Rut 25 Lse Form

What is the Rut 25 Lse?

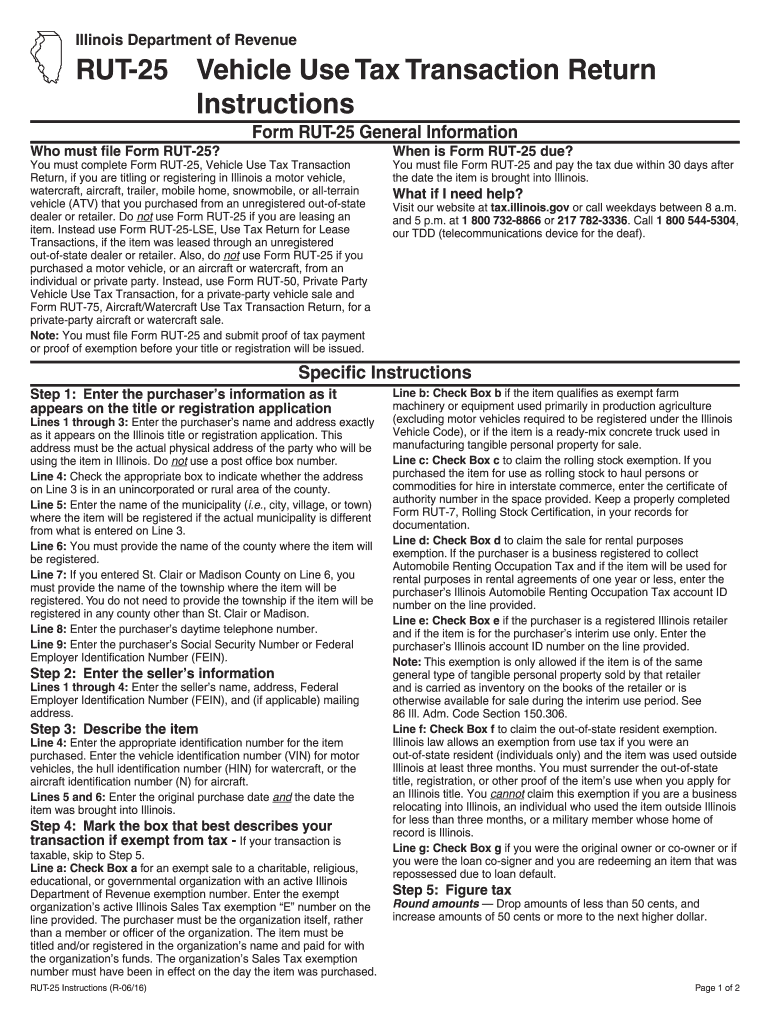

The Rut 25 Lse is a tax form used in Illinois, specifically for reporting and documenting certain tax-related information. It is essential for individuals and businesses to understand the purpose of this form, as it plays a crucial role in ensuring compliance with state tax regulations. The Rut 25 Lse is particularly relevant for those who need to report specific transactions or income that fall under the jurisdiction of Illinois tax laws.

Steps to complete the Rut 25 Lse

Completing the Rut 25 Lse involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary information, including your personal details and any relevant financial data.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill out the form accurately, ensuring that all fields are completed as instructed.

- Review your entries for any errors or omissions before finalizing the form.

- Sign and date the form to validate your submission.

Legal use of the Rut 25 Lse

The Rut 25 Lse is legally binding when filled out correctly and submitted according to state regulations. To ensure its legal standing, it must comply with the Illinois Department of Revenue guidelines. This includes using the correct version of the form and providing accurate information. Additionally, electronic signatures are accepted, provided they meet the requirements set forth by relevant eSignature laws.

Form Submission Methods

There are several methods to submit the Rut 25 Lse, allowing for flexibility based on individual preferences:

- Online Submission: Many users prefer to submit the form electronically through the Illinois Department of Revenue's online portal.

- Mail: You can print the completed form and send it via postal mail to the designated address provided in the instructions.

- In-Person: Some individuals may choose to deliver the form in person at their local tax office for immediate processing.

Key elements of the Rut 25 Lse

Understanding the key elements of the Rut 25 Lse is essential for accurate completion. Important components include:

- Taxpayer Information: This includes your name, address, and identification number.

- Income Reporting: Specific sections are designated for reporting various types of income or transactions.

- Signature: A signature is required to validate the information provided on the form.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance. The Rut 25 Lse generally has specific due dates that align with the Illinois tax calendar. It is advisable to check the Illinois Department of Revenue's website for the most current deadlines, as they may vary from year to year. Missing these deadlines can result in penalties or interest on unpaid taxes.

Quick guide on how to complete rut 25 lse

Complete Rut 25 Lse effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without hindrances. Manage Rut 25 Lse on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to edit and electronically sign Rut 25 Lse without stress

- Locate Rut 25 Lse and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specially provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tiresome form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device you prefer. Edit and eSign Rut 25 Lse and ensure superb communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rut 25 lse

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rut 25 and how does it relate to airSlate SignNow?

Rut 25 refers to a regulatory requirement for digital document submissions. airSlate SignNow complies with rut 25, ensuring that your eSigned documents meet all legal standards, thereby offering peace of mind for businesses looking to streamline their document workflows.

-

How much does airSlate SignNow cost for businesses focusing on rut 25 compliance?

The pricing for airSlate SignNow varies based on the features selected, but it is designed to be cost-effective, especially for businesses needing to comply with rut 25. By choosing airSlate SignNow, you can access a comprehensive set of tools without breaking your budget.

-

What features does airSlate SignNow offer to facilitate rut 25 compliance?

AirSlate SignNow offers features such as customizable templates, secure storage, and robust eSignature functionality. These tools ensure that all your documents adhere to rut 25 requirements, making the signing process both efficient and compliant.

-

Can airSlate SignNow integrate with other software to support rut 25 processes?

Yes, airSlate SignNow integrates seamlessly with various platforms like CRM systems and productivity tools. This integration capability helps businesses streamline their workflows and ensures that documents follow the necessary rut 25 regulations without additional hassle.

-

What are the benefits of using airSlate SignNow for rut 25 document management?

Using airSlate SignNow for rut 25 document management provides increased efficiency and reliability. It simplifies eSigning and document management while ensuring compliance with all relevant regulations, allowing your team to focus on more important tasks.

-

Is airSlate SignNow secure for handling documents related to rut 25?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure data storage, ensuring that your documents related to rut 25 are protected. You can trust airSlate SignNow to safeguard your information throughout the signing process.

-

How does airSlate SignNow improve the efficiency of workflows impacted by rut 25?

AirSlate SignNow streamlines workflows by simplifying the eSignature process required for rut 25 compliance. Its user-friendly interface allows users to send, track, and sign documents quickly, drastically reducing the time spent on paperwork.

Get more for Rut 25 Lse

- Central virginia regional mls purchase agreement form

- Niagara falls word search form

- Community based work experience timesheet mtp form

- Palm beach county impact fees form

- Sample i129 form

- Subscribers statement of claim send this claim to form

- Construction plan submittal form for health care facilities construction plan submittal form for health care facilities

- Submittal approval form

Find out other Rut 25 Lse

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template