based at Virginia St 9?

Yes, airSlate SignNow seamlessly integrates with various applications, making it a versatile choice for businesses at Virginia St 9. Whether you use CRM systems, project management tools, or cloud storage solutions, our integrations ensure that your workflow remains uninterrupted. This connectivity enhances the overall functionality of your operations at Virginia St 9.

-

What are the benefits of using airSlate SignNow for eSigning documents at Virginia St 9?

Using airSlate SignNow for eSigning documents at Virginia St 9 brings numerous benefits, including increased efficiency and reduced paper waste. Our platform allows for quick turnaround times and ensures that you can get documents signed on-the-go, which is essential for modern business operations. By adopting airSlate SignNow, your Virginia St 9 business will not only save time but also contribute to a more sustainable environment.

-

Is there a trial period for airSlate SignNow for businesses at Virginia St 9?

Absolutely! airSlate SignNow offers a free trial period for businesses at Virginia St 9, allowing you to explore our features and functionality without any commitment. This trial gives you the opportunity to evaluate how our eSigning solution can fit into your workflow and enhance your document management processes.

-

How does airSlate SignNow support customer service for users at Virginia St 9?

At airSlate SignNow, we pride ourselves on providing excellent customer support to businesses located at Virginia St 9. Our support team is available via multiple channels, including live chat, email, and phone, to assist you with any questions or issues. We are committed to ensuring that your experience with airSlate SignNow is smooth and efficient.

Get more for Virginia St 9

Find out other Virginia St 9

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple