Opus Vat Declaration Form 2014

What is the Opus Vat Declaration Form

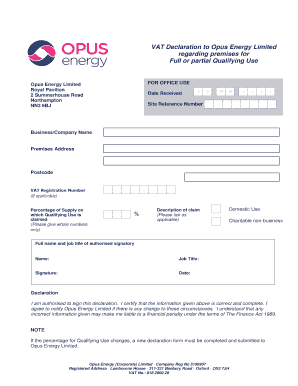

The Opus VAT Declaration Form is a crucial document used to report value-added tax (VAT) obligations for businesses operating in the United States. This form is essential for ensuring compliance with tax regulations, allowing businesses to accurately declare their VAT liabilities. By completing this form, businesses can provide necessary details regarding taxable sales, purchases, and applicable VAT rates. The Opus VAT Declaration Form serves as a formal record that can be reviewed by tax authorities, making it an important part of a company’s financial documentation.

How to use the Opus Vat Declaration Form

Using the Opus VAT Declaration Form involves several key steps to ensure accurate reporting. First, gather all relevant financial information, including sales invoices, purchase receipts, and any applicable tax rates. Next, fill out the form with precise details regarding your business transactions, ensuring that all figures are accurate. After completing the form, review it for any errors or omissions, as inaccuracies can lead to compliance issues. Finally, submit the form through the appropriate channels, whether electronically or by mail, depending on your local regulations.

Steps to complete the Opus Vat Declaration Form

Completing the Opus VAT Declaration Form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all necessary financial documents, including sales and purchase records.

- Determine the applicable VAT rates for your transactions.

- Fill in the required fields on the form, including your business information and transaction details.

- Double-check all entries for accuracy, ensuring that totals match your records.

- Submit the completed form according to your state’s submission guidelines.

Legal use of the Opus Vat Declaration Form

The legal use of the Opus VAT Declaration Form is governed by tax laws that require businesses to report their VAT liabilities accurately. This form must be completed in compliance with federal and state regulations to avoid penalties. When submitted correctly, the form serves as a legal document that can be used to verify a business's tax compliance. It is important to retain copies of submitted forms and any supporting documentation for your records, as they may be required during audits or tax reviews.

Key elements of the Opus Vat Declaration Form

Several key elements must be included in the Opus VAT Declaration Form to ensure its validity. These elements typically include:

- Business Information: Name, address, and tax identification number of the business.

- Transaction Details: A comprehensive list of taxable sales and purchases.

- VAT Rates: The applicable VAT rates for each transaction.

- Total VAT Liability: A summary of the total VAT owed or refundable.

Required Documents

To complete the Opus VAT Declaration Form, certain documents are required. These typically include:

- Sales invoices that detail taxable transactions.

- Purchase receipts for goods and services acquired.

- Any previous VAT returns or declarations, if applicable.

- Documentation supporting VAT exemptions or reductions, if claimed.

Quick guide on how to complete opus vat declaration form

Effortlessly Prepare Opus Vat Declaration Form on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Manage Opus Vat Declaration Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Way to Edit and Electronically Sign Opus Vat Declaration Form with Ease

- Find Opus Vat Declaration Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Underline important sections of the documents or redact confidential information with tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information carefully and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Opus Vat Declaration Form to guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct opus vat declaration form

Create this form in 5 minutes!

How to create an eSignature for the opus vat declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the opus vat declaration form and why is it important?

The opus vat declaration form is a crucial document used by businesses to report VAT transactions to tax authorities. It ensures compliance with tax regulations and helps businesses avoid penalties. By utilizing an efficient eSigning solution like airSlate SignNow, you can manage your opus vat declaration form seamlessly.

-

How can airSlate SignNow assist in completing the opus vat declaration form?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out and eSign your opus vat declaration form. With its intuitive design, you can streamline the process and ensure that all necessary information is captured accurately. The platform enhances efficiency and reduces the risk of errors in your tax submissions.

-

Is there a cost associated with using the opus vat declaration form in airSlate SignNow?

Yes, using the opus vat declaration form within airSlate SignNow comes with a subscription fee. However, this cost is justified by the extensive features and efficiencies provided by the platform. By investing in this solution, businesses can save time and resources, making it a cost-effective choice in the long run.

-

What features does airSlate SignNow offer for the opus vat declaration form?

airSlate SignNow provides numerous features for the opus vat declaration form, including easy-to-use templates, real-time tracking, and secure cloud storage. The platform also supports collaboration with team members, allowing everyone involved to stay updated and informed. These features enhance the experience of managing your VAT submissions.

-

Can the opus vat declaration form be integrated with other tools in airSlate SignNow?

Yes, the opus vat declaration form in airSlate SignNow can be integrated with various business tools and applications. This includes popular platforms for accounting and CRM, which streamlines your workflow and data management. Integrations enhance the overall functionality and make it easier to manage your VAT processes.

-

What benefits does using airSlate SignNow for the opus vat declaration form offer?

Using airSlate SignNow for the opus vat declaration form offers benefits such as improved accuracy and faster processing times. The ability to eSign documents remotely means you can complete submissions from anywhere, increasing flexibility. Overall, this solution helps you maintain compliance while optimizing your workflow.

-

Is airSlate SignNow secure for handling the opus vat declaration form?

Absolutely! airSlate SignNow ensures the highest level of security for handling the opus vat declaration form. With features like encryption and secure access controls, your sensitive data is protected at all times. You can trust that your VAT forms and submissions are safe with this platform.

Get more for Opus Vat Declaration Form

- Department of pesticide form dpr pml 052

- Gewerbe anmeldung gewa 1 meschede de form

- 3gpkimg form

- Vendor application blacklight run form

- 20410 br auth release confidential info hospital xfm mro corp form

- Va form 10 2850d health professions trainee data collection form

- Immunization consent form patient s last name pat

- Graphic design retainer agreement template form

Find out other Opus Vat Declaration Form

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast