Indian Bank Health Insurance Premium Chart Form

What is the Indian Bank Health Insurance Premium Chart

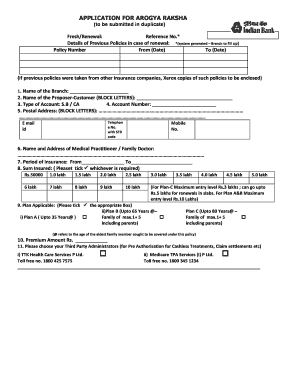

The Indian Bank Health Insurance Premium Chart is a comprehensive document that outlines the premium amounts associated with various health insurance policies offered by Indian Bank. This chart serves as a valuable resource for individuals seeking to understand their financial commitments when enrolling in health insurance plans. It details the premium rates based on factors such as age, coverage amount, and policy type, allowing potential policyholders to make informed decisions regarding their health insurance needs.

How to use the Indian Bank Health Insurance Premium Chart

To effectively use the Indian Bank Health Insurance Premium Chart, individuals should first identify the specific health insurance policy they are interested in. Once the policy type is determined, users can refer to the chart to find the corresponding premium amount based on their age and coverage requirements. This process helps in budgeting for health insurance costs and comparing different policy options. Additionally, understanding the premium structure can aid in evaluating the overall value of the insurance plan.

How to obtain the Indian Bank Health Insurance Premium Chart

The Indian Bank Health Insurance Premium Chart can be obtained through various channels. Prospective policyholders may access the chart directly from the Indian Bank’s official website, where it is typically available for download in PDF format. Alternatively, individuals can visit a local Indian Bank branch to request a printed copy of the chart. Financial advisors or insurance agents associated with Indian Bank may also provide this information during consultations.

Key elements of the Indian Bank Health Insurance Premium Chart

The Indian Bank Health Insurance Premium Chart includes several key elements that are essential for understanding health insurance costs. These elements typically include:

- Policy Type: Different health insurance plans offered by Indian Bank.

- Age Bracket: Premium rates categorized by various age groups.

- Coverage Amount: The sum insured options available under each policy.

- Premium Amount: The specific cost associated with each policy option.

- Renewal Terms: Information regarding the renewal process and any applicable premium adjustments.

Steps to complete the Indian Bank Health Insurance Premium Chart

Completing the Indian Bank Health Insurance Premium Chart involves a straightforward process. First, gather personal information such as age and desired coverage amount. Next, locate the relevant section of the chart that corresponds to your age group and selected policy type. Finally, note the premium amount listed for your specific needs. This step-by-step approach ensures that individuals accurately assess their health insurance costs and make informed decisions.

Legal use of the Indian Bank Health Insurance Premium Chart

The legal use of the Indian Bank Health Insurance Premium Chart is crucial for ensuring compliance with insurance regulations. The chart serves as a guiding document for potential policyholders, helping them understand their financial obligations. It is important to use the most current version of the chart to avoid discrepancies in premium amounts. Additionally, maintaining a copy of the chart for personal records can be beneficial during policy renewals or disputes.

Quick guide on how to complete indian bank health insurance premium chart

Complete Indian Bank Health Insurance Premium Chart effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly and without issues. Manage Indian Bank Health Insurance Premium Chart on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and electronically sign Indian Bank Health Insurance Premium Chart with ease

- Obtain Indian Bank Health Insurance Premium Chart and then click Get Form to begin.

- Utilize the utilities we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details carefully and then click the Done button to save your modifications.

- Select how you wish to share your form, either through email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Edit and electronically sign Indian Bank Health Insurance Premium Chart and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indian bank health insurance premium chart

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indian Bank Arogya Raksha policy premium chart?

The Indian Bank Arogya Raksha policy premium chart outlines the premium amounts payable for different coverage options. This chart provides a clear view of the costs associated with securing health insurance through Indian Bank. Understanding this chart is crucial for selecting the right policy that fits your budget and health needs.

-

How can I determine my premium using the Indian Bank Arogya Raksha policy premium chart?

To determine your premium using the Indian Bank Arogya Raksha policy premium chart, identify the coverage amount that suits your requirements. The chart will display the corresponding premium amounts based on age group and other factors. This allows you to make an informed decision about your health insurance investment.

-

What are the benefits of choosing the Indian Bank Arogya Raksha policy?

The Indian Bank Arogya Raksha policy offers numerous benefits, including comprehensive health coverage, cashless hospitalizations, and various sum insured options. It ensures that you receive financial support during medical emergencies. Additionally, the premium chart helps in evaluating the cost-to-benefit ratio effectively.

-

Are there different plans available in the Indian Bank Arogya Raksha policy premium chart?

Yes, the Indian Bank Arogya Raksha policy premium chart includes various plans tailored for diverse healthcare requirements. Each plan varies in terms of coverage, benefits, and premium rates, allowing you to choose one that aligns with your financial capabilities. Reviewing the premium chart is essential to understand these differences.

-

How does the Indian Bank Arogya Raksha policy premium chart compare to other insurance policies?

When comparing the Indian Bank Arogya Raksha policy premium chart to other insurance policies, consider factors like coverage, network hospitals, and premium rates. This chart allows potential customers to benchmark coverage offers from different insurers. It's important to evaluate all options to find the best fit for your needs.

-

Can I customize my coverage based on the Indian Bank Arogya Raksha policy premium chart?

Yes, many aspects of the Indian Bank Arogya Raksha policy can be customized based on your personal health requirements. The premium chart provides various coverage options, allowing you to select add-ons or riders. Tailoring your policy ensures that you receive the exact protection necessary for peace of mind.

-

Is there an online tool to assist with understanding the Indian Bank Arogya Raksha policy premium chart?

Yes, Indian Bank provides online tools to help customers navigate the Indian Bank Arogya Raksha policy premium chart effectively. These tools can assist in calculating premiums based on selected coverage levels and age. Utilizing these resources simplifies the policy selection process.

Get more for Indian Bank Health Insurance Premium Chart

Find out other Indian Bank Health Insurance Premium Chart

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word