Csio Alberta Application for Automobile Insurance Form

What is the CSIO Alberta Application for Automobile Insurance

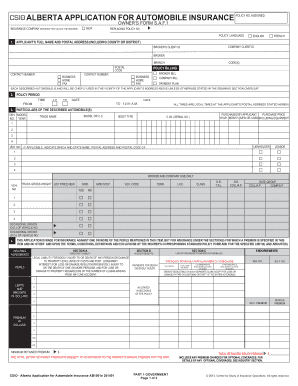

The CSIO Alberta application for automobile insurance is a standardized form used by insurance providers in Alberta, Canada, to collect necessary information from applicants seeking auto insurance coverage. This form is designed to streamline the application process, ensuring that all essential details are captured accurately. It includes sections for personal information, vehicle details, driving history, and coverage preferences, making it crucial for both insurers and applicants.

Steps to Complete the CSIO Alberta Application for Automobile Insurance

Completing the CSIO Alberta application involves several key steps:

- Gather necessary documents: Collect your driver's license, vehicle registration, and any previous insurance information.

- Fill out personal information: Provide your name, address, date of birth, and contact details.

- Detail your vehicle: Include the make, model, year, and Vehicle Identification Number (VIN).

- Provide driving history: Disclose any past accidents, claims, or traffic violations.

- Select coverage options: Choose the type of coverage you wish to obtain, such as liability, collision, or comprehensive.

- Review and submit: Double-check all information for accuracy before submitting the application.

Legal Use of the CSIO Alberta Application for Automobile Insurance

The CSIO Alberta application for automobile insurance is legally binding when completed correctly. To ensure its validity, applicants must provide accurate information and consent to the terms outlined in the form. Electronic signatures, when used in compliance with applicable laws such as ESIGN and UETA, are recognized as legally binding, making digital completion of the form a secure option.

Key Elements of the CSIO Alberta Application for Automobile Insurance

Several key elements are integral to the CSIO Alberta application:

- Personal Information: Essential details about the applicant.

- Vehicle Information: Specifics regarding the vehicle for which insurance is being sought.

- Coverage Options: Choices regarding the types of coverage desired.

- Driving History: A record of the applicant's driving behavior and any past incidents.

- Signature: Acknowledgment of the information provided and agreement to the terms.

How to Obtain the CSIO Alberta Application for Automobile Insurance

The CSIO Alberta application for automobile insurance can be obtained through various channels. Most insurance providers in Alberta offer the form on their websites, allowing applicants to download it directly. Additionally, applicants can visit local insurance offices to request a physical copy. For those preferring a digital approach, many insurers provide an online application process that incorporates the CSIO form seamlessly.

Eligibility Criteria for the CSIO Alberta Application for Automobile Insurance

To be eligible to complete the CSIO Alberta application for automobile insurance, applicants typically need to meet the following criteria:

- Be a legal resident of Alberta.

- Possess a valid driver's license.

- Own or have access to a vehicle that requires insurance.

- Provide accurate and truthful information when filling out the application.

Quick guide on how to complete csio alberta application for automobile insurance

Complete Csio Alberta Application For Automobile Insurance effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Manage Csio Alberta Application For Automobile Insurance on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The easiest way to modify and eSign Csio Alberta Application For Automobile Insurance with ease

- Obtain Csio Alberta Application For Automobile Insurance and click on Get Form to begin.

- Utilize the tools we offer to complete your paperwork.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Csio Alberta Application For Automobile Insurance to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the csio alberta application for automobile insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alberta auto application and how does it function?

The Alberta auto application is a streamlined digital tool provided by airSlate SignNow for businesses in Alberta, enabling them to easily apply for auto-related documents. It allows users to fill out forms electronically and sign them quickly, making the process efficient and user-friendly.

-

How much does the Alberta auto application cost?

airSlate SignNow offers competitive pricing for the Alberta auto application, allowing businesses to choose from various plans that fit their needs. Users can enjoy a cost-effective solution without compromising on features, ensuring they get the best value for their investment.

-

What features does the Alberta auto application include?

The Alberta auto application is packed with features designed to simplify document management, including eSigning, automated workflows, and customizable templates. These functionalities streamline the application process, making it easier for Alberta businesses to handle their auto documentation efficiently.

-

How can the Alberta auto application benefit my business?

Implementing the Alberta auto application can signNowly enhance your business operations by reducing paperwork, saving time, and minimizing errors. This electronic solution accelerates document processing, allowing you to focus on serving your customers better.

-

Is the Alberta auto application secure?

Yes, the Alberta auto application powered by airSlate SignNow is designed with advanced security features to protect your documents and data. It employs encryption and secure access controls, ensuring that all information remains confidential and protected from unauthorized access.

-

Can I integrate the Alberta auto application with other software?

Absolutely! The Alberta auto application seamlessly integrates with various business tools and software systems, enhancing your workflow and productivity. This ability to connect with existing applications makes it a versatile choice for businesses looking to streamline their processes.

-

How user-friendly is the Alberta auto application for new users?

The Alberta auto application is designed with user-friendliness in mind, making it intuitive even for those who are not tech-savvy. The straightforward interface and comprehensive support resources mean that new users can easily navigate the application and start utilizing its features effectively.

Get more for Csio Alberta Application For Automobile Insurance

Find out other Csio Alberta Application For Automobile Insurance

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple