Noncash Contributions a Taxpayer's Guide Form

Understanding Noncash Contributions A Taxpayer's Guide

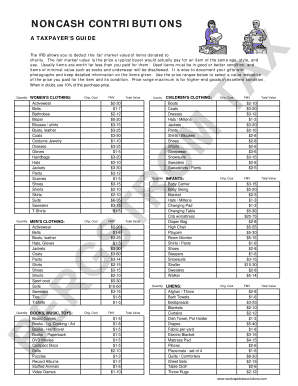

The Noncash Contributions A Taxpayer's Guide provides essential information for taxpayers who wish to claim deductions for noncash donations. Noncash contributions can include items such as clothing, household goods, and vehicles. Understanding the guidelines set by the IRS is crucial to ensure that contributions are accurately reported and eligible for deductions. This guide outlines the necessary steps to document and value these contributions, helping taxpayers maximize their potential tax benefits while remaining compliant with IRS regulations.

Steps to Complete the Noncash Contributions A Taxpayer's Guide

Completing the Noncash Contributions A Taxpayer's Guide involves several key steps:

- Determine Eligibility: Ensure that the items you wish to donate qualify as noncash contributions under IRS guidelines.

- Document Donations: Keep detailed records of each item donated, including descriptions, conditions, and estimated values.

- Obtain Required Forms: Use the appropriate forms, such as Form 8283 for noncash contributions exceeding $500, to report your donations.

- Get Appraisals if Necessary: For items valued over $5,000, obtain a qualified appraisal to substantiate the value of your donation.

- File with Your Tax Return: Include the completed forms with your tax return to claim the deductions.

IRS Guidelines for Noncash Contributions

The IRS has specific guidelines regarding noncash contributions that taxpayers must follow. These include:

- Items must be in good condition or better to qualify for a deduction.

- Taxpayers must provide a written acknowledgment from the charity for donations over $250.

- For certain high-value items, a qualified appraisal is required to determine fair market value.

- Taxpayers must report noncash contributions accurately on their tax returns to avoid penalties.

Required Documents for Noncash Contributions

To properly document noncash contributions, taxpayers should gather the following documents:

- Receipts: Obtain receipts from the charitable organizations for all donations made.

- Form 8283: Complete this form if the total deduction for noncash contributions exceeds $500.

- Appraisals: Secure appraisals for items valued over $5,000 to substantiate their worth.

- Photos: Take photographs of items donated for personal records and potential audits.

Legal Use of the Noncash Contributions A Taxpayer's Guide

Utilizing the Noncash Contributions A Taxpayer's Guide legally requires adherence to IRS regulations. Taxpayers must ensure that all contributions are made to qualified charitable organizations. Additionally, accurate record-keeping and reporting are essential to avoid issues with the IRS. Noncompliance can lead to penalties, including the disallowance of deductions or fines. Understanding the legal framework surrounding noncash contributions helps taxpayers navigate the process smoothly and responsibly.

Examples of Noncash Contributions

Common examples of noncash contributions include:

- Clothing and shoes donated to thrift stores.

- Furniture and appliances given to shelters or charities.

- Vehicles donated to nonprofit organizations.

- Stock or other investments contributed to charitable foundations.

Each of these examples requires proper documentation and adherence to IRS guidelines to ensure eligibility for tax deductions.

Quick guide on how to complete noncash contributions a taxpayers guide

Effortlessly prepare Noncash Contributions A Taxpayer's Guide on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed paperwork, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without issues. Handle Noncash Contributions A Taxpayer's Guide on any platform using airSlate SignNow's Android or iOS apps and simplify your document-related tasks today.

How to edit and electronically sign Noncash Contributions A Taxpayer's Guide effortlessly

- Locate Noncash Contributions A Taxpayer's Guide and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Noncash Contributions A Taxpayer's Guide and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the noncash contributions a taxpayers guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are non cash contributions and how do they impact taxes?

Non cash contributions refer to donations of items other than money, such as clothing or household goods. Understanding how these affect your taxes is essential; they can often be deducted from your taxable income. For a thorough breakdown, check out our non cash contributions a taxpayer's guide, which explains eligibility and valuation methods.

-

How can I accurately value my non cash contributions?

Valuing non cash contributions can be complex, as it requires a fair market value assessment. Our non cash contributions a taxpayer's guide provides insights on how to determine value, such as using online appraisal tools or consulting charities for their valuation standards. Proper valuation is crucial to ensure you're receiving the proper tax deduction.

-

Are there limits on non cash contributions that I can deduct?

Yes, there are limits on how much you can deduct for non cash contributions based on your income and the value of the items donated. Our non cash contributions a taxpayer's guide explains these limits in detail, helping you navigate the intricacies of your tax situation and maximize savings.

-

What documentation do I need for claiming non cash contributions on my taxes?

To claim non cash contributions, you need to maintain proper records, including receipts or written acknowledgments from the charity. The non cash contributions a taxpayer's guide emphasizes the importance of documentation to support your claims in case of audits. Accurate records ensure you can substantiate your deductions seamlessly.

-

Does airSlate SignNow assist in documenting non cash contributions?

Absolutely! airSlate SignNow provides an efficient way to manage and digitally sign documents related to your non cash contributions. By utilizing our platform, you can streamline the documentation process, making it easier to maintain records for your non cash contributions a taxpayer's guide.

-

How can airSlate SignNow simplify the eSigning process for charitable donations?

With airSlate SignNow, you can eSign donation agreements and receipts quickly and securely. This simplifies the process of documenting your non cash contributions, which is essential for tax purposes. Our platform allows you to stay organized and compliant while keeping your records aligned with the non cash contributions a taxpayer's guide.

-

Is there a cost associated with using airSlate SignNow for handling donations?

airSlate SignNow offers competitive pricing plans designed to meet various business needs. Our cost-effective solution simplifies document management for charitable activities, making it an excellent investment for ensuring all non cash contributions are handled efficiently. Explore our pricing options in the non cash contributions a taxpayer's guide for details.

Get more for Noncash Contributions A Taxpayer's Guide

- Food safety plan standard operating procedures form

- Aetna medicare advantage disenrollment form

- Da form 3425 r

- Pleasantville nj opra request form

- Liberty mutual declaration page form

- California hurricane hilary dr 4750 ca form

- House rental contract template form

- Month to month rental contract template form

Find out other Noncash Contributions A Taxpayer's Guide

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free