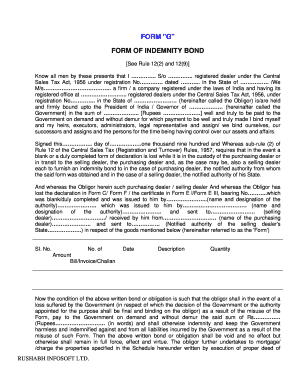

Form G in Word Format

What is the Form G In Word Format

The Form G for capital gain is a crucial document used in the United States for reporting capital gains and losses to the Internal Revenue Service (IRS). This form is specifically designed for individuals or entities that need to close a capital gain account. It provides a structured way to disclose financial information related to the sale of assets, ensuring compliance with tax regulations. The Form G in Word format allows users to easily fill out, edit, and save their information digitally, facilitating a smoother filing process.

How to use the Form G In Word Format

Using the Form G in Word format is straightforward. First, download the document from a reliable source. Once you have the form open, you can fill in the required fields, including personal information and details about the capital gains or losses. The Word format allows for easy editing, so you can make adjustments as needed. After completing the form, ensure that all information is accurate before saving and printing it for submission. This digital format also enables you to share the document with tax professionals if needed.

Steps to complete the Form G In Word Format

Completing the Form G in Word format involves several key steps:

- Download the Form G template in Word format.

- Open the document and read the instructions carefully.

- Fill in your personal details, including name, address, and Social Security number.

- Provide information about the assets sold, including purchase and sale dates, and amounts.

- Calculate the total capital gains or losses based on the provided data.

- Review the completed form for accuracy and completeness.

- Save the document and print it for submission to the IRS.

Legal use of the Form G In Word Format

The Form G for capital gain is legally recognized when it is filled out correctly and submitted in accordance with IRS guidelines. Using the Word format does not diminish its legal standing, provided that the necessary information is accurately reported. It is essential to retain a copy of the completed form for your records, as it may be required for future reference or in case of an audit. Compliance with all applicable tax laws is crucial to avoid penalties.

IRS Guidelines

The IRS has specific guidelines regarding the completion and submission of the Form G. It is important to follow these guidelines to ensure your form is accepted without issues. This includes adhering to deadlines for submission, accurately reporting all capital gains or losses, and maintaining supporting documentation. The IRS recommends consulting their official resources or a tax professional for the most current information and any changes to the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Form G are typically aligned with the annual tax filing schedule. Generally, individuals must submit their tax returns, including the Form G, by April fifteenth of the following year. However, if you require an extension, you may have until October fifteenth to file. It is crucial to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS announcements.

Required Documents

When completing the Form G for capital gain, certain documents are required to support the information provided. These may include:

- Proof of purchase and sale of assets, such as receipts or contracts.

- Records of any improvements made to the assets.

- Documentation of any related expenses incurred during the sale.

- Previous tax returns that may impact the current filing.

Gathering these documents in advance can streamline the completion process and ensure accuracy in your reporting.

Quick guide on how to complete form g in word format

Effortlessly prepare Form G In Word Format on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Form G In Word Format on any device via the airSlate SignNow Android or iOS applications and enhance your document-based processes today.

The simplest way to edit and eSign Form G In Word Format with ease

- Find Form G In Word Format and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools supplied by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details carefully and click the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form G In Word Format to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form g in word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form G for closing capital gain account?

Form G for closing capital gain account is a tax form used to report the closure of a capital gain account to ensure compliance with tax regulations. This form helps individuals and businesses summarize their capital gains and losses, allowing for accurate accounting when closing an account. Understanding how to properly fill out this form is crucial for avoiding potential penalties.

-

How can airSlate SignNow facilitate the submission of Form G for closing capital gain account?

airSlate SignNow provides an efficient platform for signing and managing documents, including Form G for closing capital gain account. With its electronic signature capabilities, users can easily complete and send their forms without the hassle of printing or mailing. This streamlines the submission process, ensuring timely compliance.

-

Are there any costs associated with using airSlate SignNow for Form G submissions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. While there is a small fee associated with the service, users often find that the efficiency and convenience provided by managing Form G for closing capital gain account online far outweigh the costs. Additionally, the savings on paper and postage can make the service even more cost-effective.

-

Can I integrate airSlate SignNow with other applications for processing Form G?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to seamlessly manage Form G for closing capital gain account along with your other business processes. This enhances workflow efficiency and helps you stay organized throughout the form submission and signing processes.

-

What are the benefits of using airSlate SignNow for Form G submissions?

Using airSlate SignNow for Form G submissions offers several benefits, including time savings, reduced paperwork, and higher document security. The platform's user-friendly interface makes it easy for anyone to access and complete documents like Form G for closing capital gain account efficiently. Plus, you can track the status of your submissions in real-time.

-

Is airSlate SignNow compliant with legal standards for Form G?

Yes, airSlate SignNow is designed to meet strict legal compliance standards required for electronic signatures, including those needed for Form G for closing capital gain account. Users can confidently sign and send documents, knowing they are adhering to applicable laws. This compliance reduces risk and ensures that your submissions are valid and recognized.

-

How long does it take to process Form G using airSlate SignNow?

Processing time for Form G using airSlate SignNow can vary based on the complexity of the document and the speed of signers. However, many users report being able to complete and submit their Form G for closing capital gain account within minutes. The platform's efficiency signNowly reduces delays compared to traditional methods.

Get more for Form G In Word Format

- Fillable online isbe isbe 73 03d form fax email print

- Search illinois state board of education form

- Employer request child labor state of new hampshire form

- Unemployment self sustaining affidavit pdf form

- Application for supply of electricity form

- At5 form

- Purple heart license plate application nebraska dmv form

- Spill bucket testing report form

Find out other Form G In Word Format

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy