Mass M3 Form

What is the Massachusetts Form M-3?

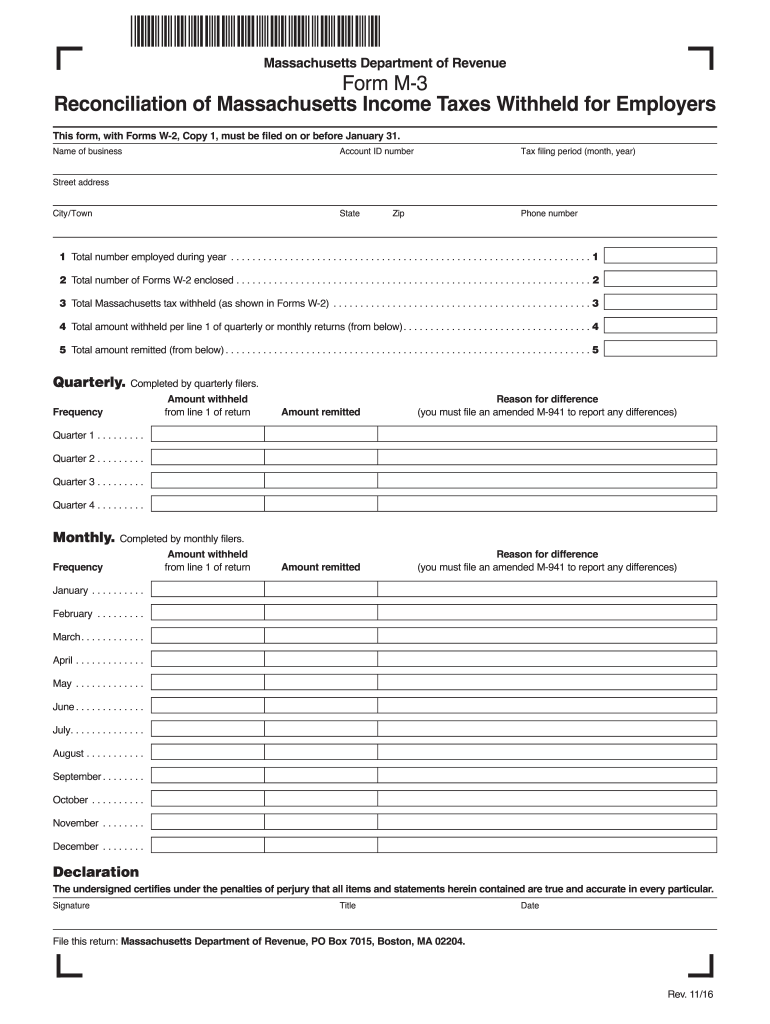

The Massachusetts Form M-3 is a reconciliation form used by businesses to report their income, deductions, and credits to the Massachusetts Department of Revenue. This form is particularly relevant for corporations and partnerships, ensuring compliance with state tax regulations. The M-3 serves as a summary of the entity's financial activities, allowing the state to verify that the correct amount of tax has been paid. It is essential for maintaining transparency and accuracy in tax reporting.

Steps to Complete the Massachusetts Form M-3

Completing the Massachusetts Form M-3 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and prior tax returns. Next, fill out the form by entering the total income, deductions, and credits as outlined in the instructions. It is important to cross-check all figures for accuracy. Once completed, review the form thoroughly to ensure all required fields are filled and calculations are correct. Finally, sign and date the form before submission.

Legal Use of the Massachusetts Form M-3

The Massachusetts Form M-3 is legally binding when completed and submitted according to state regulations. To ensure its validity, the form must be signed by an authorized individual within the business entity. Additionally, it must comply with the Massachusetts General Laws regarding tax reporting. Using a trusted electronic signature solution can enhance the legal standing of the document, provided it meets the requirements set forth by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Form M-3 are crucial to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year for corporations. For partnerships, the deadline aligns with the federal return due date. It is advisable to keep track of these dates annually and to file the form on time to ensure compliance with state tax laws.

Form Submission Methods

The Massachusetts Form M-3 can be submitted through various methods, including online, by mail, or in person. Electronic submission is encouraged for its efficiency and speed. Businesses can use the Massachusetts Department of Revenue's online portal to file the form securely. Alternatively, the form can be printed and mailed to the appropriate address, or delivered in person to a local tax office. Each method has its own processing times, so it is important to choose one that aligns with the filing deadline.

Key Elements of the Massachusetts Form M-3

Understanding the key elements of the Massachusetts Form M-3 is essential for accurate completion. The form includes sections for reporting total income, allowable deductions, and tax credits. Specific lines require detailed information about the business's financial activities, including any adjustments made during the tax year. Additionally, there are sections for providing information about the business entity itself, such as its legal structure and tax identification number. Ensuring that all elements are accurately filled out is vital for compliance and to avoid potential audits.

Who Issues the Massachusetts Form M-3?

The Massachusetts Form M-3 is issued by the Massachusetts Department of Revenue. This state agency is responsible for administering tax laws and ensuring that businesses comply with state tax regulations. The Department of Revenue provides the necessary forms and instructions, along with guidelines for proper completion and submission. It is advisable for businesses to refer to the official resources provided by the department to stay updated on any changes to the form or filing requirements.

Quick guide on how to complete mass m3

Complete Mass M3 seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents rapidly without delays. Manage Mass M3 on any device with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign Mass M3 with ease

- Locate Mass M3 and then click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to submit your form, by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Mass M3 and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mass m3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts Form M-3?

The Massachusetts Form M-3 is a tax form used by corporations to report their income, deductions, and credits for state tax purposes. It is essential for businesses operating in Massachusetts to ensure compliance with state tax regulations. airSlate SignNow offers an efficient way to manage the signing of your Massachusetts Form M-3 electronically.

-

How can airSlate SignNow help with preparing the Massachusetts Form M-3?

airSlate SignNow simplifies the process of preparing the Massachusetts Form M-3 by allowing you to create, edit, and send documents for e-signature seamlessly. Our platform ensures that all documents are securely stored and easily accessible. Plus, you can track the status of your Form M-3 to ensure timely submissions.

-

Is airSlate SignNow cost-effective for handling the Massachusetts Form M-3?

Yes, airSlate SignNow offers a cost-effective solution for handling the Massachusetts Form M-3. Our competitive pricing plans cater to businesses of all sizes, allowing you to manage document workflows without breaking the bank. With our service, you can save time and resources while ensuring compliance with Massachusetts tax laws.

-

What features does airSlate SignNow offer for the Massachusetts Form M-3?

airSlate SignNow includes features such as templates, customizable workflows, and secure electronic signatures that streamline the process of completing the Massachusetts Form M-3. Additionally, you can integrate reminders and notifications to stay informed about important deadlines. This enhances your productivity and helps in managing multiple forms.

-

How do I integrate airSlate SignNow with other tools for the Massachusetts Form M-3?

Integrating airSlate SignNow with other tools is straightforward and enhances your ability to manage the Massachusetts Form M-3. Our platform supports various integrations with popular CRM and accounting software, allowing for seamless document management. Check our integration options to find tools that work best for your business needs.

-

Can I store my completed Massachusetts Form M-3 in airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store your completed Massachusetts Form M-3 and other important documents in the cloud. This feature ensures easy access and retrieval at any time, making it convenient to reference your tax documents when needed. Your data is protected with industry-standard security measures.

-

What benefits can I expect from using airSlate SignNow for the Massachusetts Form M-3?

Using airSlate SignNow for the Massachusetts Form M-3 offers numerous benefits, including increased efficiency, reduced costs, and improved compliance. The e-signature process is fast and convenient, reducing the turnaround time for document approvals. This means you can focus more on your business rather than on paperwork.

Get more for Mass M3

Find out other Mass M3

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF