Ct 1099 Form

What is the CT 1099 Form

The CT 1099 form is a tax document used in the United States to report various types of income that are not classified as wages, salaries, or tips. This form is typically issued by businesses to report payments made to independent contractors, freelancers, and other non-employees. The information reported on the CT 1099 form is important for both the payer and the recipient, as it helps ensure accurate income reporting to the Internal Revenue Service (IRS). Common types of income reported on this form include rents, royalties, and payments for services rendered.

How to Use the CT 1099 Form

Using the CT 1099 form involves several key steps. First, businesses must gather the necessary information about the payee, including their name, address, and taxpayer identification number (TIN). Next, the payer fills out the form, detailing the amount paid during the tax year. Once completed, the form must be distributed to the payee and submitted to the IRS by the designated deadline. It is essential to ensure that all information is accurate to avoid potential penalties or issues with tax filings.

Steps to Complete the CT 1099 Form

Completing the CT 1099 form requires careful attention to detail. Follow these steps:

- Collect the payee's information, including their legal name, address, and TIN.

- Determine the total amount paid to the payee during the tax year.

- Fill out the CT 1099 form, entering the payee's information and the payment amount in the appropriate fields.

- Review the form for accuracy, ensuring all information is correct.

- Distribute copies of the completed form to the payee and submit the original to the IRS.

Legal Use of the CT 1099 Form

The CT 1099 form serves a critical legal function in the tax reporting process. It ensures that all income is reported accurately to the IRS, which helps maintain compliance with federal tax laws. Failure to file the CT 1099 form when required can result in penalties for the payer. Additionally, the payee must report the income received on their tax return, making this form essential for both parties in fulfilling their tax obligations.

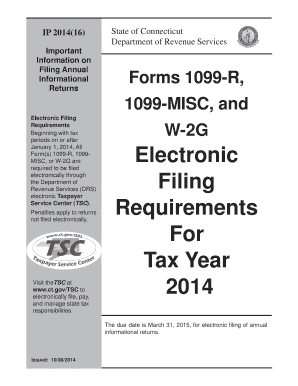

Filing Deadlines / Important Dates

Filing deadlines for the CT 1099 form are crucial for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. If the form is filed electronically, the deadline may extend to March thirty-first. It is important for businesses to be aware of these dates to avoid late filing penalties and ensure timely reporting of income.

Who Issues the Form

The CT 1099 form is typically issued by businesses, including sole proprietors, partnerships, and corporations, that make payments to non-employees. This can include payments to independent contractors, freelancers, and service providers. It is the responsibility of the payer to ensure that the form is completed accurately and distributed to the appropriate parties in a timely manner.

Penalties for Non-Compliance

Non-compliance with CT 1099 form filing requirements can result in significant penalties. The IRS may impose fines for failing to file the form on time, providing incorrect information, or not providing a copy to the payee. These penalties can escalate depending on how late the form is filed and the size of the business. It is essential for businesses to understand these potential consequences and ensure compliance to avoid unnecessary costs.

Quick guide on how to complete ct 1099 form

Complete Ct 1099 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Ct 1099 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Ct 1099 Form without hassle

- Obtain Ct 1099 Form and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark necessary sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Update and eSign Ct 1099 Form and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1099 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CT 1099 form and why is it important?

The CT 1099 form is a tax document used in Connecticut to report various types of income other than wages, salaries, and tips. It's essential for both businesses and individuals to ensure compliance with state tax requirements, thus avoiding potential penalties.

-

How can airSlate SignNow help with the CT 1099 form process?

airSlate SignNow streamlines the process of completing and eSigning your CT 1099 form. Our platform enables you to fill out your form electronically, send it securely to recipients, and get it signed, all in one place, simplifying the entire workflow.

-

What pricing plans does airSlate SignNow offer for eSigning CT 1099 forms?

airSlate SignNow offers various pricing plans designed to accommodate different business needs. Our plans include features for unlimited eSigning and document storage, making it cost-effective for handling documents like the CT 1099 form.

-

Are there any features specifically beneficial for managing CT 1099 forms?

Yes, airSlate SignNow includes features such as customizable templates and automated reminders for CT 1099 forms. These features help you save time and ensure that your documents are completed and submitted on schedule.

-

Can I integrate airSlate SignNow with accounting software for my CT 1099 forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing for easy import and export of your CT 1099 form data. This integration helps streamline the process by ensuring that all financial records are in sync.

-

Is airSlate SignNow secure for sending sensitive CT 1099 forms?

Yes, security is a top priority at airSlate SignNow. We use strong encryption protocols to protect your documents, including sensitive information on CT 1099 forms, ensuring that your data remains safe throughout the signing process.

-

Can multiple users collaborate on a CT 1099 form in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on your CT 1099 form. You can share access with team members to fill out different sections, making it easier to complete complex forms collectively.

Get more for Ct 1099 Form

- Fillable income verification form

- Fillable online mi occupational license application level 1 form

- Renewal state of michigan form

- Michigan patient care record protocol state of michigan form

- Application for special organization license plate form

- Application for special organization license plates form

- Lobby late filing fee waiver request form lobby lff waiver form

- Request for a state complaint investigation special education state complaint michigan form

Find out other Ct 1099 Form

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament