Axa Loan Application Form

What is the Axa Loan Application

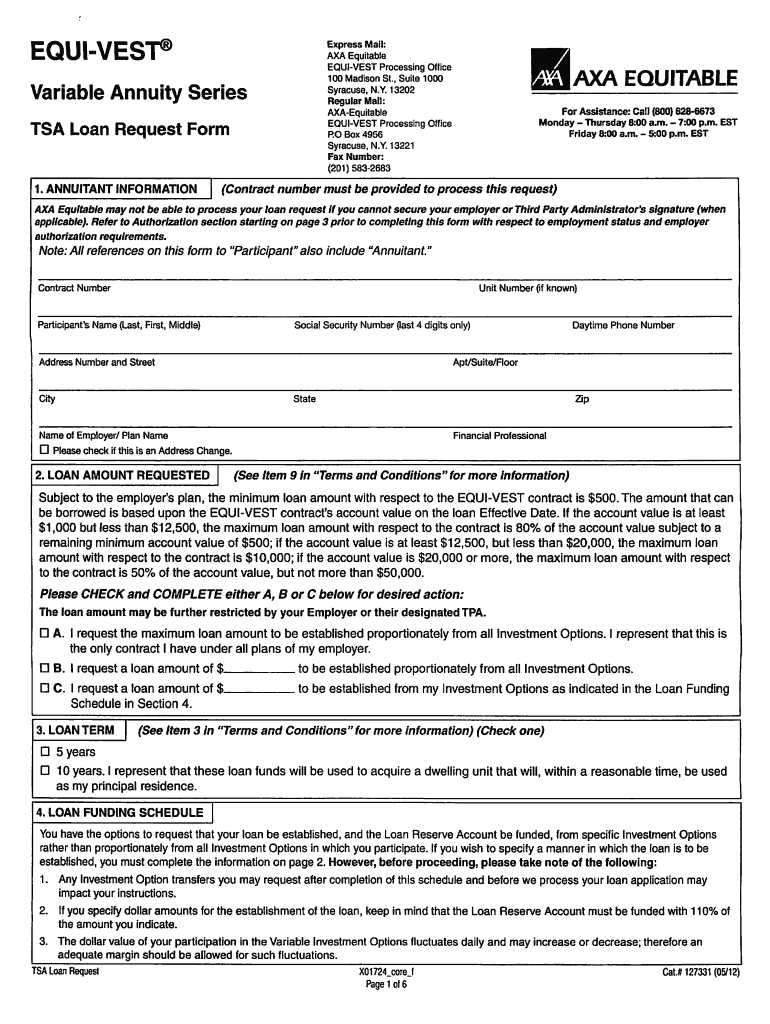

The Axa loan application is a formal request for financial assistance provided by Axa, a leading insurance and financial services company. This application allows individuals or businesses to apply for various loan products, including personal loans, home equity loans, and business loans. The application process is designed to assess the applicant's financial situation, creditworthiness, and eligibility for the desired loan amount. Understanding the specifics of the Axa loan application is crucial for potential borrowers to ensure they meet the requirements and can provide the necessary documentation.

Steps to complete the Axa Loan Application

Completing the Axa loan application involves several key steps to ensure accuracy and compliance. Follow these steps for a smooth application process:

- Gather necessary documents, including proof of income, identification, and any relevant financial statements.

- Access the Axa loan application form, which can be obtained online or through a local Axa office.

- Fill out the application form with accurate personal and financial information, ensuring all fields are completed.

- Review the application for errors or omissions before submission.

- Submit the completed application either online, via mail, or in-person at an Axa branch.

Legal use of the Axa Loan Application

The Axa loan application is legally binding once submitted and approved. It is essential for applicants to understand the legal implications of signing the application, as it includes a commitment to repay the loan under the specified terms. Compliance with federal and state lending laws is crucial, and Axa adheres to regulations that protect consumers during the loan process. Borrowers should ensure they read all terms and conditions before signing to understand their rights and obligations.

Required Documents

When applying for an Axa loan, several documents are typically required to support the application. These may include:

- Proof of identity, such as a driver's license or passport.

- Recent pay stubs or tax returns to verify income.

- Bank statements to demonstrate financial stability.

- Any existing loan information if applicable.

- Additional documentation related to the purpose of the loan, such as property details for home equity loans.

Eligibility Criteria

Applicants must meet specific eligibility criteria to qualify for an Axa loan. Common requirements include:

- Being at least eighteen years old and a legal resident of the United States.

- Having a stable source of income to ensure loan repayment.

- Maintaining a satisfactory credit score, which may vary depending on the loan type.

- Providing accurate and complete information on the loan application.

Application Process & Approval Time

The application process for an Axa loan typically involves several stages, including submission, review, and approval. After submitting the loan application, Axa will assess the provided information and documentation. The approval time can vary based on the loan type and complexity of the application, but many applicants receive a decision within a few business days. Once approved, borrowers will receive information regarding loan terms, interest rates, and repayment schedules.

Quick guide on how to complete axa loan application

Prepare Axa Loan Application effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as it allows you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly without any hold-ups. Manage Axa Loan Application on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Axa Loan Application without hassle

- Find Axa Loan Application and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select how you want to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choice. Edit and eSign Axa Loan Application and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the axa loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an equitable loan form and how does it work?

An equitable loan form is a document used in lending that helps ensure fair and just practices in loan agreements. It outlines the terms of the loan, including repayment conditions and obligations for both borrower and lender. With airSlate SignNow, you can easily create and eSign equitable loan forms, streamlining the process and enhancing efficiency.

-

How can I create an equitable loan form using airSlate SignNow?

Creating an equitable loan form with airSlate SignNow is simple. You can start by selecting a template or creating a document from scratch, then customize it as per your requirements. Our intuitive interface allows you to add fields, such as signatures and dates, ensuring that your equitable loan form is complete and compliant.

-

What are the pricing options for using airSlate SignNow for equitable loan forms?

airSlate SignNow offers several pricing plans that cater to various business needs, whether you're a small startup or a large enterprise. Our pricing is designed to be cost-effective while providing you with all the necessary features to manage your equitable loan forms efficiently. You can choose a plan that aligns with your budget and document volume requirements.

-

What features does airSlate SignNow offer for managing equitable loan forms?

airSlate SignNow provides a comprehensive set of features for managing equitable loan forms, including customizable templates, in-app editing, and real-time tracking. You can also take advantage of advanced security features to protect sensitive information. The platform enhances collaboration by allowing multiple users to access and sign documents simultaneously.

-

How does airSlate SignNow ensure the security of my equitable loan forms?

Security is a top priority for airSlate SignNow. Our platform uses encrypted connections and secure storage solutions to ensure that your equitable loan forms are protected from unauthorized access. Furthermore, we comply with industry standards and regulations to provide peace of mind when handling sensitive loan documents.

-

Can I integrate airSlate SignNow with other software for managing equitable loan forms?

Yes, airSlate SignNow offers seamless integrations with a variety of popular software applications, including CRM systems and project management tools. This allows you to enhance your workflow and manage your equitable loan forms more effectively. With integration, you can automate tasks and sync data across platforms easily.

-

What are the benefits of using airSlate SignNow for equitable loan forms?

Using airSlate SignNow for your equitable loan forms streamlines the document management process, saving you time and reducing paperwork. The platform is user-friendly, meaning you can quickly create, send, and execute loan agreements online. Moreover, the electronically signed documents are legally binding, enhancing your business transactions' efficiency.

Get more for Axa Loan Application

- Relationship rating form

- Alacourt eforms

- National police check application form certificates australia

- Odh form 283

- South dakota peace officers associationa forum for all form

- Registration form south dakota state fair

- Weatherization and energy efficiency assistance form

- Account application vnowdoc certificate of foreign persons claim that income is effectively connected with the conduct of a form

Find out other Axa Loan Application

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter