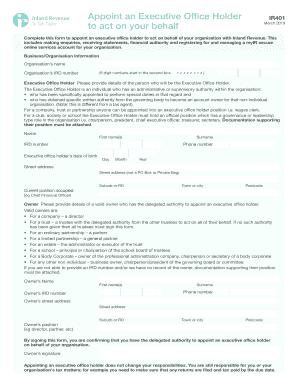

Ir401 Form

What is the IR401 Form?

The IR401 form is a tax document used by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). It is essential for ensuring compliance with U.S. tax laws and regulations. The form is particularly relevant for those who need to disclose income, deductions, and other financial details pertinent to their tax obligations. Understanding the purpose and requirements of the IR401 form is crucial for accurate tax reporting and avoiding potential penalties.

How to Use the IR401 Form

Using the IR401 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form with the relevant details, ensuring that all figures are correctly calculated. It is important to review the completed form for accuracy before submission. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail, depending on your preference.

Steps to Complete the IR401 Form

Completing the IR401 form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, such as W-2s, 1099s, and other income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income by entering the total amounts from your financial documents.

- List any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the IR401 Form

The IR401 form is legally binding and must be filled out in accordance with IRS guidelines. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be submitted by the required deadlines to maintain compliance with U.S. tax laws. Utilizing a reliable platform for electronic signatures can enhance the legal validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the IR401 form vary depending on the type of taxpayer and the specific tax year. Generally, individual taxpayers must submit their forms by April fifteenth of the following year. Extensions may be available, but it is important to file for an extension before the original deadline. Keeping track of these important dates helps avoid late fees and ensures compliance with IRS regulations.

Required Documents

To complete the IR401 form accurately, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses

- Previous tax returns for reference

Having these documents ready can streamline the process and help ensure that all necessary information is reported correctly.

Quick guide on how to complete ir401

Effortlessly Prepare Ir401 on Any Device

Digital document administration has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Ir401 across any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to edit and electronically sign Ir401 without hassle

- Find Ir401 and click on Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the specialized tools offered by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional signature with ink.

- Review the information and then click the Done button to save your changes.

- Choose how you prefer to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or overlooked files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ir401 and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir401

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ir401 form and why do I need it?

The ir401 form is a crucial document for reporting various tax liabilities related to businesses. It helps users maintain compliance with tax regulations, ensuring they report their earnings and expenses accurately. Understanding the ir401 form is essential for any business looking to manage their finances effectively.

-

How does airSlate SignNow help with the ir401 form process?

airSlate SignNow simplifies the process of completing the ir401 form by providing an intuitive platform for electronic signatures and document management. Users can easily create, send, and track the ir401 form, making the filing process seamless and efficient. This signNowly reduces paperwork and enhances productivity.

-

Is there a cost associated with using airSlate SignNow for the ir401 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when handling the ir401 form. Each plan is designed to be cost-effective while providing all the necessary features to efficiently manage and sign important documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the ir401 form?

airSlate SignNow provides features such as document templates, real-time tracking, electronic signatures, and integration capabilities that enhance the management of the ir401 form. These tools streamline the preparation and submission process, allowing users to easily gather signatures and finalize documents with confidence.

-

Can I integrate airSlate SignNow with other tools for the ir401 form?

Absolutely! airSlate SignNow supports integrations with various applications and services, which facilitates a comprehensive approach to managing the ir401 form. Whether you use accounting software or customer relationship management (CRM) tools, airSlate SignNow can enhance productivity by allowing you to connect seamlessly with your existing systems.

-

What benefits does airSlate SignNow provide when handling the ir401 form?

One of the main benefits of using airSlate SignNow for the ir401 form is the efficiency it brings to document management. You'll save time, reduce errors, and ensure compliance through electronic signatures and automated workflows. This way, you can focus on growing your business instead of getting bogged down by paperwork.

-

Is airSlate SignNow secure for submitting the ir401 form?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect your documentation, including the ir401 form. All user data is encrypted, and the platform maintains strict access controls to ensure that your sensitive information remains confidential and secure.

Get more for Ir401

Find out other Ir401

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online