N 196 Form

What is the N 196 Form

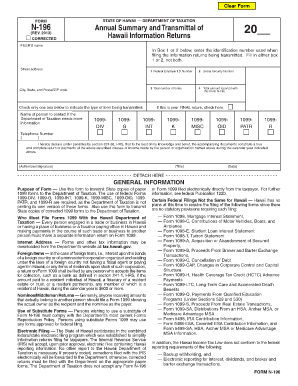

The N 196 form is a specific document used in Hawaii for tax reporting purposes. This form is essential for individuals and businesses to accurately report certain types of income and deductions to the state tax authorities. It is particularly relevant for those who may have income from sources that require specific reporting in Hawaii. Understanding the N 196 form is crucial for compliance with state tax laws.

How to use the N 196 Form

Using the N 196 form involves several key steps. First, gather all necessary financial documents that pertain to the income and deductions you plan to report. Next, accurately fill out the form, ensuring that all information is complete and correct. It is important to review the form for any errors before submission. Finally, submit the completed form to the appropriate state tax office by the designated deadline.

Steps to complete the N 196 Form

Completing the N 196 form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income statements and receipts for deductions.

- Begin filling out the form, starting with your personal information, including your name and address.

- Report your income accurately, ensuring that you include all sources of income that require reporting.

- List any deductions you are eligible for, supported by the appropriate documentation.

- Review the entire form for accuracy before signing and dating it.

- Submit the form by mail or electronically, depending on the submission methods available.

Legal use of the N 196 Form

The N 196 form is legally recognized by the state of Hawaii for tax reporting. To ensure its legal validity, it must be completed accurately and submitted on time. Compliance with state regulations regarding the use of this form is crucial to avoid penalties. The form serves as an official record of your income and deductions, which can be referenced in case of audits or inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the N 196 form are critical for compliance. Typically, the form must be submitted by the state tax deadline, which aligns with federal tax deadlines. It is advisable to verify specific dates each tax year, as they can vary. Late submissions may result in penalties or interest on any taxes owed, so timely filing is essential.

Form Submission Methods (Online / Mail / In-Person)

The N 196 form can be submitted through various methods, offering flexibility for taxpayers. Options typically include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the state tax website, which often provides a streamlined process.

- Mail: The form can also be printed and mailed to the appropriate tax office. Ensure that you use the correct address for submissions.

- In-Person: Some individuals may choose to submit the form in person at their local tax office, allowing for immediate confirmation of receipt.

Quick guide on how to complete n 196 form

Effortlessly Prepare N 196 Form on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Handle N 196 Form on any platform with airSlate SignNow's applications for Android or iOS and enhance any document-focused process today.

How to Edit and Electronically Sign N 196 Form with Ease

- Find N 196 Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign N 196 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the n 196 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'n 196 hawaii' in relation to airSlate SignNow?

'n 196 hawaii' refers to a specific documentation requirement that can be efficiently managed using airSlate SignNow. Our platform allows businesses in Hawaii to streamline the signing process and ensure compliance with local regulations related to 'n 196 hawaii'.

-

How does airSlate SignNow address the needs for 'n 196 hawaii' documentation?

airSlate SignNow simplifies the process of handling 'n 196 hawaii' documentation by providing templates and cloud storage solutions that ensure easy access anytime. Users can create, send, and track 'n 196 hawaii' documents with a few clicks, enhancing workflow efficiency.

-

What are the pricing options for airSlate SignNow with features related to 'n 196 hawaii'?

Our pricing for airSlate SignNow is designed to be cost-effective, providing various plans that include features essential for managing 'n 196 hawaii' documentation. Plans start at a competitive rate, giving users access to powerful tools tailored to meet their needs.

-

What are the key features of airSlate SignNow for 'n 196 hawaii' processing?

Key features of airSlate SignNow for 'n 196 hawaii' include electronic signatures, document templates, real-time tracking, and compliance checks. These features ensure that all 'n 196 hawaii' documents are processed securely and efficiently.

-

Can I integrate airSlate SignNow with other applications for 'n 196 hawaii'?

Yes, airSlate SignNow offers integrations with various applications to streamline your workflows related to 'n 196 hawaii'. Whether you use CRM systems, document management tools, or email platforms, we have the right integrations to meet your needs.

-

What are the benefits of using airSlate SignNow for 'n 196 hawaii' compliance?

Using airSlate SignNow for 'n 196 hawaii' compliance ensures that your documents are legally binding and securely processed. This not only saves time but also reduces the risk of errors often associated with manual documentation.

-

Is airSlate SignNow user-friendly for handling 'n 196 hawaii' documents?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes handling 'n 196 hawaii' documents easy for users of all skill levels. Our platform provides step-by-step guidance to assist you in managing your documentation efficiently.

Get more for N 196 Form

- Catering technology form

- Non permit confined space form

- Patient authorization for release of medical penn state health 443294545 form

- British airways third party nominee form

- Acr bformatb memono10789 serc ap state portal

- Sf88 form

- Official oems attendance roster form

- Autopsy request form arkansas department of health healthy arkansas

Find out other N 196 Form

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now