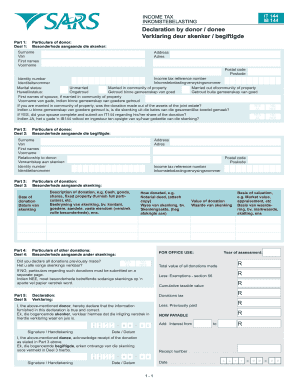

It144 Form

What is the IT144?

The IT144 form, also known as the IT144 donation form, is a document used in the United States for reporting certain types of donations. This form is particularly relevant for individuals or organizations that wish to claim deductions for charitable contributions. It serves as a declaration of the donations made, ensuring that the donor complies with IRS regulations. Understanding the purpose of the IT144 is essential for accurate tax reporting and maximizing potential deductions.

How to obtain the IT144

To obtain the IT144 form, individuals can visit the official IRS website or contact their local tax office. The form is typically available as a downloadable PDF, making it easy to access and print. Additionally, many tax preparation software programs include the IT144, allowing users to fill it out electronically. Ensuring you have the correct version of the form is crucial, as updates may occur annually.

Steps to complete the IT144

Completing the IT144 form involves several key steps:

- Gather necessary information, including details about the donations made and the recipient organizations.

- Download the IT144 form PDF from a reliable source.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate your declaration.

Following these steps carefully can help ensure that your IT144 form is filled out correctly, minimizing the risk of issues during tax filing.

Legal use of the IT144

The IT144 form must be used in accordance with IRS guidelines to ensure its legal standing. This includes adhering to rules regarding the types of donations that can be claimed and the documentation required to support these claims. When properly completed and submitted, the IT144 serves as a legally binding declaration of donations, which can be crucial in the event of an audit. It is important to keep copies of the form and any supporting documents for your records.

Key elements of the IT144

Several key elements are essential when filling out the IT144 form:

- Donor Information: This includes the name, address, and taxpayer identification number of the donor.

- Recipient Information: Details about the organization receiving the donation, including their tax-exempt status.

- Donation Details: A description of the items or cash donated, along with their estimated value.

- Signature: The donor's signature is required to validate the declaration.

Ensuring that all these elements are accurately represented on the IT144 is vital for compliance and successful tax reporting.

Form Submission Methods

The IT144 form can be submitted in various ways, depending on the preferences of the donor and the requirements of the IRS. Common submission methods include:

- Online Submission: Some tax preparation software allows for electronic filing of the IT144 as part of the overall tax return.

- Mail: The completed form can be printed and mailed to the appropriate tax authority.

- In-Person: Donors may also choose to submit the form in person at their local tax office.

Choosing the right submission method can streamline the process and ensure timely filing.

Quick guide on how to complete it144

Complete It144 effortlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle It144 on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign It144 with ease

- Find It144 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and electronically sign It144 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it144

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT144 form and how does it work with airSlate SignNow?

The IT144 form is a document used for various tax-related purposes. With airSlate SignNow, you can easily create, send, and eSign the IT144 form, ensuring all your signatures are legally compliant and securely stored.

-

How can I utilize the IT144 form with airSlate SignNow?

Using airSlate SignNow, you can upload the IT144 form directly, customize it if needed, and then send it out for eSignature. The user-friendly interface simplifies the entire process, ensuring that all parties can review and sign the form without hassle.

-

Is there a cost associated with using the IT144 form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans include access to features for managing the IT144 form and other documents, allowing businesses to choose the most cost-effective solution.

-

What features does airSlate SignNow offer for managing the IT144 form?

airSlate SignNow provides features such as document templates, automated reminders, real-time tracking, and cloud storage to streamline the management of the IT144 form. These features help users save time and ensure a smooth signing process.

-

How does eSigning the IT144 form help my business?

eSigning the IT144 form using airSlate SignNow reduces time spent on paperwork and accelerates approval processes. It allows for quick turnaround times, improving overall efficiency while ensuring secure and legally binding signatures.

-

Can I integrate airSlate SignNow with other applications for the IT144 form?

Yes, airSlate SignNow offers numerous integrations with popular applications, allowing you to enhance your workflow for the IT144 form. This means you can connect your existing tools and seamlessly manage your documents in one platform.

-

What benefits does airSlate SignNow provide when using the IT144 form?

airSlate SignNow offers signNow benefits such as enhanced compliance, reduced printing costs, and convenience in managing the IT144 form. By digitizing your documentation process, you can streamline operations and focus more on your core business activities.

Get more for It144

Find out other It144

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History