Form 1040 Schedule 8812 Sp 2022

What is the Form 1040 Schedule 8812 sp

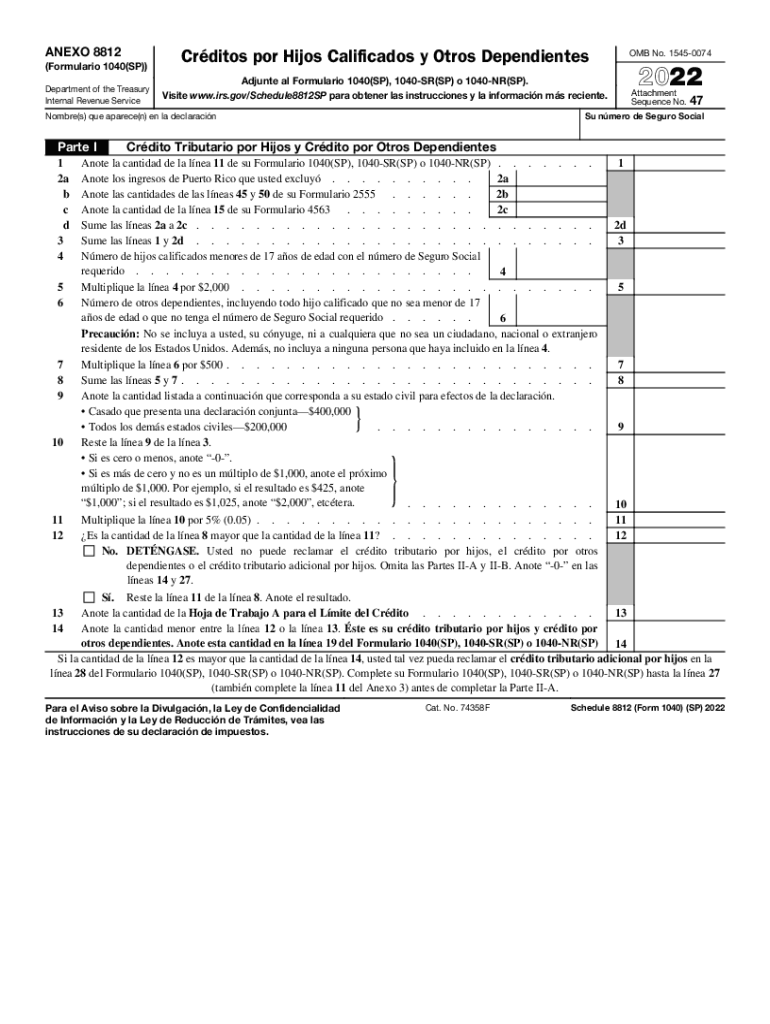

The Form 1040 Schedule 8812 sp is a supplemental form used by taxpayers in the United States to claim the Child Tax Credit (CTC) and the Additional Child Tax Credit (ACTC). This form is specifically designed for those who are filing their taxes in Spanish, providing a clear and accessible way to report eligible children and calculate the tax credits available. The CTC is intended to help families reduce their tax liability, while the ACTC may provide a refund even if the taxpayer does not owe any taxes.

How to use the Form 1040 Schedule 8812 sp

Using the Form 1040 Schedule 8812 sp involves several steps. First, ensure that you have completed your Form 1040. Next, gather information about your qualifying children, including their names, Social Security numbers, and ages. Once you have this information, fill out the Schedule 8812 sp to report your eligibility for the Child Tax Credit and Additional Child Tax Credit. After completing the form, attach it to your Form 1040 when submitting your tax return. It is important to double-check all entries for accuracy to avoid delays in processing your return.

Steps to complete the Form 1040 Schedule 8812 sp

To complete the Form 1040 Schedule 8812 sp, follow these steps:

- Begin by entering your name and Social Security number at the top of the form.

- List each qualifying child in the designated sections, including their name, Social Security number, and date of birth.

- Calculate the total amount of Child Tax Credit and Additional Child Tax Credit you are eligible for based on the information provided.

- Transfer the calculated amounts to your Form 1040 in the appropriate sections.

- Review the form for any errors or omissions before submission.

Key elements of the Form 1040 Schedule 8812 sp

Key elements of the Form 1040 Schedule 8812 sp include the identification of qualifying children, the calculation of the Child Tax Credit, and the determination of eligibility for the Additional Child Tax Credit. Each section of the form is designed to guide taxpayers through the process of reporting their dependents and calculating the credits accurately. It is essential to provide accurate information, as discrepancies can lead to delays or penalties.

Eligibility Criteria

To qualify for the Child Tax Credit and Additional Child Tax Credit reported on the Form 1040 Schedule 8812 sp, taxpayers must meet specific eligibility criteria. Generally, the child must be under the age of 17 at the end of the tax year, be claimed as a dependent on the taxpayer's return, and have a valid Social Security number. Additionally, the taxpayer's income must fall within certain limits to receive the full credit amount. It is advisable to review the IRS guidelines for the most current eligibility requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule 8812 sp align with the standard tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that they submit their Form 1040 and any attached schedules, including Schedule 8812 sp, by the deadline to avoid penalties. Extensions may be available, but they do not extend the time to pay any taxes owed.

Quick guide on how to complete form 1040 schedule 8812 sp

Prepare Form 1040 Schedule 8812 sp effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals alike. It offers a perfect eco-conscious substitute for traditional printed and signed documents, as you can obtain the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Form 1040 Schedule 8812 sp on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 1040 Schedule 8812 sp with ease

- Find Form 1040 Schedule 8812 sp and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Alter and eSign Form 1040 Schedule 8812 sp to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 schedule 8812 sp

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule 8812 sp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 Schedule 8812 sp?

Form 1040 Schedule 8812 sp is a supplemental form used by taxpayers to claim the Child Tax Credit and the Additional Child Tax Credit for qualifying children. It's essential for ensuring you maximize your potential tax benefits, especially for families. Understanding how to fill it out correctly can signNowly impact your tax refund.

-

How can airSlate SignNow help with Form 1040 Schedule 8812 sp?

With airSlate SignNow, you can easily fill out and eSign Form 1040 Schedule 8812 sp, streamlining your tax preparation process. Our intuitive platform allows you to manage documents securely and efficiently, ensuring accuracy and speed when submitting your forms. This can help alleviate stress during tax season as you can track all documents in one place.

-

What are the pricing options for using airSlate SignNow for Form 1040 Schedule 8812 sp?

AirSlate SignNow offers competitive pricing plans tailored to suit different business needs, starting with a free trial. You can choose monthly or annual subscriptions that provide access to various features, including eSigning and document management, all facilitating your handling of Form 1040 Schedule 8812 sp. Check our website for the latest subscription options and details.

-

Are there any key features of airSlate SignNow for managing documents like Form 1040 Schedule 8812 sp?

Yes, airSlate SignNow includes essential features such as customizable templates, secure eSigning, and collaborative document editing. These functionalities are designed to help you efficiently handle Form 1040 Schedule 8812 sp and any other tax documents. Additionally, you can track document status, which enhances productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents like Form 1040 Schedule 8812 sp offers signNow benefits, including time savings, enhanced security, and increased accuracy. The platform simplifies the signing process, reduces paperwork, and minimizes errors by ensuring that all stakeholders can easily access and sign documents electronically. This helps to streamline your entire tax preparation process.

-

Can I integrate airSlate SignNow with other platforms for my tax documents?

Absolutely! AirSlate SignNow integrates seamlessly with various third-party applications and platforms, including popular CRMs and cloud storage services. This integration capability allows you to connect your workflows and easily manage Form 1040 Schedule 8812 sp along with other essential tax documents in a centralized location. Explore our integrations page to learn more.

-

Is airSlate SignNow compliant with tax regulations for using Form 1040 Schedule 8812 sp?

Yes, airSlate SignNow adheres to industry standards and regulatory requirements, ensuring that your use of Form 1040 Schedule 8812 sp remains compliant with tax laws. Our platform utilizes advanced encryption and security protocols to protect sensitive information. This dedication to compliance means you can confidently manage your tax documents.

Get more for Form 1040 Schedule 8812 sp

- Contractors fuel fired heating appliance inspection report form

- Mcaa toolbox talks form

- Sunscreen permission form 42283427

- Adult safeguarding alert form shropshire council

- Photosynthesis notes form

- Denis y dol form

- D 410p d 410 web 7 24 instructions application fo form

- Speaker for virtual event agreement template form

Find out other Form 1040 Schedule 8812 sp

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure