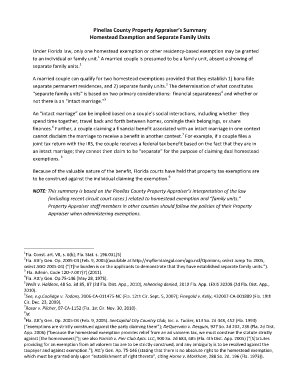

Pinellas County Homestead Exemption Application Form

What is the Pinellas County Homestead Exemption Application

The Pinellas County Homestead Exemption Application is a formal request that property owners in Pinellas County, Florida, submit to qualify for tax exemptions on their primary residence. This exemption can significantly reduce the taxable value of the home, leading to lower property taxes. The application is designed to ensure that homeowners meet specific eligibility criteria, which may include residency requirements and ownership status. Understanding the purpose and benefits of this application is crucial for any homeowner looking to maximize their tax savings.

Eligibility Criteria for the Pinellas County Homestead Exemption Application

To qualify for the Pinellas County Homestead Exemption, applicants must meet certain eligibility criteria. These include:

- The property must be the applicant's primary residence.

- The applicant must be a legal resident of Florida.

- The applicant must own the property as of January first of the tax year.

- Applicants must provide proof of residency, such as a Florida driver's license or state ID.

Meeting these criteria is essential to ensure that the application is approved and that the homeowner can benefit from the tax exemptions available.

Steps to Complete the Pinellas County Homestead Exemption Application

Completing the Pinellas County Homestead Exemption Application involves several key steps:

- Gather necessary documentation, including proof of ownership and residency.

- Access the application form online or at the local property appraiser's office.

- Fill out the form accurately, ensuring all required information is provided.

- Submit the application by the established deadline, which is typically March first of the tax year.

Following these steps carefully can help ensure a smooth application process and increase the chances of approval.

Required Documents for the Pinellas County Homestead Exemption Application

When applying for the Pinellas County Homestead Exemption, certain documents are required to support the application. These may include:

- A copy of the property deed or title.

- Proof of residency, such as a utility bill or lease agreement.

- A Florida driver's license or state ID showing the applicant's address.

- Any additional documentation that may demonstrate eligibility, such as tax returns or affidavits.

Providing these documents helps verify the applicant's eligibility and ensures that the application is processed efficiently.

Form Submission Methods for the Pinellas County Homestead Exemption Application

Homeowners in Pinellas County have several options for submitting their Homestead Exemption Application. These methods include:

- Submitting the application online through the Pinellas County Property Appraiser's website.

- Mailing the completed application to the local property appraiser's office.

- Delivering the application in person to the property appraiser's office.

Choosing the right submission method can depend on personal preference and convenience, but online submission is often the fastest and most efficient option.

Legal Use of the Pinellas County Homestead Exemption Application

The legal use of the Pinellas County Homestead Exemption Application is governed by Florida state law. Homeowners must ensure that they comply with all relevant regulations to avoid penalties. Misrepresentation or failure to meet eligibility criteria can lead to denial of the exemption or even legal repercussions. It is essential for applicants to provide accurate information and maintain compliance with state guidelines to protect their rights and benefits under the homestead exemption program.

Quick guide on how to complete pinellas county homestead exemption application

Prepare Pinellas County Homestead Exemption Application easily on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Pinellas County Homestead Exemption Application on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Pinellas County Homestead Exemption Application without hassle

- Find Pinellas County Homestead Exemption Application and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put aside concerns about missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Pinellas County Homestead Exemption Application while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pinellas county homestead exemption application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pinellas County homestead exemption?

The Pinellas County homestead exemption is a property tax exemption that reduces the taxable value of your primary residence, resulting in lower property taxes. To qualify, homeowners must apply through the Pinellas County Property Appraiser’s office. This exemption can provide substantial savings and is designed to support local residents.

-

How do I apply for a Pinellas County homestead exemption?

To apply for the Pinellas County homestead exemption, you must complete an application form available on the Pinellas County Property Appraiser's website. Applications can typically be submitted online or by mail, and the deadline for submission is usually March 1 of the year for which you are seeking the exemption. Ensure you have all the necessary documents ready, including proof of residency.

-

What are the financial benefits of the Pinellas County homestead exemption?

The financial benefits of the Pinellas County homestead exemption include a signNow reduction in property tax assessments, which can lead to increased savings each year. This exemption can lower the taxable value of your home by up to $50,000 for qualifying applicants, depending on overall property value. Over time, these savings can accumulate substantially for homeowners.

-

Are there different types of homestead exemptions available in Pinellas County?

Yes, there are several types of homestead exemptions available in Pinellas County, including the basic homestead exemption, a senior citizen exemption, and exemptions for disabled veterans. Each type has specific eligibility criteria and benefits. It's essential to explore these options to maximize savings on your property taxes.

-

Can I apply for the Pinellas County homestead exemption online?

Yes, you can apply for the Pinellas County homestead exemption online via the Pinellas County Property Appraiser’s website. The online application process is user-friendly and allows you to upload documentation required for verification quickly. Ensure you complete and submit your application before the March 1 deadline to ensure eligibility.

-

What happens if I sell my property with a Pinellas County homestead exemption?

If you sell your property that has a Pinellas County homestead exemption, you will lose the exemption, as it is tied to your primary residence. However, you can apply for a new exemption if you purchase a new home and make it your primary residence. This flexibility allows homeowners to retain the benefits of the homestead exemption when moving within the county.

-

Can I transfer my Pinellas County homestead exemption to a new property?

Yes, under certain conditions, you may transfer your Pinellas County homestead exemption to a new property within Florida. This process is known as 'porting' your exemption. You must apply for the new exemption on your new home while maintaining the necessary criteria to qualify, which can lead to continued tax savings.

Get more for Pinellas County Homestead Exemption Application

- Dd 1610 example form

- Jha sheet form

- Usarec form 601 37 44

- Fallon prior authorization form

- Taxi transport subsidy scheme nsw form

- St martin parish sales tax form

- Records keeping compliance form pursuant to 18 usc 2257

- Jv 594 response to prosecutor request for access tosealed juvenile case file judicial council forms

Find out other Pinellas County Homestead Exemption Application

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now