Mpvattax Form

What is the Mpvattax?

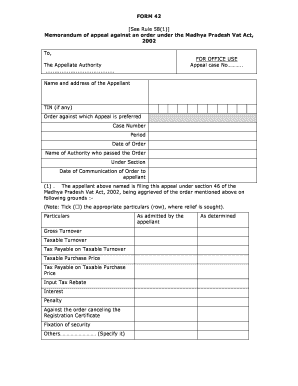

The Mpvattax is a specific form used in the context of value-added tax (VAT) appeals. It allows taxpayers to contest decisions made by tax authorities regarding VAT assessments. This form is crucial for businesses and individuals who believe they have been incorrectly assessed or wish to challenge a VAT ruling. Understanding the Mpvattax is essential for ensuring compliance and protecting your rights as a taxpayer.

Steps to complete the Mpvattax

Filling out the Mpvattax requires careful attention to detail to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary documentation, including previous VAT returns and any correspondence with tax authorities.

- Clearly state the grounds for your appeal, providing specific details about the assessment you are contesting.

- Complete the Mpvattax form accurately, ensuring all required fields are filled out correctly.

- Review the completed form for any errors or omissions before submission.

- Submit the form via your chosen method, whether online, by mail, or in person, depending on the guidelines provided by the tax authority.

Legal use of the Mpvattax

The Mpvattax must be filled out and submitted in accordance with legal requirements to be considered valid. It is essential to adhere to the guidelines set forth by tax authorities, including deadlines and specific submission methods. Failure to comply with these regulations can result in the rejection of your appeal or additional penalties. Utilizing a trusted electronic signature solution can further ensure that your submission meets legal standards.

Required Documents

When completing the Mpvattax, certain documents are typically required to support your appeal. These may include:

- Copies of previous VAT returns.

- Correspondence with tax authorities related to the assessment.

- Any relevant financial statements or records that substantiate your claim.

- Proof of payment of any disputed VAT amounts, if applicable.

Having these documents ready will facilitate a smoother appeal process and strengthen your case.

Form Submission Methods

The Mpvattax can be submitted through various methods, depending on the regulations in your state or locality. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, where available.

Each method has its own advantages, and selecting the right one can impact the speed and efficiency of your appeal process.

Filing Deadlines / Important Dates

Timeliness is critical when submitting the Mpvattax. Each jurisdiction may have specific deadlines for filing an appeal after receiving a VAT assessment. It is important to be aware of these dates to avoid missing the opportunity to contest the assessment. Regularly checking the tax authority's website or contacting them directly can help ensure you stay informed about relevant deadlines.

Quick guide on how to complete mpvattax

Complete Mpvattax effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Handle Mpvattax on any device with airSlate SignNow applications for Android or iOS, and streamline any document-related tasks today.

How to modify and eSign Mpvattax with ease

- Locate Mpvattax and select Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the frustration of searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Mpvattax while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mpvattax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a vat appeal form?

A vat appeal form is a document used by businesses to formalize their objections against VAT decisions made by tax authorities. Utilizing airSlate SignNow, you can easily create and eSign your vat appeal form, streamlining the submission process and ensuring swift action on your appeal.

-

How does airSlate SignNow help with the vat appeal form process?

airSlate SignNow simplifies the vat appeal form process by allowing you to fill out, sign, and send documents electronically. Our secure platform ensures that your information is protected, while also providing a user-friendly interface to manage your VAT appeals efficiently.

-

Is there a cost associated with using the vat appeal form feature in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit your business needs. The cost of using the vat appeal form feature is included in our subscription plans, which are designed to be budget-friendly while providing robust eSigning capabilities.

-

Can I integrate airSlate SignNow with my existing systems for vat appeal forms?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, including CRM, accounting, and document management systems. This means you can easily incorporate the vat appeal form process into your current workflow without any hassle.

-

What are the benefits of using airSlate SignNow for my vat appeal form?

Using airSlate SignNow for your vat appeal form provides several advantages, including enhanced accuracy, faster processing times, and improved document tracking. You can manage your appeals from anywhere, ensuring that you never miss an important deadline.

-

Is there customer support available for help with the vat appeal form?

Yes, we offer dedicated customer support to assist you with any questions related to the vat appeal form. Whether you need help with the signing process or troubleshooting, our knowledgeable support team is here to guide you every step of the way.

-

How secure is the vat appeal form process on airSlate SignNow?

The vat appeal form process on airSlate SignNow is highly secure, utilizing advanced encryption and compliance with industry standards. We prioritize your data protection, ensuring that your sensitive information is safe throughout the entire signing and submission process.

Get more for Mpvattax

Find out other Mpvattax

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself