Quebec Pay Stub Form

Understanding the Quebec Pay Stub

The Quebec pay stub is a crucial document that provides employees with detailed information about their earnings and deductions for a specific pay period. It typically includes the employee's gross pay, net pay, tax withholdings, and contributions to benefits such as retirement plans and health insurance. This document serves as a record for both employees and employers, ensuring transparency in compensation and compliance with provincial regulations.

Key Elements of the Quebec Pay Stub

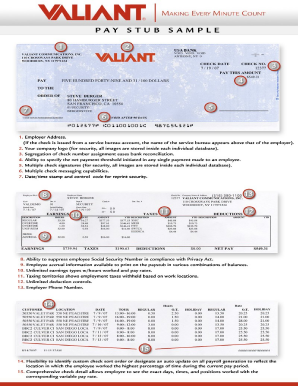

A comprehensive Quebec pay stub should contain several key elements:

- Employee Information: Name, address, and employee identification number.

- Employer Information: Company name, address, and employer identification number.

- Pay Period: The start and end dates of the pay period.

- Gross Pay: Total earnings before any deductions.

- Deductions: Itemized list of taxes and other deductions, such as CPP, EI, and health benefits.

- Net Pay: The amount the employee takes home after deductions.

Steps to Complete the Quebec Pay Stub

Completing a Quebec pay stub involves several steps to ensure accuracy and compliance:

- Gather Employee Information: Collect necessary details such as the employee's name, address, and identification number.

- Calculate Gross Pay: Determine the total earnings for the pay period, including regular hours, overtime, and bonuses.

- Deduct Taxes and Contributions: Calculate applicable taxes and deductions based on current rates and regulations.

- Calculate Net Pay: Subtract total deductions from gross pay to determine the final amount payable to the employee.

- Review for Accuracy: Double-check all calculations and ensure all required information is included.

Legal Use of the Quebec Pay Stub

The Quebec pay stub must adhere to specific legal requirements to be considered valid. Employers are obligated to provide accurate and complete pay stubs to their employees, detailing all earnings and deductions. This transparency helps ensure compliance with labor laws and protects both the employer and employee in case of disputes. Failure to provide a compliant pay stub can result in penalties for employers.

How to Obtain the Quebec Pay Stub

Employees can obtain their Quebec pay stub through various methods, depending on the employer's practices:

- Digital Access: Many employers provide electronic pay stubs through secure online portals, allowing employees to download or print their pay stubs as needed.

- Physical Copies: Employers may also issue paper pay stubs during regular pay periods, either handed directly to employees or mailed to their addresses.

Examples of Using the Quebec Pay Stub

The Quebec pay stub serves multiple purposes for employees:

- Tax Filing: Employees use pay stubs to report income and calculate taxes owed during tax season.

- Loan Applications: Financial institutions often require pay stubs as proof of income when assessing loan applications.

- Budgeting: Employees can track their earnings and deductions to manage personal finances effectively.

Quick guide on how to complete quebec pay stub

Complete Quebec Pay Stub effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the required forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Quebec Pay Stub on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and electronically sign Quebec Pay Stub seamlessly

- Obtain Quebec Pay Stub and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Quebec Pay Stub and ensure exceptional communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quebec pay stub

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pay stub template Canada PDF?

A pay stub template Canada PDF is a standardized document format used to provide employees with a detailed breakdown of their earnings, deductions, and net pay. This template ensures compliance with Canadian payroll regulations while offering a professional appearance. Using a pay stub template Canada PDF can greatly simplify the payroll process for employers.

-

How can I create a pay stub template Canada PDF using airSlate SignNow?

Creating a pay stub template Canada PDF with airSlate SignNow is straightforward. Simply choose the pay stub template from our library, customize it with your business details, and download it in PDF format. This efficient process saves time and ensures accuracy in your payroll documentation.

-

Is there a cost associated with using airSlate SignNow for pay stub templates?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost of using our service includes access to a wide range of templates, including the pay stub template Canada PDF. You can choose a plan that best fits your budget and requirements.

-

What features does the pay stub template Canada PDF offer?

The pay stub template Canada PDF in airSlate SignNow includes features such as customizable fields, automatic calculations for taxes and deductions, and easy integration with payroll systems. Additionally, the template is designed to meet Canadian government standards, ensuring compliance and professionalism.

-

Can I integrate the pay stub template Canada PDF with other payroll software?

Absolutely! The pay stub template Canada PDF is designed to integrate seamlessly with various payroll software solutions. This allows for automatic population of employee data and simplifies the payroll process. Our integration capabilities enhance the overall efficiency of your payroll management.

-

What are the benefits of using a pay stub template Canada PDF?

Using a pay stub template Canada PDF streamlines the payroll process, reduces the likelihood of errors, and ensures employees receive clear documentation of their earnings. Additionally, it saves time for HR and payroll departments, allowing them to focus on other business tasks. Overall, it promotes transparency and trust between employers and employees.

-

Is it easy to modify the pay stub template Canada PDF?

Yes, modifying the pay stub template Canada PDF in airSlate SignNow is user-friendly. You can easily edit the necessary fields, update employee information, and adjust any calculations as required. This flexibility makes it convenient for businesses to keep their payroll records accurate and up-to-date.

Get more for Quebec Pay Stub

- Sbb last chance review form

- Student of the month nomination example form

- Certificate of relief form

- Fuldmagt skabelon 315609977 form

- Candidate transfer request entries form 3 cambridge cie org

- Catalytic coaching forms

- Unit conversions gizmo answer key pdf form

- Hospitality employment contract template form

Find out other Quebec Pay Stub

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document